The WealthTech market continues to grow at a steady rate and is becoming increasingly interwoven with the wealth and asset management sector. In fact, the WealthTech sector was valued at $9.7bn in 2024 and is expected to grow at a 25.2% CAGR to be worth $37.7bn by 2032, according to a report from Kingpin Market Research.

The US and Europe have helped lead the way for WealthTech, but the sector is gaining serious momentum in other regions around the world. In some regions, WealthTech could help accelerate financial inclusion and even adopt new technology quicker due to having less legacy infrastructure.

Tamara Kostova, CEO at investing-as-a-service provider Velexa, explained, “We believe that emerging markets really have the greatest potential for embedded investing. In Brazil, not only is there significant regulatory reform, but a middle class that grew by more than 50% in the past decade. Southeast Asia, while fragmented, has a lot of digitally native users looking to invest money in a new way, while MENA is recycling petro-dollars into creating a consumer-led economy.”

Brazil is also going through a push for greater digitalisation. A new Growth Acceleration Program is injecting billions of dollars across major sectors in the country with the aim of boosting internet access and technology. With a rising middle class and greater financial inclusion, more opportunities are opening for consumers looking to grow their wealth. In fact, data from Statista show the total transaction value in Brazil’s digital investment market is expected to grow at 4% CAGR to reach $32bn by 2028.

Similarly, Southeast Asia is set for major growth in the coming years. APAC could soon become the largest market in the world for FinTech. A recent report from Boston Consulting Group predicts the region’s FinTech revenue to grow by 8-times between 2021 and 2030 to reach $600bn. For comparison, the North American market is projected to be worth $520bn and $190bn in Europe.

Sticking with each of those three regions, Kostova highlighted that they each have their own unique challenges. For instance, Brazil faces difficulties due to the complexity of its local regulatory framework, in the MENA region, investments need to be aligned with halal guidelines. “In Southeast Asia, the environment is highly competitive, requiring navigation through numerous country-specific details, such as payment systems,” Kostova added.

Brazil, Southeast Asia and MENA are primed for significant growth over the coming years, Kostova noted. “In Brazil, advancements will likely focus on simplifying regulatory processes and enhancing digital financial services. Southeast Asia’s market will continue to expand rapidly, driven by increasing digital adoption and the integration of innovative payment systems across diverse markets. In the MENA region, growth will be shaped by the alignment of fintech solutions with Shariah principles, fostering greater inclusion. Across these regions, technological advancements, regulatory reforms, and the rise of digital-native consumers will be key drivers of transformation.”

Latin America & Africa

Latin America and Africa are the two regions that Alan Phipps, Securities Lending SME at DLT Apps, sees as the most exciting for digitalisation within wealth management. However, Phipps noted that all main markets around the world would benefit from increased digitalisation.

What makes Latin America and Africa the most exciting is that their adoption of WealthTech is providing a host of new opportunities for companies. “The growth in wealth and access to tech in both Latin America and Africa is opening brand new markets for FinTech companies who in the past have concentrated on the established markets e.g North America, Europe etc and these markets although still offering opportunities are well represented by FinTech companies.”

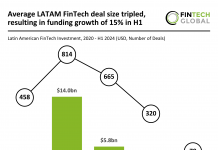

A recent report from Boston Consulting Group emphasised how big of an opportunity there is for FinTech in Latin America and Africa. Its findings claim that both regions will be the fastest growing FinTech markets by 2030. FinTech revenue growth is expected to rise by 12.5-times in LatAm and by 13-times in Africa and revenues are projected to be $125bn and $65bn, respectively.

While these regions are in a period of exciting growth, there are still some challenges they face. These include political instability, enforcement and acceptance of regulations, such as KYC and AML. One of the biggest challenges they face is access to reliable internet, Phipps explained. “In my opinion these challenges can lead to companies not willing to take the risk or invest in time and money. Even if you find a niche product but you are a small FinTech startup will investors (and we all need these) be willing to back you?”

Regarding the future of the regions, Phipps concluded, “I’m extremely excited for the WealthTech landscape in these regions in the coming years as I hope the wealth in the regions moves onto the younger generation who have a more worldwide outlook and realize that to prosper Tech is not a bad word and can enhance how they live their lives and ensure prosperity is for all not just the chosen few.”

Gulf Cooperation Council (GCC)

For Fredrik Davéus, the CEO and co-founder of financial analytics API developer Kidbrooke, the Gulf Cooperation Council (GCC) is going through an exciting period. The GCC includes Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the United Arab Emirates. Davéus said, “GCC is very exciting since they’re in the process of building a new system for occupational pension benefits and also rapidly adding new regulation.”

However, as these are greenfield developments, it will take time for them to be finetuned and settle into efficient processes. As the sector continues to grow, Davéus is interested in seeing what players will rise to the top. “It will be interesting to see if local tech providers emerge or if most tech will be sourced from existing global providers.”

The opportunity for WealthTech in the GCC is already leading to a number of new players enter the field. Last year, investment bank BNY and alternative investment firm Lunate deployed $300m into a new UAE-based WealthTech startup, Alpheya. The company is building a next-gen wealth and trading platform that is tailored to the MENA region. Its services include financial planning and risk assessment, portfolio management, portfolio analysis, stress testing, simulation, single and multi-order execution, and more.

Another hopeful startup in the GCC region is Abyan Capital. The robo-advisory firm recently closed its Series A funding round on $18m, with commitments coming from STV, Wa’ed Ventures and RZM Investment. Founded in 2022, the company offers an automated, user-friendly, Shariah-compliant investment and savings solution. Its aim is to help consumers efficiently manage investments, optimise asset allocations and achieve financial objectives.

Keep up with all the latest FinTech news here.

Copyright © 2024 FinTech Global