It was a diverse week for FinTech funding, with deals closing across nine different countries.

There were a total of 17 FinTech funding rounds covered by FinTech Global this week. Collectively, the companies amassed a total of $1.1bn, helped by four deals over $100m.

The US continued its role as the driving force of deal activity, accounting for six of the deals. Despite its deal volume, it was mainly comprised of smaller funding rounds, with the biggest US deal being Snap! Mobile’s $23m growth investment from Runway Growth Capital. Snap! is a fundraising platform for schools and organizations.

The other US-based FinTechs to raise capital this week are NovoPayment, Notabene, Payfinia, Talli and Zeplyn.

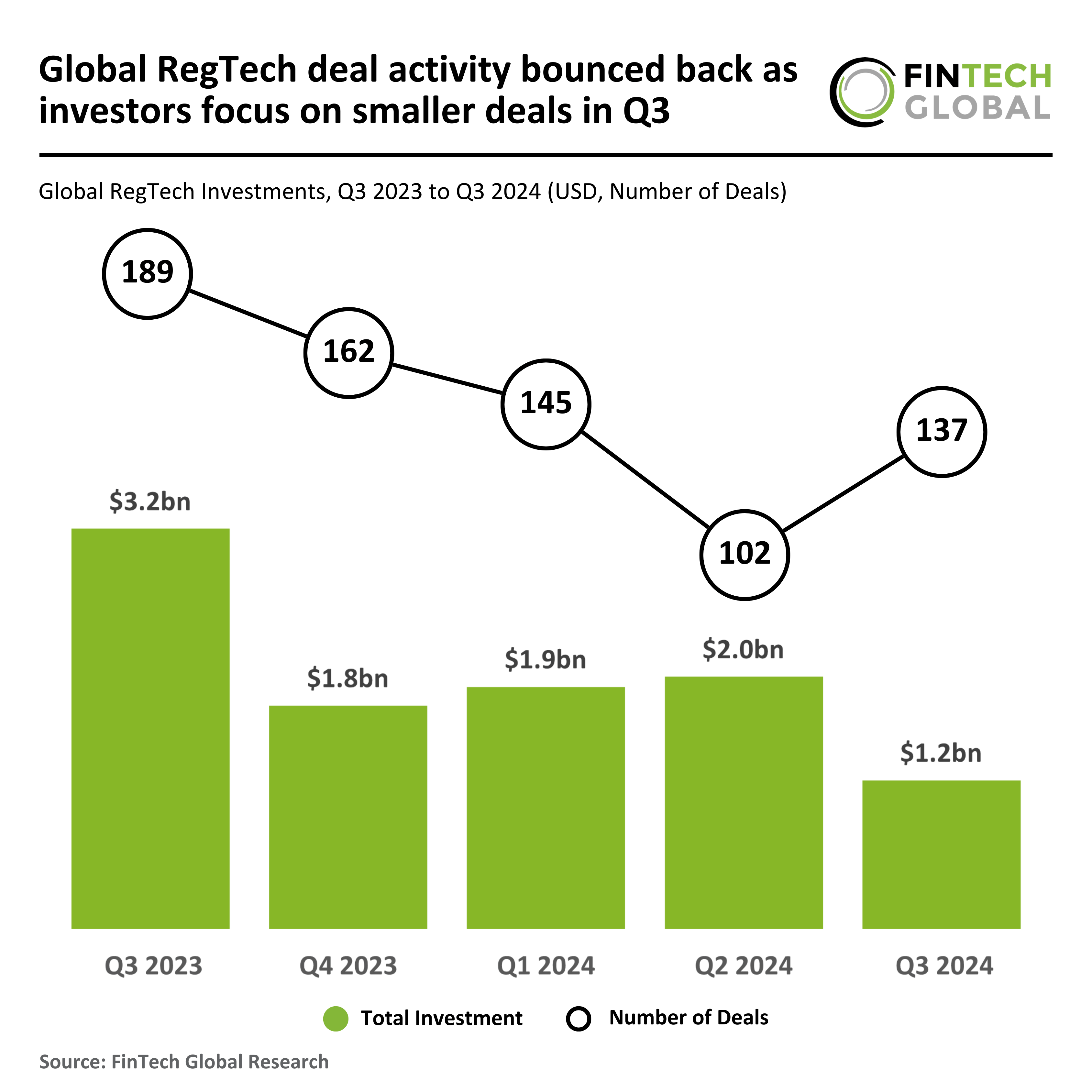

Despite the US dominating the FinTech sector each week, the country is seeing a reduction in activity. A recent report from FinTech Global found that US FinTech funding projected to drop by 56% in 2024, with investors focusing on smaller deals.

