CyberTech companies accounted for the lion’s share of FinTech deals this week, accounting for 11 of the total 34 deals.

Not only did the CyberTech sector do well in terms of the total number of deals, it also accounted for more than half of the total capital that was raised this week. The sector amassed a combined total of $850.6m, including six of the ten biggest deals. The combined total funding across all sectors this week reached $1.3bn.

The 11 CyberTech companies to raise capital this week were: Axonius, Claroty, Zama, Todyl, DTEX Systems, Sweet Security, CHEQUER, Cayosoft, Reach Security, Bluecyber and Nuke From Orbit.

This is the second week on the trot that CyberTech has led the way in terms of FinTech deals. Last week, the sector accounted for six of the 20 deals completed.

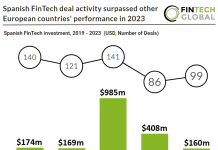

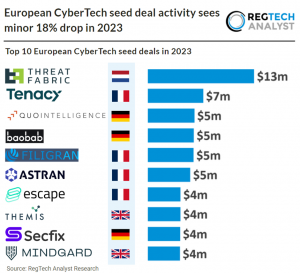

Despite the strength of the CyberTech sector, 2023 was not its strongest year. According to research from FinTech Global found that European CyberTech seed deal activity was down by 18% in 2023, compared to the previous year. There were a total of 102 deals in the year. The total funding was also down YoY, with CyberTech seed deals amassing $124m in 2023, down 43% on 2022.

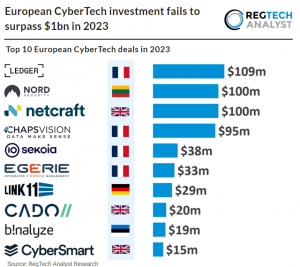

Another report from FinTech Global found that total European CyberTech investment in 2023 failed to surpass $1bn. A total of $876m was raised in 2023, representing a 53% drop YoY. Similarly, there was a decline in deals, with a total of 180 deals completed, down 17% on the previous year. In Europe, the UK was the most active CyberTech country in Europe during 2023 with a 29% share of deals.

Moving away from CyberTech, both WealthTech and Infrastructure & Enterprise Software had a good week, with both recording six deals. The WealthTech companies were: Monzo, Wagely, Altro, Zactor Tech, ZaraFX and tookeez. This week’s Infrastructure & Enterprise Software companies to secure funds were: Healthee, Synctera, Fijoya, PayShepherd, Lettuce Financial and RemotePass.

As for the other sectors, PayTech recorded three deals (Yuno, Ubirider and Sibstar), two InsurTech deals (Overjet and INSRD), two marketplace lending (Carputty and Billhighway), two RegTech (Idfy and Meo), and two data & analytics (Fluent and Theia Insights).

In terms of countries, it was business as usual for the US, accounting for 15 of the deals (Axonius, Claroty, Carputty, Overjet, Todyl, DTEX Systems, Healthee, CHEQUER, Cayosoft, Reach Security, Synctera, Lettuce Financial, RemotePass, Altro and Billhighway).

Other countries this week to see a FinTech close a funding round was the UK (Monzo, Theia Insights, Nuke From Orbit and Sibstar), India (Idfy and Zactor Tech), Canada (Fluent and PayShepherd), Israel (Sweet Security), France (Zama), Brazil (Bluecyber), Germany (INSRD), UAE (ZaraFX), Indonesia (Wagely), Colombia (Yuno), Portugal (Ubirider), Denmark (Meo) and Morocco (tookeez).

Here are the 34 funding rounds covered on FinTech Global this week.

Monzo secures $430m from CapitalG and others, valuation hits $5bn

Monzo, the UK’s largest digital bank, boasting over nine million customers, has closed a funding round, raising $430m.

