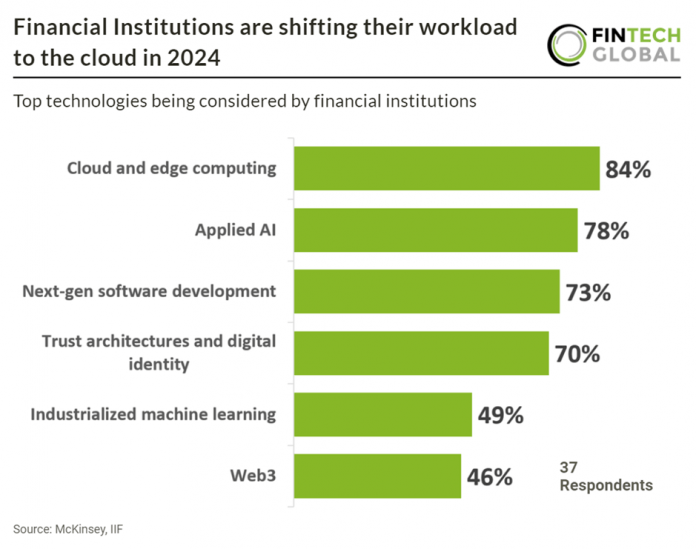

This research was derived from a 2023 survey conducted by McKinsey and The Institute of International Finance of 37 financial services companies around the world. The institutions surveyed included asset managers and private equity companies; retail, corporate, and investment banks; payment companies and clearing houses; capital markets; insurers; and a major data provider. Twenty-six of the institutions reported less than $30 billion in annual revenues, and five reported at least $60 billion.

The survey highlights the growing importance of cloud and edge computing in financial services, with 84% of respondents recognizing their relevance. Six in ten reported that over 25% of their workload now resides in the cloud, a number expected to rise with evolving capabilities. Cloud adoption is already mature, with over 70% of companies beyond the pilot stage. Applied AI is also gaining attention, with nearly 80% of respondents considering it relevant. While AI has a long history in finance, its maturity level varies, with many use cases still in early development stages. However, efforts are underway to explore AI’s potential in areas like customer interaction and fraud detection. Next-generation software development is seen as applicable by almost 75% of respondents, offering the promise of transforming development processes. Although still in the pilot stage for many, companies anticipate simplifying custom development tasks.