There were 441 deals recorded in Q3 2024, representing a 58% decrease from the 1,059 deals completed in Q3 2023. As for funding, US-based FinTech firms raised $8.8bn in Q3 2024 – a 54% decline from the $19bn raised in Q3 2023.

The UK was home to three of the FinTech deals. This included the third biggest deal of the week, iwoca’s £200m investment. iwoca offers a range of lending products tailored to meet the varied financial needs of smaller and medium-sized businesses across the UK and Europe. The other UK-based FinTechs are Tranched and Investa.

Canada was the only other country to see multiple FinTech funding rounds this week. One of these was Neo Financial, which pulled in CAD $360m. This deal, which was the second largest of the week, includes CAD $110m of equity and CAD $250m of debt. Neo Financial operates at the intersection of technology and finance, providing innovative financial products designed to offer Canadians viable alternatives to traditional banking. There was just one other Canadian company to close an investment this week, Trolley.

The biggest deal of the week was raised by Argentina’s Ualá. The mobile banking provider secured $300m for its Series E funding round, which brings its valuation to an impressive $2.75bn. The round was backed by Allianz’s venture capital arm, as well as several other investors. Ualá’s banking services are used by over eight million people across Argentina, Mexico and Colombia.

Other countries represented in this week’s deal activity are Israel (Upwind), Saudi Arabia (Lean Technologies), Italy (Satispay), Poland (Big xyt) and the UAE (Pemo).

In terms of sectors, PayTech was the most dominant. There were five PayTechs to secure funds this week. These were Satispay, NovoPayment, Notabene, Payfinia and Talli.

It was followed by WealthTech, which accounted for four deals. However, the two biggest deals of the week are both WealthTechs (Ualá and Neo Financial). Zeplyn and Investa are the other two WealthTechs to secure funds this week, the two smallest funding rounds of the week.

