Napier AI, a RegTech company offering a range of compliance tools and services, has launched its inaugural AI / AML Index, revealing that artificial intelligence could enable global economies to save $3.13trn annually by enhancing the detection and prevention of money laundering and terrorist financing.

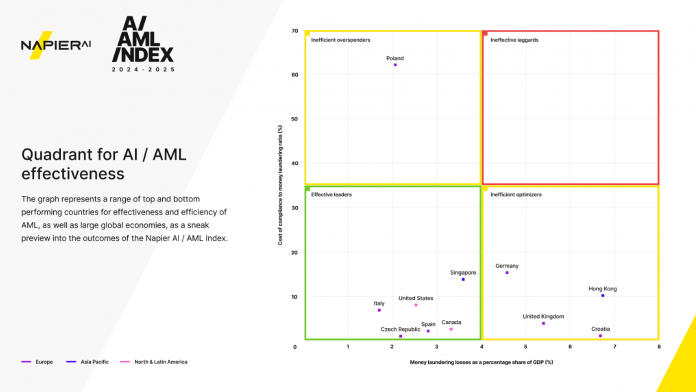

This report, produced in partnership with GlobalData, ranks 35 nations by their AML (anti-money laundering) effectiveness, highlighting both high and low-performing regions.

The report underscores the staggering costs associated with financial crime, with money laundering alone costing the global economy $5.2trn in 2023. The Napier AI / AML Index provides extensive insights, ranking countries based on their effectiveness in combatting financial crime and evaluating the potential savings achievable through AI implementation.

Among the highest-ranking countries in AML effectiveness are Italy, the Czech Republic, and Finland. These nations have demonstrated the most efficient use of AML resources, spending wisely to achieve optimal results in preventing illicit financial flows.

Of the countries in Napier AI’s Index, Croatia, Romania, Russia and Hong Kong were the least efficient in attempts to stop money laundering.

Regionally, North America, the Nordics, and Central Europe showed the smallest percentage of GDP lost to money laundering. At the other end of the list, United Arab Emirates and Brazil recording the highest GDP losses to financial crime, at 9.32% and 8.74% respectively.

The AI Index / AML Index offers a deep analysis of each country researched for the report, outlining their score, the money laundering losses and potential AI savings, as well as an assessment of their AML landscape.

According to the index, financial institutions, including banks, payment providers, wealth managers, and insurance companies, could cut compliance costs by $138bn annually by adopting AI-driven AML strategies. The United States stands to benefit significantly, potentially saving $23.4bn in compliance costs, followed by Germany with a possible $14.2bn in savings, and France with $11.08bn.

Commenting on the findings, Dr. Janet Bastiman, Napier AI’s chief data scientist, noted the unique challenges facing mature financial hubs: “Financial hubs are much more vulnerable to financial crime. Mature economies like Canada, the US and UK have effectively balanced open banking and AI innovation with the cost of managing financial crime risks. Fast-growing economies with strong financial services industries are looking to find this balance to reduce financial losses to the black market.”

Napier AI CEO Greg Watson highlighted the transformative role of AI in compliance: “We are at the tipping point where technology can drive monumental change in financial crime prevention. At Napier AI, we see AI not only as a tool but as a catalyst that can enhance compliance efforts globally, delivering better results with greater efficiency. The numbers from this year’s Index are a testament to what is achievable when AI is effectively AML, in what we call a compliance-first approach.”

The report’s data-driven insights, based on GDP, criminality data from UNODC, and indices such as the Organized Crime Index, FATF, and the Basel Index, provide a robust foundation for understanding how AI can revolutionise AML efforts globally. The analysis also includes perspectives from senior executives on the practical impacts of AI within AML strategies, further supporting its critical role in the financial crime compliance landscape.

Sam Murrant, consulting director at GlobalData, pointed out the operational inefficiencies in AML compliance, stressing the opportunity for AI-driven optimisation: “One of the key findings in our research was that AML compliance, while seen almost unanimously as essential, is generally inefficient. It is clear from the findings of this report that there is huge potential to improve AML processes. According to our model, implementation of technological solutions to save valuable time among the experts working in AML can save banks billions annually in compliance costs alone.”

Napier AI’s Continuum platform, trusted by over 150 institutions globally. By shifting compliance from a regulatory necessity to a strategic advantage, Napier AI aims to empower financial institutions in reducing the financial impact of crime on the global economy.

To read the full report, it can be downloaded for free here.

Keep up with all the latest FinTech news here.

Copyright © 2024 FinTech Global