The investment was spearheaded by CapitalG, Alphabet’s independent growth fund renowned for its investments in companies like Stripe and Airbnb. This round also welcomed contributions from a mix of leading global tech investors, including GV (Google Ventures) and HSG (HongShan Capital), alongside support from existing backers Passion Capital and Tencent.

The funding has propelled Monzo’s valuation to an impressive $5bn.

This substantial financial injection comes on the heels of a year marked by record growth for Monzo, positioning it as a profitable entity with an expanding customer base and an array of new product offerings. The bank now serves over nine million retail customers, with an additional 400,000 business accounts, highlighting a significant growth spurt with two million new customers acquired in 2023 alone. Monzo’s journey into profitability in March 2023 underscores its successful diversification strategy and the launch of innovative products like Instant Access Savings, Monzo Investments, Cashback, Mortgage Tracker, and the Call Status fraud prevention tool, among others.

The newly acquired capital will be channelled towards fuelling Monzo’s expansion ambitions, following a trajectory of record growth. The bank plans to leverage these funds to further enrich its product roadmap, aiming to cement its position as the go-to app for managing customers’ entire financial lives. This strategy is part of Monzo’s broader ambition to not only scale its operations to new heights but also to continue innovating and offering unparalleled service in the financial sector.

Axonius raises $200m for cybersecurity asset management expansion

Axonius, the trailblazer in cybersecurity asset management and SaaS management, has recently secured $200m in a Series E extension funding round.

This impressive sum was led by Accel and Lightspeed Venture Partners, with Stripes also contributing as an existing investor.

At its core, Axonius specializes in providing a unified platform that simplifies the management of a vast array of digital assets. This includes everything from devices and users to software, SaaS applications, cloud services, and more.

The firm’s innovative approach offers clients a comprehensive system of record for all digital infrastructure, enabling swift mitigation of threats, risk navigation, automation of actions, and strategic business insights. Axonius has distinguished itself as a vital resource for IT and security teams worldwide, catering to a clientele that spans Fortune 500 companies and notable global organizations like Schneider Electric, News Corp, and Anheuser-Busch InBev.

The newly acquired funds are earmarked for accelerating innovation and scaling operations globally, responding to the burgeoning demand for the Axonius Platform. This strategic move comes on the heels of the company surpassing $100m in annual recurring revenue in 2023, a testament to its rapid market penetration and the high value it delivers to its customers.

In addition to its financial success, Axonius has made significant strides in product development. The launch of Axonius 6.0, a unified platform, has set a new industry benchmark by offering a combined solution for Cyber Asset Attack Surface Management (CAASM), SaaS Security Posture Management (SSPM), and SaaS Management Platforms (SMP). This enhancement, coupled with over 1,000 platform integrations, positions Axonius uniquely in the cybersecurity asset management space, providing unmatched insights into security gaps, risk, misconfigurations, and more.

Contributing to the company’s accolades, Axonius CEO and co-founder Dean Sysman highlighted the rapid growth trajectory, stating, “Axonius has gone from zero revenue to exceeding $100 million in ARR in just 4.5 years, making us one of the fastest growing cybersecurity companies.

Cybersecurity leader Claroty secures $100m for strategic expansion and innovation

Claroty, a leader in the protection of cyber-physical systems, has successfully completed a strategic growth financing round, securing $100m.

This significant financial boost comes from a group of prestigious investors, including Delta-v Capital leading the equity charge, complemented by contributions from AB Private Credit Investors at AllianceBernstein, Standard Investments, Toshiba Digital Solutions, SE Ventures, Rockwell Automation, and Silicon Valley Bank, a division of First Citizens Bank.

With this latest investment, Claroty’s total funding escalates to $735m, underscoring its dominant position in the critical infrastructure cybersecurity sphere.

The company specializes in safeguarding cyber-physical systems (CPS) across various sectors, including industrial, healthcare, commercial, and the public sector. Through its comprehensive platform, Claroty offers visibility, risk and vulnerability management, threat detection, and secure remote access, integrating seamlessly with customers’ existing infrastructure. This approach ensures robust protection for the Extended Internet of Things (XIoT), critical in today’s increasingly connected world.