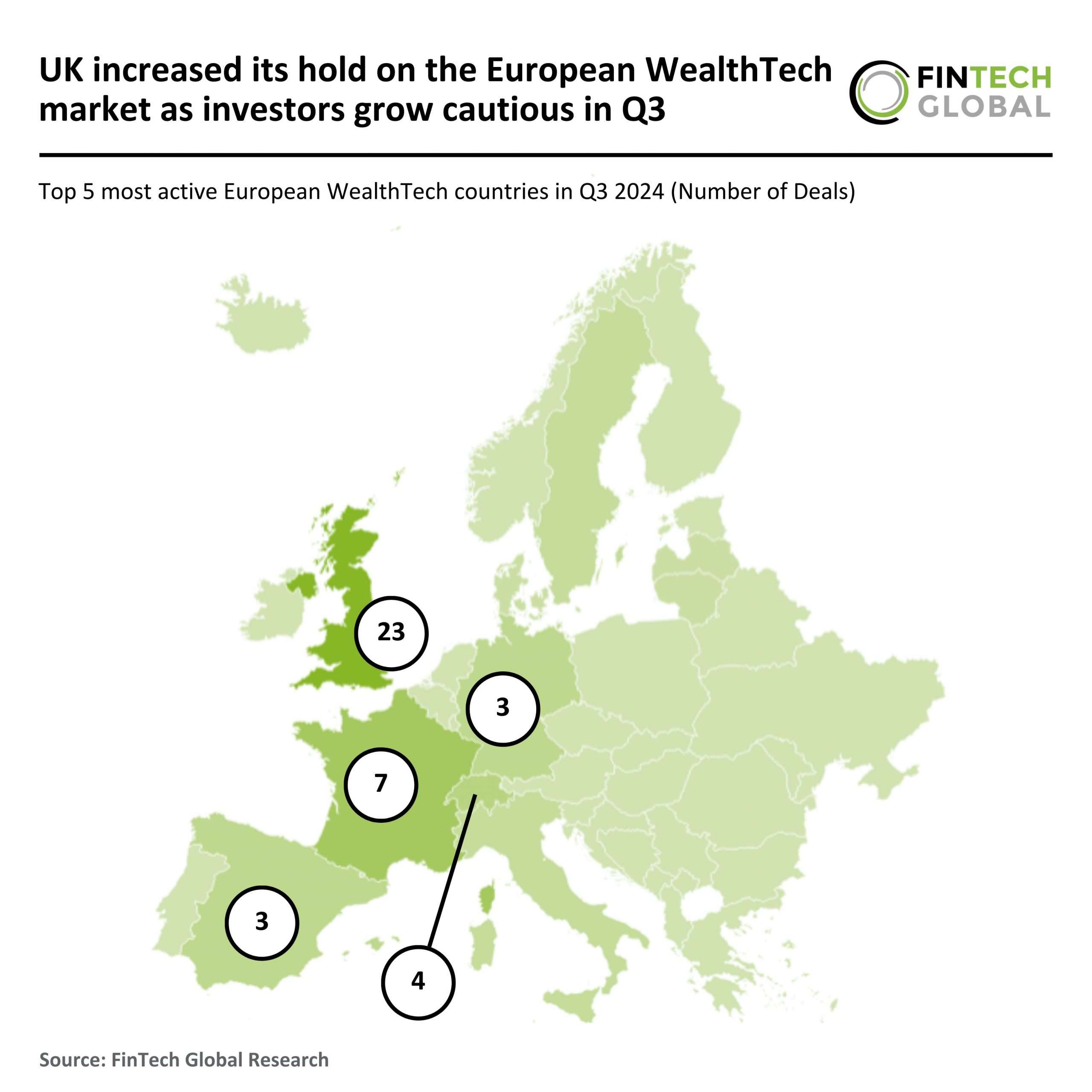

While WealthTech was responsible for a large portion of this week’s funding, the sector is having a tough year. A recent report from FinTech Global found that in the European WealthTech market experienced a sharp downturn in both funding and deal activity in Q3, compared to last year.

The sector recorded 38 funding rounds, an 87% decrease from the 300 deals completed in Q3 2023. Similarly, European WealthTechs raised $311m during Q3 2024, a 91% drop from $3.41bn raised in Q3 2023.

There were three infrastructure & enterprise software companies to close rounds this week (Lean Technologies, Trolley and Pemo) and two marketplace lending providers (iwoca and Tranched). Finishing off the week are CyberTech Upwind, Data & Analytics provider Big xyt and funding platform Snap! Money.

Here are this week’s 17 FinTech deals covered on FinTech Global this week.

Argentinian Ualá secures $300m in Series E to expand LatAm operations

Ualá, the Argentinian mobile banking pioneer, has successfully closed a $300m Series E funding round, spearheaded by Allianz’s venture capital arm.

According to Finextra, this significant investment boosts Ualá’s valuation to an impressive $2.75bn. Joining Allianz in this round were several notable investors including Stone Ridge Holdings Group, Tencent, Pershing Square Foundation, Ribbit Capital, Goldman Sachs Asset Management, Soros Fund Management, Rodina, SoftBank Latin America Fund, Jefferies, D1 Capital Partners, Claure Group, AlleyCorp, and Monashees.

Founded in 2017, Ualá has rapidly expanded its customer base to over eight million across Argentina, Mexico, and Colombia, issuing more than seven million loans. Originally starting with a debit card, Ualá now holds banking licenses and offers a comprehensive range of services through its app. These services include money transfers, bill payments, credit options, and savings and investment products.

The company is distinguished by its proprietary AI-driven credit scoring engine that analyzes socio-demographic, transactional, and user data to tailor personalized offers to its users.

With the fresh capital, Ualá plans to continue enhancing its product offerings and expanding its market presence. “The trust and confidence from our investors reaffirms our vision: we will soon be the largest bank in Argentina. Mexico and Colombia are next. Our single focus is the finest product: we will keep delivering the best value proposition for our users in Mexico, Argentina, and Colombia — and grow beyond,” said Pierpaolo Barbieri, CEO of Ualá.

Canadian FinTech leader Neo Financial announces massive fundraising effort

Neo Financial recently celebrated a significant milestone by announcing a CAD $360m ($255.6m) Series D funding round.

This latest financial injection includes CAD $110m of equity and CAD $250m of debt, marking it as one of the most substantial FinTech funding rounds globally this year.

