Key Global InsurTech seed investment stats in Q1 2023

• InsurTech deal activity reached 39 deals in Q1 2023, a 53% drop from Q1 2022

• Eighteen countries announced InsurTech seed deals in Q1 2023

• The average InsurTech deal size was $2.8m in Q1 2023, a 24% increase YoY

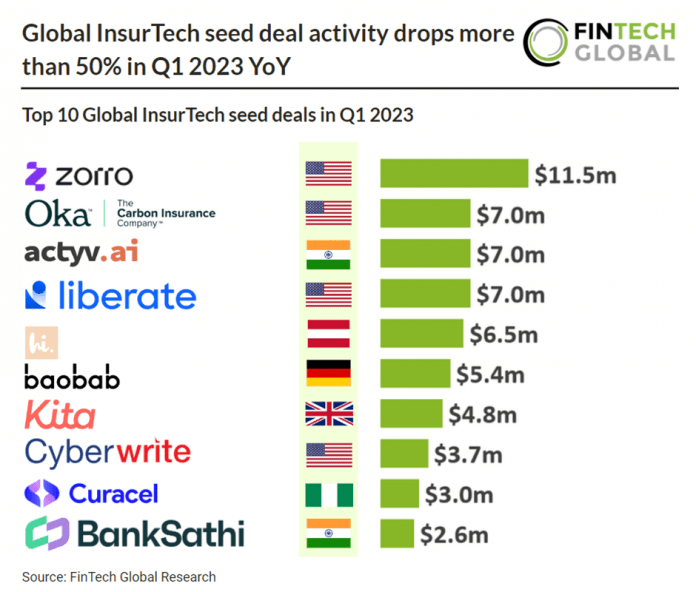

InsurTech has fell victim to the global downturn in seed deal funding with both deal activity and investment dropping in the first quarter of 2023. InsurTech deal activity dropped to 39 deals in Q1 2023, a 53% decrease YoY. InsurTech seed investment has also dropped with InsurTech seed companies raising a combined $76m in Q1 2023, a 41% drop from Q1 2022. This puts average InsurTech seed deal size at $2.8m in Q1 2023, a 24% increase from Q1 2022.

Zorro, an end-to-end insurance management solution and employee benefits platform, was the largest InsurTech seed deal in Q1 2023 after raising $11.5m from 10D and Pitango VC. “Zorro sits at the exciting intersection of the healthcare and financial sectors, and we’re proud to have developed a technology that makes offering employee health insurance plans more transparent, cost-effective and personalized,” said Guy Ezekiel, CEO and co-founder of Zorro. “Our solution flips the outdated health benefits model upside down and gives employers predictability, while providing employees with the coverage that best fits their needs. The multi-disciplinary expertise that exists among the Zorro team members, including in healthcare, InsurTech, software and big data, is a unique asset that allows us to accomplish our important mission of improving access to quality and affordable healthcare.” Zorro examines the benefit goals of employers in order to establish a consistent budget and benefit allocation for individual employees or employee groups. It goes beyond that by offering a complete insurance management solution that simplifies and enhances the process of administering benefits through a unified platform. Moreover, Zorro serves as a financial partner, evaluating employees’ healthcare requirements, family circumstances, risk preferences, and other personal attributes. Based on this analysis, it generates a personalized package of benefits, which includes health insurance, supplementary coverage, tailored digital health solutions, and additional financial value-added services.

Overall, there were 18 countries with companies that raised InsurTech seed deals in Q1 2023 with the USA being the most active. The USA was home to the highest number of InsurTech seed deals in Q1 2023 with 14 transactions, a 26% share of total deal activity. The UK was the second most active InsurTech country with four deals, a 10% share of total deals. Nigeria and India were the joint third most active InsurTech seed countries with three deals each.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2023 FinTech Global