Key USA InsurTech investment stats in Q1 2024:

• USA InsurTech deal activity reached 41 funding rounds in Q1 2024, a 32% drop from Q1 2023

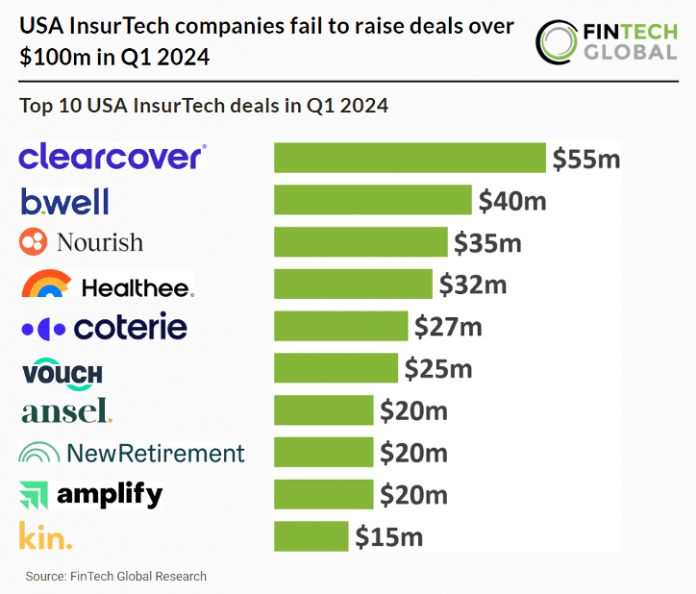

• USA InsurTech companies raised a combined $328m in Q1 2024, a 28% drop YoY

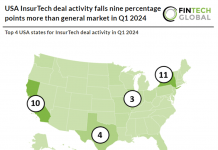

• New York was the most active InsurTech state in the United States with 11 deals, a 27% share of all transactions

In the first quarter of 2024, the deal activity within the US InsurTech sector saw a decline, totalling 41 funding rounds, a 32% decrease compared to the same period in 2023 and a nine percentage points more than general market’s 23% drop. USA InsurTech companies also experienced a downturn in fundraising, collectively securing $328m, reflecting a notable 28% drop YoY.

Clearcover, a next-gen car insurance provider, had the largest USA InsurTech funding round in Q1 2024, after raising $55m in their latest venture round. The week prior to this funding round Clearcover launched their generative AI insurance tool to expedite claims processing and improve customer experience. “Our underlying foundation was built with best-in-class technology for digitally native customers, which has enabled us to get ahead of the curve,” said Clearcover CEO and Co-founder Kyle Nakatsuji. “I am incredibly proud of our Product, Claims and CX departments for leaning into this industry challenge and raising the bar for AI insurance solutions.” As one of the first-to-market InsurTech to include this capability, Clearcover is rolling out a series of AI products to enhance its end-to-end insurance experience. Earlier this year, Clearcover’s custom-built claims assistant began supporting claims adjusters in analyzing files and drafting communications to claimants and their representatives. The company also plans to integrate conversational AI into its mobile app to answer customer questions 24/7 in real-time. The feature will later be included within the company’s agent portal and website.

New York was the most active InsurTech state in the US with 11 deals, a 27% share of all transactions. This was followed by California with 10 funding rounds, a 24% share of total deals and Texas was third with four deals, a 10% share.