The funding round drew notable contributions from several high-profile Canadian founders and entrepreneurs renowned for scaling global tech brands. Notable investors include Tobi Lütke, CEO and founder of Shopify; Stewart Butterfield, founder and former CEO of Slack; David Baszucki, investor and CEO of Roblox; and Mike Wessinger, co-founder and Executive Chair of PointClickCare. They are joined by existing investors such as Valar Ventures, Golden Ventures, Afore Capital, and Thomvest Ventures.

Neo Financial operates at the intersection of technology and finance, providing innovative financial products designed to offer Canadians viable alternatives to traditional banking. The company, in response to the lukewarm venture funding climate, has not only persevered but also thrived, reflecting a robust demand for its services.

The fresh capital will be used to further accelerate the development of Neo Financial’s product offerings. From premium credit cards to competitive mortgage rates and AI-driven budgeting tools, the company is keen on expanding its suite and maintaining its competitive edge. This expansion aligns with Neo’s mission to enhance productivity and innovation across Canada.

Additional information highlights Neo Financial’s rapid growth from offering just one product two years ago to now featuring a full suite that rivals legacy Canadian banks. The company’s product range includes everything from high-interest savings accounts to innovative budgeting tools and instant bill payment services.

iwoca lands £200m ($252.6m) funding package from financial giants Citi and Waterfall Asset Management

iwoca, one of Europe’s largest lenders focused on small and medium-sized enterprises (SMEs), has secured a fresh debt funding package of £200m from financial giants Citi and Waterfall Asset Management.

The funding comes as iwoca aims to expand its support for medium-sized businesses, doubling its maximum loan offering to £1m, according to FF News.

The recent £200m debt financing round is a significant addition to iwoca’s previous funding activities.

Over the last two years, the FinTech lender has raised a substantial £740m in debt financing from key partners, including Citi, Barclays, Värde Partners, Pollen Street Capital, and Insight Investment. Since its inception in 2012, iwoca’s cumulative funding has now reached nearly £1.5bn.

Founded with a mission to make business financing accessible for SMEs, iwoca offers a range of lending products tailored to meet the varied financial needs of smaller and medium-sized businesses across the UK and Europe.

The company has now raised the maximum loan limit to £1m to address rising demand from medium-sized enterprises seeking larger financing solutions.

With this new influx of funds, iwoca plans to increase its lending capacity and bolster its presence within the UK’s SME sector.

The company recently published data from its SME Expert Index indicating that demand for loans over £100,000 is on the rise, with nearly one-third of brokers expecting this segment to drive the most applications in the coming six months.

Additional milestones underscore iwoca’s momentum in the UK FinTech sector. In 2023, it was recognised among the top 10 UK FinTech performers, alongside well-known names like Monzo, Starling, and Revolut.

iwoca reported £143m in revenue that year and achieved net profitability in Q4 2022, a position it has maintained since. This year’s growth is set to outpace previous records, with a projected annualised revenue rate of £251m by Q3 2024, representing a 62% year-on-year increase.

Israeli cloud security firm Upwind seeks $100m in Series B funding

Israeli cybersecurity firm Upwind, known for its advanced cloud infrastructure security solutions, has attracted significant investor interest in its upcoming funding round.

Upwind is looking to raise $100m in a Series B funding round, bringing its post-money valuation between $850m and $900m, according to a report from TechCrunch.

The round includes both new and existing investors, such as Craft Ventures, Greylock, CyberStarts, Leaders Fund, Omri Casspi’s Sheva Fund, and basketball star Steph Curry’s Penny Jar fund, it said.

Founded by Amiram Shachar, Upwind addresses cloud infrastructure vulnerabilities through a platform that minimizes the overwhelming volume of alerts typical in cybersecurity threat detection. The company’s technology streamlines security operations by reducing these alerts by 90%, enabling teams to focus more on actual, high-priority threats. Upwind’s platform addresses cloud services by providing solutions in areas like vulnerability management, identity security, container security, and API vulnerability management, covering an integrated approach that supports security across various facets of cloud infrastructure.

The newly secured funds are set to drive Upwind’s research and development initiatives and support expansion efforts. Plans include hiring an additional 100 staff members across locations in Israel, San Francisco, and Iceland, enhancing Upwind’s capacity to support its growing client base, which includes numerous Fortune 500 companies.