The newly acquired funds are earmarked for scaling Claroty’s platform across key verticals and regions, enhancing product innovation, and fostering strategic partnerships. The investment will support the company’s efforts in expanding its reach within the public sector and critical infrastructure industries, broadening its footprint across the Americas, EMEA, and Asia-Pacific, and accelerating research and development for core and adjacent technologies.

Over the past year, Claroty has witnessed significant milestones, including surpassing $100m in annual recurring revenue (ARR) and achieving over 300% growth in customer base since 2020. The company has formed strategic alliances with industry giants such as CrowdStrike, ServiceNow, and AWS, and has been recognized as a leader in numerous industry analyst reports and awarded for its innovative solutions and contribution to cybersecurity.

Carputty lands $80m boost to revolutionise auto finance

Zama raises $73m to revolutionize internet encryption with FHE technology

Zama, an open-source cryptography company specializing in Fully Homomorphic Encryption (FHE), has announced a successful $73m Series A funding round, one of the largest of its kind in France’s history.

This monumental investment was co-led by Multicoin Capital and Protocol Labs, with notable contributions from Metaplanet, Blockchange, VSquared, Stake Capital, and Portal Ventures. Additionally, several key figures in the blockchain and AI industries, including Juan Benet of Filecoin/IPFS, Gavin Wood of Ethereum/Polkadot, Anatoly Yakovenko of Solana, Julien Bouteloup of StakeDAO, and Tarun Chitra of Gauntlet, have joined as strategic investors.

Zama’s mission revolves around making the internet fully encrypted from end to end using FHE, often considered the “holy grail” of cryptography. Four years after its inception, Zama has significantly advanced the practical application of FHE. Initially, FHE was largely theoretical, plagued by issues of speed, cost, and complexity. However, through the team’s relentless efforts, these challenges have been addressed, making FHE accessible to developers without a deep background in cryptography for the first time.

The company provides a comprehensive suite of open-source FHE libraries and solutions. These tools allow anyone, from individual developers to large corporations, to implement end-to-end encrypted applications. Zama’s FHE scheme, built upon TFHE, supports a wide array of applications, significantly expanding FHE’s applicability across various sectors.

With the new funding, Zama plans to accelerate its research and development, focusing on enhancing the performance and usability of its FHE solutions. The company has already achieved a 20x improvement in the speed of its FHE scheme, with goals to reach a 100x increase soon. This improvement is crucial for unlocking confidential blockchain and AI use cases. Zama also anticipates the release of dedicated FHE hardware accelerators, which will further enable web-scale applications, including confidential Large Language Models (LLMs) and encrypted Software-as-a-Service (SaaS) offerings.

Overjet bags $53.2m in latest funding round to see valuation soar to $550m

Overjet, a leading provider of dental artificial intelligence (AI) solutions, has secured a monumental $53.2m Series C funding round, to see the company’s valuation soar to $550m.

This investment, led by March Capital, with participation from General Catalyst, Insight Partners, and other notable investors, signifies the largest-ever funding round in AI for the dental industry, and sees Overjet’s total raised capital stand at approximately $133m.

Overjet specialises in leveraging advanced artificial intelligence (AI) technology to revolutionise dental care and streamline insurance-related processes. Through its innovative platform, the firm empowers dental professionals to make precise clinical decisions, enhance patient communication, and reduce administrative overhead.

The company’s AI solutions play a crucial role in facilitating claims processing, ensuring accurate diagnosis documentation, and optimising treatment planning.

The latest funding round will enable Overjet to further its mission of making dentistry more patient-centric by expanding its AI capabilities and enhancing its platform’s reach.

With a focus on accelerating product development and scaling operations, Overjet aims to solidify its position as a leader in dental AI technology.

