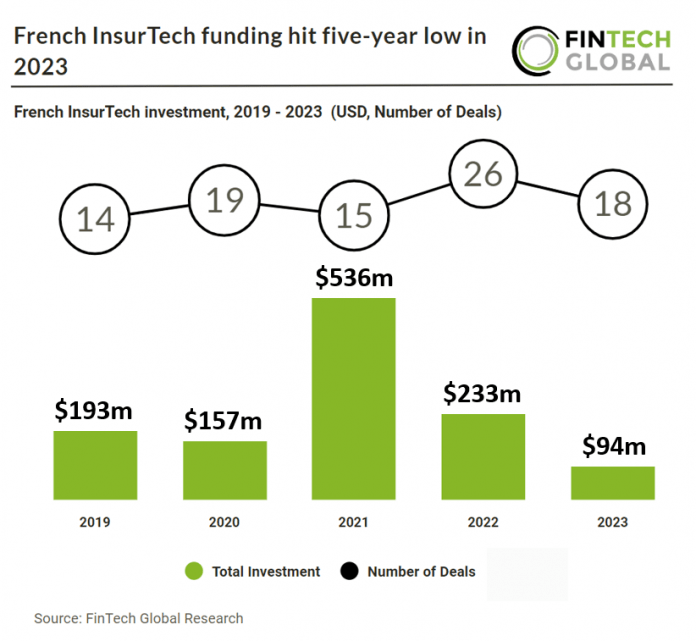

Key French InsurTech investment stats in 2023:

• French InsurTech companies raised a combined $94m in 2023, a 60% drop from 2022

• French InsurTech deal activity totalled at 18 deals in 2023, a 31% drop YoY

• French InsurTech companies have raised a combined $1.2bn from 2019-2023

In 2023, French InsurTech companies experienced a significant decline in funding, with a collective total of $94m raised, marking a notable 60% decrease compared to the previous year. From 2019 to 2023, French InsurTech firms collectively secured a total of $1.2bn in funding. Deal activity within the sector also saw a downturn, with a total of 18 deals recorded, reflecting a 31% drop year-on-year.

Akur8, a predictive analytics platform for P&C and health insurers, had the largest French InsurTech deal in 2023 after raising $25m in their latest Venture funding round, led by FinTLV Ventures. The fresh funding will enable Akur8 to accelerate their transformation of insurance pricing even further and fuel their growth in key markets such as the US and APAC. “To further enable and enhance our capabilities, we recently conducted a new fundraising to bring additional strategic partners to the table. FinTLV Ventures, a leading global venture capital firm with an extensive network investing in top insurtech and fintech companies, chose to invest in Akur8 – a powerful endorsement of our immediate and future potential,” noted Samuel Falmagne, CEO of Akur8.

In 2024, regulatory changes in France, will significantly impact the insurance sector, particularly regarding sustainability and non-financial standards. The Corporate Sustainability Reporting Directive (CSRD), passed in December 2022, will start to be enforced gradually from January 1, 2025. Insurers will need to report carbon emissions data based on their 2024 operations, including direct emissions from their equipment and facilities, emissions from energy production, and emissions from third parties involved in value creation, such as distribution, claims management, and asset management.