Riyadh-based FinTech platform Lean Technologies secures $67.5m Series B round

Lean Technologies, a Riyadh-based FinTech infrastructure platform, has raised $67.5m in its latest Series B funding round.

This financing was led by General Catalyst, a prominent Silicon Valley venture capital firm known for supporting high-growth tech companies, according to Finextra.

The funding round also saw participation from several major investors, including Bain Capital Ventures, Stanley Druckenmiller’s Duquesne Family Office, Arbor Ventures, and Saudi Venture Capital, among others.

With this new round, Lean Technologies has now raised over $100m in total funding to date.

The firm aims to drive financial innovation throughout the MENA region by providing secure access to essential financial infrastructure.

The company’s solutions enable businesses to embed personalised financial services within their platforms, ultimately making financial data and payment processing more accessible, transparent, and valuable for consumers and companies alike.

With the fresh capital, Lean Technologies plans to expand its range of Pay-by-Bank and Open Banking solutions. This will enhance its ability to support businesses across the Middle East, enabling Lean to streamline payment processes, develop strategic partnerships, grow its team of experts, and strengthen its role as a leading fintech infrastructure provider in the region.

Over the past three years, Lean has significantly impacted the financial sector in the MENA region. Regulated by ADGM in the UAE, Lean has facilitated payment processes for companies such as e&, DAMAC, and Careem, processing over $2bn in transactions.

In Saudi Arabia, the firm has introduced data solutions under the Saudi Central Bank’s regulatory sandbox, allowing clients in insurance, lending, and marketplaces to streamline operations and improve customer experiences.

Lean’s services have been embraced by notable clients, including Tawuniya, ALJUF, Salla, Tabby, and Tamara, making it a central player in the region’s financial ecosystem.

Satispay secures €60m to expand mobile payment and investment services

Empowering school fundraising: Snap! Mobile raises $23m from Runway Growth Capital

Snap! Mobile, a leading fundraising platform for schools and organizations, has secured a $23m growth investment from Runway Growth Capital.

This investment underscores Runway’s commitment to supporting ventures that provide innovative solutions to significant community needs, particularly in educational settings.

The investment will be directed towards expanding Snap! Mobile’s digital offerings, enhancing the capabilities of its platform to empower more organizations to raise essential funds for high school athletics and other extracurricular activities. Snap! has established itself as a pioneer in digital fundraising, simplifying the process for schools across the U.S. to support their sports teams and clubs.

Beyond mere fundraising, Snap! Mobile offers a comprehensive suite of software solutions that support the daily operational needs of athletic directors, coaches, and organizational leaders. These solutions include account management, scheduling, communications, fan engagement, and even an integrated team store. This holistic approach not only aids in funding but also enhances the overall management and community engagement within school programs.

Trolley gears up with $23m Series B for global expansion of payout solutions

Trolley, an end-to-end global payouts platform, today announced it has successfully secured a Series B growth equity investment totaling $23m USD.

The funding round was led by Wavecrest Growth Partners, with continued support from existing investor Pace Capital. This financial backing is set to significantly enhance Trolley’s compliance and payment solutions globally.

The company specializes in streamlining payouts, tax compliance, and ID verification processes for businesses worldwide. Trolley serves a wide range of clients, from startups to Fortune 500 companies, offering solutions that manage the complexities of global payouts efficiently.

The newly acquired funds will be strategically utilized to accelerate Trolley’s product development, expand its market presence, and enhance its platform to meet the growing needs of its diverse client base. Trolley aims to improve its existing offerings while also expanding its reach to new geographies and industries.

Over the past three years, Trolley has experienced remarkable growth, with a 484% increase in revenue. This surge has been recognized in the Deloitte Technology Fast 50™ rankings for two consecutive years. With this latest round of funding, Trolley is well-positioned to continue its path toward profitability and further secure its financial stability.

NovoPayment secures $20m from Morgan Stanley to boost FinTech innovations

NovoPayment, an embedded financial and payment infrastructure service provider, has recently raised $20m in funding.

According to Finextra, this significant investment was made by Morgan Stanley Expansion Capital, marking a pivotal moment for the US-headquartered firm.