Todyl secures $50m in Series B to bolster SMB cybersecurity efforts

Todyl, a leading security and networking firm, has recently announced a significant milestone, securing a $50m Series B funding round.

The investment was spearheaded by Base10 Partners, with notable contributions from Anthos Capital, Tech Operators, and StoneMill Ventures. This financial infusion is earmarked to propel Todyl’s mission of transforming cybersecurity through a comprehensive, all-in-one security platform designed to equip IT professionals with essential tools, insights, and automation for combating evolving threats.

At its core, Todyl is revolutionizing cybersecurity for small and medium businesses (SMBs). The company has positioned itself at the forefront of the cybersecurity domain by consolidating pivotal security services, including Secure Access Service Edge (SASE), Security Information & Event Management (SIEM), and Managed eXtended Detection & Response (MXDR), among others, into a singular, cloud-first platform. This innovative approach enables IT professionals to effectively prevent, detect, and respond to modern threats across diverse environments, from SaaS and cloud to data centers and remote offices, using a single agent.

The newly secured funds will be utilized to enhance Todyl’s platform, specifically targeting headcount growth, global office expansion, and accelerated development through engineering investments. This strategic financial boost is aimed at solidifying Todyl’s commitment to providing SMBs with accessible, efficient, and comprehensive cybersecurity solutions.

Adding to Todyl’s strategic advancements, the company recently introduced a Security Orchestration, Automation & Response (SOAR) module. This addition is poised to empower businesses with the ability to execute swift, automated response actions, particularly across endpoints and Microsoft 365, setting the stage for future innovations focused on automation, orchestration, and response to swiftly tackle threats.

DTEX Systems raises $50m to enhance insider risk management through AI

DTEX Systems, a global leader in the field of insider risk management, has successfully closed a Series E funding round of $50m.

The investment was led by CapitalG, Alphabet’s independent growth fund, elevating DTEX Systems’ total investment to $138m. This capital infusion is earmarked for the expansion of the company’s U.S. engineering team and the acceleration of its global go-to-market (GTM) operations.

The company specializes in leveraging AI and behavioral science to innovate the insider risk management market. DTEX Systems aims to provide organizations with the tools they need to proactively safeguard against insider threats. Their approach combines large language models (LLMs) with cutting-edge behavioral science research, offering a unique and effective solution for managing insider risk.

The new funding will support DTEX’s mission to protect organizations worldwide from insider threats by enhancing its technological offerings. This includes expanding the application of LLMs and behavioral science in their product development to disrupt the current market landscape. DTEX has demonstrated significant growth in the past year, doubling its annual recurring revenue (ARR) growth rate and closing an unprecedented number of high-value deals.

Sweet Security secures $33m in Series A to revolutionise cloud runtime security

Sweet Security, a pioneering cloud security firm, has recently closed a $33m Series A funding round, which was led by Evolution Equity Partners and saw contributions from Munich Re Ventures and Glilot Capital Partners.

At its core, Sweet Security is dedicated to transforming how businesses secure their cloud environments. Utilising a unique blend of behavioral analysis and deep runtime analysis, Sweet’s technology is designed to identify and mitigate cloud risks that matter the most.

Their platform stands out for its ability to provide first-to-market technology focusing on non-human identities and posture in runtime environments, thereby addressing a critical gap in current cloud security practices.

The primary use of the newly acquired funds will be to scale Sweet’s operations within the U.S. market and to further develop its platform. This includes the recent enhancements to its unified runtime platform, which now boasts capabilities for runtime posture enhancement and management of runtime non-human identities.

Healthee secures $32m to scale its operations

Healthee, a healthcare tech pioneer, has managed to secure $32m in its Series A funding round, as it looks to strategically scale its operations.

The round, which was co-led by Fin Capital, Glilot Capital Partners, and Group11, with strategic partner TriNet also participating.

