Key US RegTech investment stats in H1 2024:

- US RegTech deal activity dropped by over 40% in YoY comparison

- Claroty secured the biggest RegTech deal in the US during the first half of the year with $100m funding round

- California cemented its place as the top hub for RegTech and FinTech in the US after topping both lists for deal activity

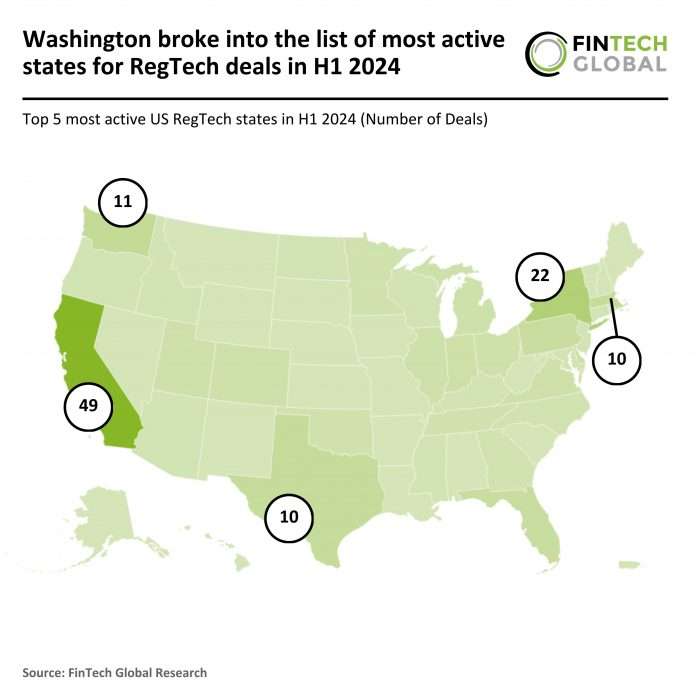

In the first half of 2024, the US RegTech sector recorded 177 transactions, a significant decline of 43% from the 311 deals completed in H1 2023. California led the market by a fair distance with 49 deals (13.8% share) which was more than the next top 3 states combined. The states that followed were New York with 22 deals (6.2% share), Washington with 11 deals (3.1% share), Texas and Massachusetts with 10 deals each (2.8% share respectively). This marks a shift from H1 2023, where California held a stronger position with 80 deals (25.7%), followed by New York with 43 deals (13.8%), and Florida, Massachusetts, and Texas each with 19 deals (6.1%). The top 5 active states saw Washington replacing Florida, while other states remained active but with a reduced share.

Claroty, a leader in RegTech and the protection of cyber-physical systems, successfully completed a strategic growth financing round, securing $100m, marking the largest funding round in the US RegTech market for H1 2024. This significant financial boost comes from a group of prestigious investors, including Delta-v Capital leading the equity charge, complemented by contributions from AB Private Credit Investors at AllianceBernstein, Standard Investments, Toshiba Digital Solutions, SE Ventures, Rockwell Automation, and Silicon Valley Bank, a division of First Citizens Bank. The company specializes in safeguarding cyber-physical systems (CPS) across various sectors, including industrial, healthcare, commercial, and the public sector, while ensuring regulatory compliance through comprehensive risk management and monitoring solutions. By integrating advanced RegTech solutions into its offerings, Claroty helps organizations navigate complex regulatory landscapes, ensuring compliance and robust protection for the Extended Internet of Things (XIoT). The newly acquired funds are earmarked for scaling Claroty’s platform across key verticals and regions, enhancing product innovation, and fostering strategic partnerships, supporting the company’s efforts in expanding its reach within the public sector and critical infrastructure industries across the Americas, EMEA, and Asia-Pacific.

California has firmly established itself as a leading hub not only for RegTech but for FinTech as a whole, consistently driving the majority of transactions in the US. In the first half of 2024, California dominated the RegTech sector with 49 deals, representing 13.8% of the national total. This dominance is mirrored in the broader FinTech landscape, where California-based companies led the nation with 497 funding rounds, capturing 31% of the market despite a significant decline from the previous year. The state’s sustained leadership in both RegTech and FinTech underscores its crucial role in shaping the financial technology ecosystem across the country.