Specializing in a broad spectrum of financial services, NovoPayment provides a comprehensive suite of tools that cater to banks, financial institutions, neo-banks, digital merchants, and FinTech companies. Their offerings include digital wallets, instant issuance of deposit accounts, virtual cards, real-time payment (RTP) capabilities, cross-border transfers, digital lending, and cash management solutions.

The company plans to utilize the fresh capital to further enhance its innovative platform and expand its footprint in the embedded finance market. With a focus on reducing friction and driving efficiency, NovoPayment aims to solidify its position as a pivotal player in modernizing financial services across its operational markets, which span North America, Latin America, and the Caribbean.

Notabene secures $14.5m in Series B to propel stablecoin and payment innovations

Notabene, the leading digital asset payment authorization network, announced today that it has raised $14.5m in a Series B funding round.

The round was spearheaded by DRW VC and saw participation from several prestigious firms including Apollo, NextBlock, ParaFi Capital, and Wintermute, alongside existing investors such as CMT Digital, F-Prime, Green Visor Capital, Illuminate Financial, Jump Capital, Signature Ventures, and Y Combinator.

The company is renowned for automating the secure transfer of sensitive data across financial institutions, simplifying the compliance process required by the global financial regulation known as the Travel Rule. This rule mandates that digital asset companies, including exchanges and payment processors, securely exchange information about both the sender and receiver of funds.

Notabene has played a pivotal role in processing over half a trillion dollars worth of transactions.

With this new capital, Notabene plans to expand its support to traditional financial institutions venturing into digital payments. Given the burgeoning global adoption, with over $20trn processed in stablecoin transactions last year, Notabene is keen to unlock stablecoins’ potential as fast, low-cost, borderless payments. The company aims to facilitate a secure, transparent system that supports an open, interoperable payment network.

Big xyt secures €10m ($10.5m) from Finch Capital to spearhead global FinTech expansion

Big xyt, a leading provider of AI-analytics for financial markets, announced today that it has secured a significant €10m in funding.

The investment was led by European growth investment firm Finch Capital, marking the first round of external funding for big xyt after a decade of profitable self-sustaining growth.

The €10m investment will be instrumental in accelerating big xyt’s global expansion plans, focusing on extending its reach into Europe, the US, and APAC markets. The funding will also support a strategic hiring initiative slated for 2025.

Big xyt specializes in delivering comprehensive data analytics solutions that simplify complex market dynamics for financial institutions. The company’s advanced technology platform provides detailed insights into trading environments, liquidity, and market trends, which are crucial for data science and quant teams within major global investment banks, asset managers, exchanges, and regulatory bodies.

Big xyt’s platform is renowned for its ability to systematically collect, clean, validate, and store vast quantities of tick data from over 120 trading venues globally. This data is then processed to generate metrics that measure all forms of trading activity, supported by comprehensive APIs that facilitate deeper quantitative research and system integration for algorithmic and decision-support tools.

UAE’s Pemo secures $7m to innovate spend management in GCC

Pemo, a leading Dubai-based spend management platform, recently announced securing $7m in Pre-Series A funding.

Following two years of exceptional growth in the UAE, Pemo reached a milestone with AED 1.4bn in annualised transactions. This success underscores its commitment to outstanding customer service and positions it as a key player in the region.

The funding round, co-led by Shorooq and Augmentum Fintech, comes as Pemo aims to innovate further in its product offerings and deliver unparalleled value to its customers. These investments are crucial as the company eyes expansion into broader markets within the GCC, particularly Saudi Arabia, an emerging technology hub with a robust demand for smart, digitally-connected solutions.

Pemo simplifies spend management by offering corporate virtual and physical cards along with automated tools. These solutions ensure full visibility and control over financial data, empowering businesses to make swift, informed decisions that fuel growth. The recent addition of corporate income tax in the UAE makes these services especially valuable, aiding businesses in maintaining compliance and streamlining operations.

With its platform, Pemo enables companies to manage expenses efficiently, allowing for real-time analytics and AI-driven automated accounting. This advanced technology facilitates better control over finances by letting employees set limits, match receipts, and track expenditures.

Payfinia secures $4.5m funding to expand instant payments platform

Payfinia, an independent payments company committed to democratising instant payments, has launched the Payfinia Credit Union Service Organisation (CUSO).

The company has secured $4.5m in seed funding from Star One Credit Union, based in Sunnyvale, California. The credit union, which holds $9.9bn in assets and serves 126,000 members, has been a key collaborator in developing Payfinia’s flagship Instant Payment Xchange™ (IPX) platform.