The tranche will facilitate the strategic scaling of operations, accelerate product development, and support expansion initiatives, underscoring the company’s unwavering commitment to redefine the healthcare landscape through innovative, AI-driven technology solutions.

Focused on enhancing care outcomes and reducing overhead for employers and employees alike, Healthee’s comprehensive platform provides personalised, instant, and uncomplicated answers to coverage, treatment, and benefits questions, end-to-end Open Enrolment support, and tailored preventive care suggestions.

Harnessing the dynamic fusion of innovation and cutting-edge AI technology, Healthee strives to empower individuals in making informed decisions about their well-being, ultimately enhancing care outcomes and reducing overhead for all parties.

IDfy secures $27m in funding to revolutionise identity verification across Asia

IDfy, an innovative player in the identity verification space, has recently announced a significant financial boost, raising $27m in a recent investment round.

The round saw participation from Elev8 Venture Partners, KB Investment, and Tenacity Ventures, marking a pivotal moment for the company.

Founded in 2011 by Ashok Hariharan and Vineet Jawa, IDfy set out with a noble mission to eliminate fraud and establish trust in digital interactions. Today, IDfy stands as Asia’s leading Integrated Identity Platform, serving major enterprises across India, Southeast Asia, and the Middle East. The company impacts over 150 million lives and supports more than 60 million verifications each month, showcasing the scale and effectiveness of its solutions.

The new infusion of capital is earmarked for accelerating IDfy’s growth, with plans to expand their offerings and enhance their product development. This will enable IDfy to serve even more businesses, helping to unlock opportunities for trustworthy interactions and transactions across a broader demographic.

IDfy’s technology suite includes over 140 APIs, a Video Solutions platform, RiskAI, IDfy360, and a SaaS-based Background Verification tool, among others. These products are designed to help enterprises eliminate fraud, ensure compliance, and establish trust through advanced, tech-powered solutions for KYC, KYB, and more.

Yuno secures $25m in Series A to bolster global expansion in FinTech sector

Yuno, a pioneering force in the global payments orchestration landscape, has secured $25m in funding.

This financial injection comes from a consortium of high-profile investors, including DST Global Partners, Andreessen Horowitz, Tiger Global, Kaszek Ventures, and Monashees.

The firm is co-founded by tech veterans Juan Pablo Ortega and Julián Núñez. Yuno distinguishes itself through its innovative approach to payments orchestration, serving influential clients such as McDonald’s, Avianca, inDrive, and Rappi across 40 countries.

With features like one-click checkout modifications, smart routing, and the integration of information from all payment processors and anti-fraud tools into a unified interface, Yuno is revolutionising sectors such as retail, e-commerce, travel, and mobility.

The Series A funding aims to bolster Yuno’s operations within North and South America while facilitating its ambitious expansion into new markets in Europe, Asia, and Africa. This strategic move is expected to enhance the service quality for Yuno’s customers, who benefit from the company’s innovative payment solutions tailored to various geographical needs.

B2B SaaS cyber security innovator CHEQUER accelerates with $24.82m investment

CHEQUER, a frontrunner in the B2B SaaS cyber security platform sector, has recently announced the closure of a significant investment round.

This strategic financial infusion is poised to catapult the company into a new phase of global expansion and innovation, particularly in the realm of cloud-native security platforms.

The investment round, co-led by Salesforce Ventures and Z Venture Capital (ZVC), has elevated the total funding received by CHEQUER Inc. to $24.82m, inclusive of a seed round completed in 2021.

Founded in Silicon Valley in 2016 and a Y Combinator alumni of the W20 cohort, CHEQUER has carved a niche for itself primarily within the markets of Japan and South Korea. The company’s flagship offering, QueryPie, is a Cloud Data Protection Platform (CDPP) that empowers organizations to manage data governance comprehensively. This platform facilitates integrated management of data access control, auditing, and monitoring within cloud environments. By leveraging QueryPie, businesses can achieve enhanced cyber security, cost savings, and revenue growth, all within a zero-trust framework that complies with stringent global data security regulations.

