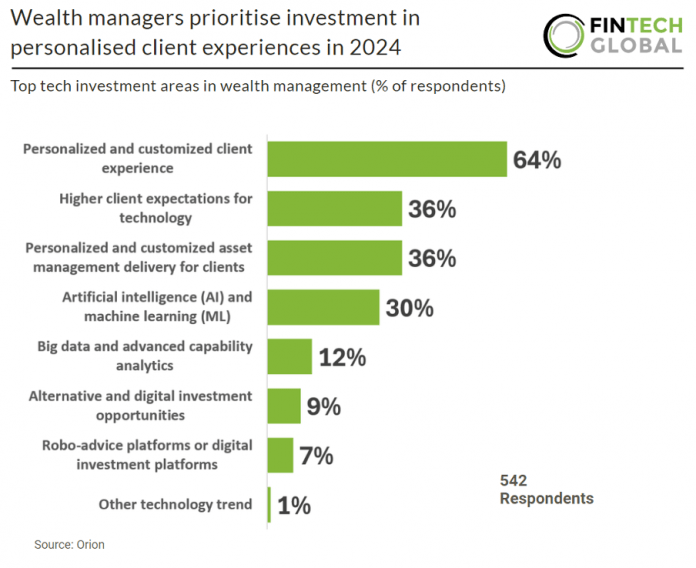

In a recent WealthTech survey conducted in January 2024 by Orion, 542 Principal, Portfolio Managers, Chief Operating Officers, Operations Staff, Compliance/Risk Managers and Others were surveyed on WealthTech implementation and usage.

The report highlights a strong trend towards investing in personalized client experiences, with 64% of advisors surveyed prioritizing this, although it has decreased by three percentage points compared to 2023. Additionally, there is an increasing shift towards integrating artificial intelligence (AI) and machine learning (ML) into operations, rising by 12 percentage points from 2023 to 30% in 2024.

While personalised and customised asset management delivery for clients remains one of the top three priorities, fewer advisors noted it as a priority for investment, falling by 8 percent from 2023. Similarly, there was a decline of 10% for the trend of higher expectations for technology, which includes multi-channel touchpoints leveraging different technologies.

Orion’s report also surveyed respondents on which technology will be the most disruptive to the wealth management sector over the next three years. Unsurprisingly, AI and ML topped that list, with 38% putting the technology as the biggest disruptor – up from 23% in 2023. It was then followed by personalised and customised customer experience at 16%, and robo-advisors and digital investment platforms at 14%.