Payfinia offers a comprehensive real-time payments solution through IPX, a payments-as-a-service (PaaS) framework certified to process transactions on the FedNow Service. The platform allows credit unions and financial institutions to execute instant payments with embedded fraud prevention, improving operational efficiency and cash flow management.

The newly raised funds will enable Payfinia to refine the IPX product roadmap and scale its integration capabilities. Notably, Star One Credit Union has already processed a series of $500,000 instant payment transactions through the platform, achieving settlement times of under five seconds. Payfinia highlighted the platform’s ability to handle dynamic user settings, permitting higher transaction limits while reducing fraud risks.

Talli secures $4m to revolutionize legal payments with cutting-edge digital solutions

Talli, a pioneering digital payments platform specifically crafted for the legal sector, announced today a significant milestone in securing a $4m seed investment.

The round was spearheaded by Vestigo Ventures, marking a robust vote of confidence in Talli’s innovative approach to legal financial transactions.

Talli is redefining the landscape of legal settlements by offering a comprehensive digital solution aimed at legal professionals managing client settlements and reimbursements.

This platform addresses several longstanding issues within the industry, including manual and outdated processes, unpredictable reimbursement cycles, and excessive transaction costs, among others.

The newly acquired funds are earmarked for accelerating Talli’s mission to digitize and streamline legal payment processes.

Tranched secures $3.4m funding to revolutionize asset-based financing with blockchain

Tranched, a London-based FinTech company, has successfully raised $3.4m in pre-Seed funding.

This round was spearheaded by Speedinvest and saw participation from influential investors including Andressen Horowitz’s Accelerator, Blockwall, Kima, and OVNI Capital, according to a report from FinTech Finance News.

These funds are earmarked to enhance Tranched’s offerings with new features and to broaden its global reach.

Tranched is designed to automate the traditionally manual and complex process of bundling loans into securities, utilising cutting-edge blockchain technology. This innovation promises to strip away structural complexities and reduce exorbitant fees typically associated with securitisation.

The new capital will be used to expand Tranched’s technological capabilities and its geographic footprint. Initially focused on European markets, Tranched plans to extend its services to lenders, credit funds, asset managers, and banks worldwide.

Zeplyn lands $3m to enhance advisor efficiency with AI-driven platform

Zeplyn, a WealthTech company founded by former Google engineers, focuses on streamlining workflows for financial advisors through AI-powered solutions.

The company has successfully raised $3m in a seed funding round led by Leo Capital, with additional participation from Converge and a group of angel investors. These funds will support Zeplyn’s mission to revolutionise the wealth management sector with AI-native technologies.

The firm’s flagship product, the Zeplyn Meeting Assistant, enhances efficiency by automating administrative tasks, enabling advisors to focus on client relationships.

Zeplyn’s Meeting Assistant leverages artificial intelligence to transform unstructured conversational data into accurate notes, automating meeting preparation, note-taking, and follow-up tasks. It integrates seamlessly with popular CRMs, such as Salesforce, Redtail, and Wealthbox, to update client records and ensure compliance with industry standards. The platform saves financial advisors an average of 10-12 hours per week by reducing the burden of administrative work.

Investa secures £700k in inaugural crowdfunding campaign

Investa, the UK’s first zero-commission listed options trading app, has successfully closed its inaugural crowdfunding campaign, securing £700k.

According to FinTech Finance, the round was notably oversubscribed, prompting an early close due to high demand. Founded by former Citi options brokers and the co-founder of Freetrade, Investa is positioned to democratize access to stock and options trading.

The funds raised in this round are earmarked for accelerating development and expanding marketing efforts as the company nears its official launch. Investa aims to redefine the trading experience by simplifying the technical journey, enabling on-the-go traders to engage with the market more effectively.

Currently, Investa is the only app in the UK that allows zero-commission trading of listed options, aiming to fill a significant market gap. This innovative approach intends to make options trading more accessible to UK investors, of whom only 2% are estimated to have traded options compared to 20% in the US.

The recent addition of Ian Fuller to the team underscores the company’s commitment to enhancing investor participation in options trading. His expertise is expected to be pivotal in refining the user experience.

Keep up with all the latest FinTech news here.

Copyright © 2024 FinTech Global