Key Canadian FinTech investment stats In Q1 2024:

• Canadian FinTech deal activity reached 48 transactions in Q1 2024, a 51% drop YoY

• Canadian FinTech companies raised a combined $162m in Q1 2024, a 60% drop from Q1 2023

• PayTech was the most active Canadian FinTech subsector with nine deals in Q1 2024

In the first quarter of 2024, the Canadian FinTech sector experienced a significant decline in deal activity, with only 48 deals recorded, marking a substantial 51% drop compared to the previous year. Canadian FinTech companies also faced a substantial decrease in fundraising, collectively raising $162m, reflecting a notable 60% decline from the same period in 2023.

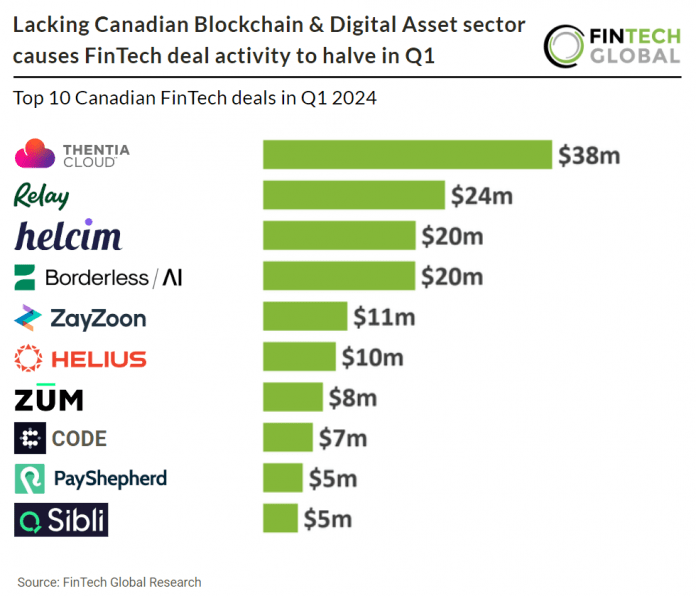

Thentia, a regulatory and compliance platform for accountants, had the largest Canadian FinTech deal in Q1 2024 after raising $38m in their latest Series B funding round, led by BDC Venture Capital, Espresso Capital, First Ascent Ventures and Spring Mountain Capital. The company plans to utilize the funds to expand operations, drive rapid growth, allocate resources to artificial intelligence initiatives, and bolster its capacity to serve its growing global clientele. Led by CEO Julian Cardarelli, Thentia works for regulators and regulatory agencies worldwide with a platform that handles department functions including licensing, investigations, enforcement, fitness to practise, quality assurance, scope of practise, continuing education, board management, data analysis, and more. Thentia Cloud empowers regulators to transcend the constraints of legacy processes, custom-built solutions, and a web of disparate applications, all with a platform.

PayTech was the most active Canadian FinTech subsector with nine deals in Q1 2024, a 19% share of total deals. This was followed by WealthTech with seven deals, a 15% share of deals and Blockchain & Digital Asset was third with six deals, a 13% share of deals. Blockchain & Digital Asset was the most active FinTech subsector in Q1 2023 with a 18% share of deals. This shift in funding could indicate a drop in hype for the sector or a maturing sector with a lack of new innovation.

In Canda’s Budget 2024, the government proposes to introduce legislation to establish a framework for consumer-driven. Consumer-driven banking, also known as open banking or consumer-directed finance, refers to frameworks that allow consumers and small businesses to securely transfer their financial data through an application programming interface (API) to approved service providers of their choice. Consumer-driven banking enables consumers to securely use data-driven financial services that can help them better manage their finances and improve their financial outcomes. For example, through consumer-driven banking, people could access services that allow them to build their credit by reporting their on-time rental payments to credit bureaus, making it easier to qualify for a mortgage.