Key Global InsurTech investment stats in H1 2024:

- Global InsurTech investments halved in H1 YoY

- US companies cemented its place on the Global InsurTech stage completing 45% of all deals for the first half of the year

- Element, startup offering white-label insurance products, secured the largest deal in the German InsurTech market for the first half of the year, with a funding round of $54m

In H1 2024, the global InsurTech market experienced a dramatic drop in both deal activity and funding. The sector recorded 157 funding rounds, a sharp 50% drop from the 311 deals completed in H1 2023. Similarly, InsurTech companies raised $2.1bn in H1 2024, reflecting a substantial 51% decrease from the $4.4bn raised during the same period in the previous year. This sharp contraction in both funding and deal volume indicates a challenging environment for the InsurTech industry, as investor interest appears to have reduced considerably compared to 2023.

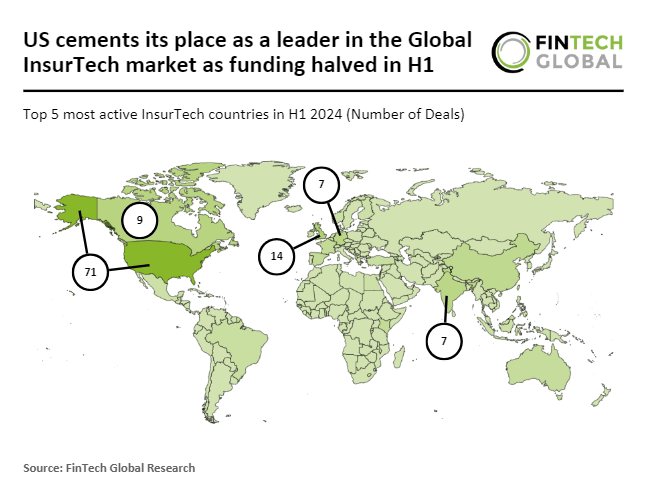

The United States remained the most active InsurTech market globally, with companies in the country completing 71 deals (45 share) in H1 2024. This marks a significant 46% decrease from the 132 deals closed in H1 2023. However, despite the drop in the number of deals, the US increased its overall share of global InsurTech activity, underscoring its continued dominance in the sector. The United Kingdom followed with 14 deals (9% share), down from 27 deals in H1 2023, while Canada secured third place with nine deals (6% share), overtaking France, which completed 15 deals in H1 2023. Despite the overall decline in activity, the US and UK, maintained their status as the leading players in the global InsurTech landscape.

Element, a German based InsurTech startup offering white-label insurance products, raised $54m from Versorgungswerk der Zahnärztekammer Berlin K.d.ö.R. and Alma Mundi, marking it the largest funding round in the German InsurTech market for the first half of the year. Founded in 2017, Element is a cloud-based InsurTech startup licensed by the German Federal Financial Supervisory Authority (BaFin) as a direct insurer for non-life insurance. The company provides white-labelled insurance products that clients market under their own brand. Element aims to become the first choice for Managing General Agents (MGAs) and reinsurers across Europe by leveraging its data-driven primary insurance capabilities. Licensed and approved in all European countries, Element supports MGAs throughout the EU, ensuring comprehensive and economically viable risk coverage through its integrated reinsurance panel, which matches MGAs with optimal reinsurance capacity providers.

Keep up with all the latest FinTech research here

Copyright © 2024 FinTech Global