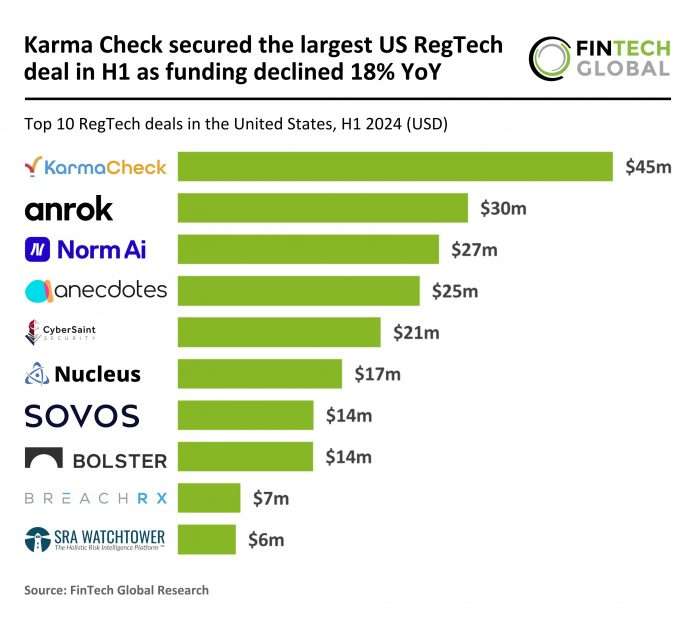

Key United States RegTech investment stats in H1 2024:

- United States RegTech funding dropped by 18% in H1 2024 YoY

- California emerged as the top state with 40% of the top 10 deals taking place in the region

- Norm AI, an emerging leader in AI-powered regulatory compliance, announced its arrival to the US RegTech market with a Series A funding round of $27m

In first six months of 2024, the U.S. RegTech sector saw 137 deals, a steep decline of 37% from the 218 transactions recorded in H1 2023, and a 30% drop from the 195 deals completed in H2 2023. Despite the decrease in deal volume, total RegTech funding in H1 2024 amounted to $3.08bn, marking a 18% decrease from the $3.76bn raised in H1 2023 and a 5% drop from the $3.23bn raised in H2 2023. This suggests that while the number of deals has declined significantly, there is still considerable investment in larger funding rounds. The shift to larger deals could be a response to market consolidation and growing demand for more comprehensive regulatory technology solutions.

The top 10 deals in H1 2024 were spread across five states, with California emerging as the clear leader, securing four top deals—up from just one in H1 2023. Massachusetts maintained its position with two top deals, the same as in H1 2023, reflecting its continued prominence in the U.S. RegTech landscape. Florida and New York, both of which had two top deals each in H1 2023, saw reduced activity, with each securing only one top deal in H1 2024. Meanwhile, Virginia made its debut in the top 10 with two major deals, signalling the state’s growing significance in the sector. Texas and Washington, which each had one top deal in H1 2023, were absent from the list in the first half of 2024.

Norm AI, an emerging leader in AI-powered regulatory compliance, announced its arrival with a $27m Series A funding round led by Coatue, with participation from Bain Capital Ventures, Blackstone Innovations Investments, Citi Ventures, and others. Over the past 11 months, Norm AI has raised over $38m from institutions managing more than $5.75tn in assets. Norm AI has developed the first platform that translates government regulations into computer code, enabling companies to automate compliance analyses efficiently and accurately using Regulatory AI Agents. These AI-powered agents convert regulations into executable programs, allowing businesses to ensure compliance with greater speed and precision. Already deployed by Fortune 100 companies, Norm AI is transforming how industries like insurance and asset management handle regulatory assessments, reducing the time spent on compliance from days to minutes. This new funding will help Norm AI expand its platform and further integrate AI into compliance processes, positioning the company as a pioneer in the RegTech space.

Keep up with all the latest FinTech research here

Copyright © 2024 FinTech Global