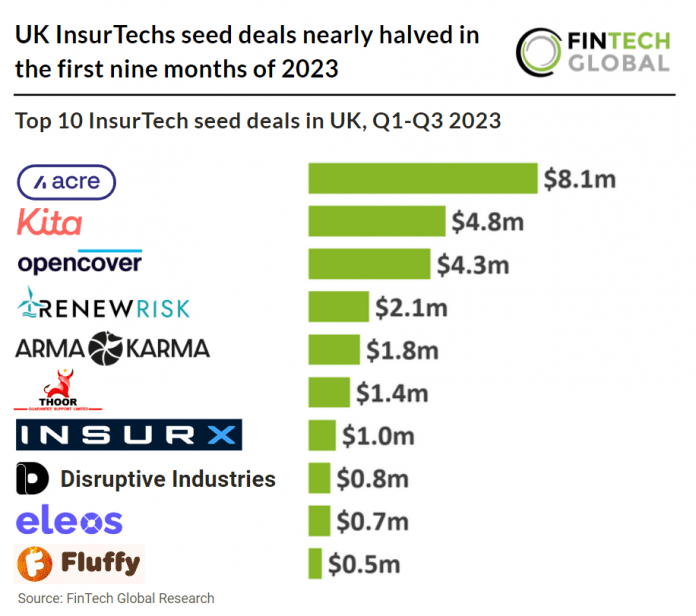

Key UK InsurTech seed deal investment stats in Q1-Q3 2023:

• UK InsurTech seed deal activity reached 16 deals in Q1-Q3 2023, a 47% drop from Q1-Q3 2022

• The average size of UK InsurTech seed deals increased 39% in Q1-Q3 2023 YoY to $1.98m

• UK InsurTech seed deals raised a combined $25.8m during the first three quarters of 2023, a 17% reduction from the same period in 2022

Seed deal activity in the UK’s InsurTech sector has faltered in 2023 dropping by almost 50%. In Q1-Q3 2023, the number of seed deals in the UK InsurTech sector fell by 47% compared to the same period in 2022, totalling 16 deals. The YoY average for UK InsurTech seed deals in Q1-Q3 2023 saw a significant rise of 39%, reaching $1.98 million. In Q1-Q3 2023, UK InsurTech seed deals collectively secured $25.8M in funding, marking a 17% decrease compared to the corresponding period in 2022.

Acre, which are improving the insurance and mortgage application process for advisers, had the largest InsurTech seed deal in the UK during Q1-Q3 2023 after raising $8.1 (£6.5m) in their seed round, led by Aviva Ventures and McPike Global Family Office. After securing this investment, Acre intends to sustain its current pace of customer expansion and work towards its goal of revolutionizing the home buying process. Acre is set to establish fresh collaborations with lenders and insurers to streamline its brokers’ ability to recommend and facilitate the acquisition of suitable financial products and services. A fundamental aspect of Acre’s vision involves a single entry and verification of client data and identity, to be seamlessly shared throughout the entire home buying journey. The firm’s ongoing evolution comes at a time when lending is increasingly complex due to the difficult economic climate, and brokers’ increased responsibility for outcomes for their customers. Acre CEO and founder Justus Brown said, “We pride ourselves on being at the forefront of innovation in financial advice, delivering a new, modern approach that simplifies the advice journey for brokers and delivers on the needs of clients. This latest fundraise demonstrates our strength and commitment to the market and supercharges our ambitions as the tech platform of choice for brokers.

In 2024, the UK’s InsurTech sector is poised for significant regulatory changes and evolution. The regulatory landscape is becoming more accommodating, with the Prudential Regulation Authority (PRA) actively working on regulatory frameworks to foster innovation and competition. This includes the proposed mobilization regime under the review of Solvency II, aimed at easing market entry for smaller InsurTech firms. Additionally, the creation of the New Insurer Start-Up Unit by the PRA and FCA demonstrates regulatory support for new entrants. Regulation is also extending to InsurTech platform providers, who play a crucial role in the industry. Outsourcing and operational resilience remain focal points, requiring firms to manage risks associated with third-party services. The Financial Services and Markets Act 2023 introduces oversight of critical third parties (CTPs), which could include InsurTech platform providers. This development aims to address systemic risks posed by certain third parties, such as cloud providers and data analytics firms.