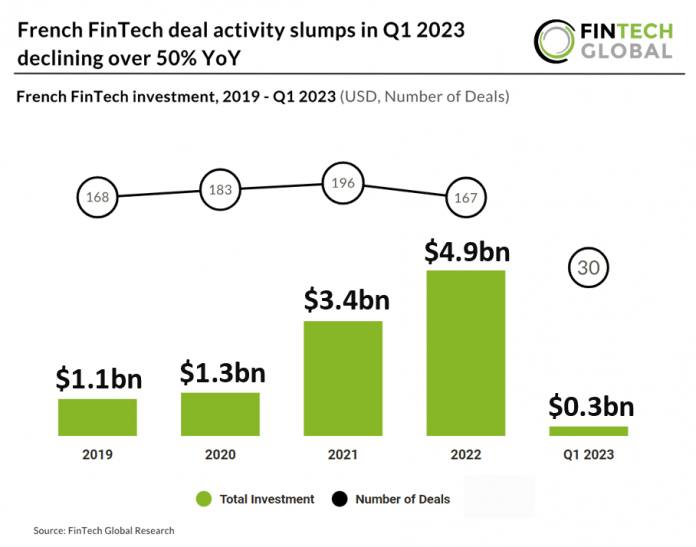

Key French FinTech investment stats in Q1 2023:

• French FinTech funding reached $299m in Q1 2023, an 83% drop when compared to the same period last year

• FinTech deal activity in France in Q1 reached 30 deals, a 57% drop from Q1 2022

• Blockchain & Crypto was the most active French FinTech sector in Q1 2023 with seven deals

The beginning of the year brought disappointment to France’s FinTech sector as both investment and deal activity experienced significant declines in Q1 2023 compared to Q1 2022. French FinTech investment suffered a substantial drop, reducing to $299m, marking an 83% decrease year-on-year. Similarly, French FinTech deal activity in Q1 2023 reached a total of 30 deals, reflecting a 57% decline compared to Q1 2022. Based on the deal activity observed in Q1 2023, it is projected that French FinTech will experience a 29% drop in number of transactions by year end.

Ledger, which provides security and infrastructure solutions to critical digital assets, was the largest French FinTech deal in Q1 2023 raising $108m to extend their Series C funding round. The extension round maintained the company’s valuation at €1.3 Billion. The company intends to use the funds to further its global ambitions and accelerate its drive to support blockchain innovation. Led by Pascal Gauthier, Chairman and CEO, Ledger is a global platform for digital assets and Web3. With more than 6M devices sold to consumers in 200 countries and 10+ languages, 100+ financial institutions and brands as customers, 20 % of the world’s crypto assets are secured, plus services supporting trading, buying, spending, earning, and NFTs.

Blockchain & Crypto was the most active French FinTech sector in Q1 2023 with seven deals, a 23% share. RegTech was the second most active FinTech subsector with five deals, a 17% share and PayTech was the third most active with four transactions, a 13% share of total deals.

As of January 2023, The French government has changed specific rules for how it taxes capital gains made by people who manage their own money. If you exchange “qualifying” types of cryptocurrencies, there’s no tax on that. But if you sell a “qualifying” cryptocurrency for regular money, you’ll have to pay a flat tax of 30%. You can also choose to pay tax based on your income. If you sell a cryptocurrency that doesn’t qualify, you’ll have to pay tax based on your income, which could be as high as 49%. You also have to tell the government about any cryptocurrency accounts you have outside of France every year. Some people have been audited and had to pay higher taxes because the government decided they were acting like professionals instead of just managing their own money.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2023 FinTech Global