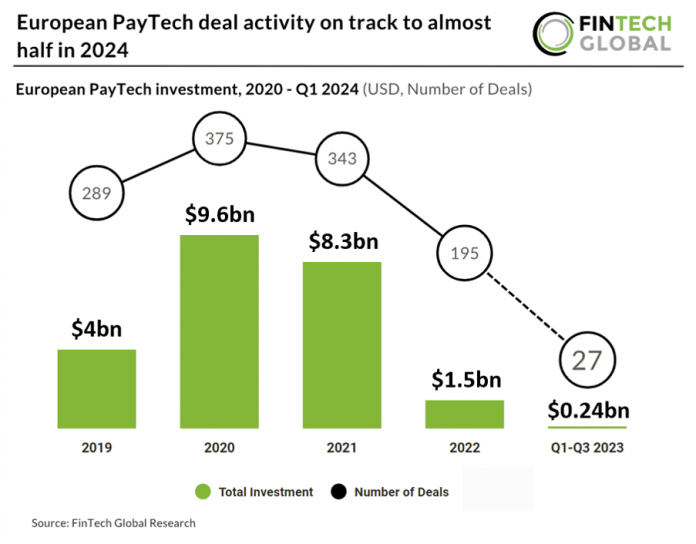

Key European PayTech stats in Q1 2024:

• European PayTech deal activity totalled at 27 deals in Q1 2024, a 55% drop from Q1 2023

• European PayTech companies raised a combined $235m in Q1 2024, a 18% reduction YoY

• The UK was home to the highest number of PayTech deals with 11 transactions, a 40% share of deals on the continent

In the first quarter of 2024, European PayTech companies experienced a notable decrease in investment, with deal activity dropping by 55% to a total of 27 funding rounds compared to the same period in the previous year. Based on this activity, deals are expected to reach 108 in Q1 2024, a 45% drop from 2023. These companies also raised a combined total of $235m, marking an 18% reduction YoY.

PPRO, a digital payment provider to banks and businesses, had the largest FinTech deal in Q1 2024 after raising $93m in their latest private equity funding round. The funding will be used to pursue growth in key markets and further enhance its global network of local payment methods. The funding is provided by new and existing investors, including Eurazeo, HPE Growth, Sprints, PayPal Ventures, J.P. Morgan, Citi Ventures, Claret Capital Partners, and funds managed by BlackRock. “PPRO had a stellar 2023, delivering record revenue.” said Rahul Raswant, Chief Financial Officer, PPRO. “Our focus on helping customers access new markets by creating seamless local payment experiences is validated by the strong demand we’re seeing, as well as by this infusion of capital which represents a real vote of confidence in PPRO’s growth prospects.”

The UK was the most active European PayTech country with 11 deals, a 40% share of all transactions. The second most active country was Estonia with three deals, a 11% share of deals. Sweden, Germany and Switzerland were joint third with two deals each.

In February 2024, The EU Council approved a regulation facilitating instant euro payments across the EU and EEA, aiming to bolster the region’s economic and financial independence by reducing reliance on non-EU financial institutions. This move is expected to benefit individuals and businesses, enabling money transfers within ten seconds at any time, including cross-border transactions. Payment service providers must offer instant payment services at rates no higher than standard transfers, with a transition period for implementation. Additionally, the regulation extends access to payment systems for payment and e-money institutions, subject to safeguards to mitigate risks. Notably, the regulation mandates verification of beneficiary details to prevent errors or fraud and includes a review clause for assessing credit charges.