CHEQUER has been on a rapid growth trajectory since its inception, demonstrating significant achievements. For instance, the company has successfully launched QueryPie SAC (System Access Controller), broadening its suite of security solutions that meet both Korean and international data security standards. Furthermore, CHEQUER Inc. has garnered the trust of leading Korean and international corporations, evidencing the company’s capability to deliver exceptional value across B2B SaaS platform sectors.

Wagely, transforming financial health for workers in Asia, raises $23m in new funding

Wagely, Asia’s leading financial wellness platform, has just announced a significant boost to its operations with the successful securing of $23m in new funding.

This substantial influx of capital comes at a critical time, showcasing investor confidence in Wagely’s mission and performance amidst a challenging funding environment. The platform stands out by offering a unique service that enables workers to access their earned pay on a daily basis, a pioneering concept particularly in Indonesia and Bangladesh.

The funding round is a mix of equity and debt financing, with Capria Ventures spearheading the equity portion. Participation from existing investors, along with a noteworthy contribution from a prominent private debt fund, signifies strong belief in Wagely’s vision. This collective investment aims to bolster Wagely’s core Earned Wage Access (EWA) service in its key markets of Indonesia and Bangladesh.

Wagely’s platform is designed to empower workers to manage their finances more effectively by providing access to their earnings after each workday. This service, offered free to employers to then extend as an optional benefit to their employees, has placed Wagely at the forefront of financial wellness services in the region. Through its platform, users can not only track their salary but also avail themselves of financial literacy resources, promoting a path towards financial stability and freedom.

The company plans to utilise the newly raised funds to expand its core EWA service in Indonesia and Bangladesh. This expansion is expected to extend Wagely’s reach and impact, reinforcing its position as a leading financial wellness service. In 2023 alone, Wagely disbursed over US$25m in salaries, handling nearly one million transactions and serving 500,000 workers, demonstrating the significant demand and potential for growth in its services.

Cayosoft attracts $22.5m from Centana Growth Partners

Cayosoft, a leader in Microsoft Active Directory management, monitoring, and recovery, has announced a milestone in its growth trajectory.

The company has secured a $22.5m minority investment from Centana Growth Partners. This funding round marks a significant vote of confidence in Cayosoft’s innovative approach to Active Directory (AD) management and recovery, a critical area of cybersecurity.

With the latest investment, Cayosoft aims to accelerate its market outreach and enhance its patent-pending technology. This technology enables instant recovery of Active Directory forests in a matter of seconds to minutes—a stark contrast to traditional recovery methods that are not only time-consuming but also require additional hardware and are prone to failure due to infrequent testing.

Cayosoft’s solutions are pivotal in today’s digital landscape, where over 90% of organisations rely on Active Directory for daily operations. Active Directory has become a prime target for cyberattacks, leading to a significant increase in AD outages. Cayosoft’s technology addresses this challenge head-on, offering a solution that is both instant and reliable.

The funding will be channelled towards expanding Cayosoft’s sales and marketing efforts, with a particular focus on reaching a global audience. Additionally, the company plans to continue its innovation streak by seeking new and creative ways to help customers secure, govern, and manage their Microsoft ecosystems. This expansion strategy is supported by the company’s impressive growth figures, including a 175% year-over-year growth in 2023 and a staggering 480% increase in revenue since 2017.

Ballistic Ventures spearheads $20m investment in AI-driven Reach Security

Reach Security, a trailblazing startup, has successfully raised $20m in a Series A funding round.

The investment is led by Ballistic Ventures and sees contributions from Artisanal Ventures and notable industry figures such as Mark McLaughlin, former CEO and President of Palo Alto Networks, and Denise Persson, CMO of Snowflake.

Existing investors, including Webb Investment Network, Ridge Ventures, and TechOperators, have also participated in this round.

The company stands at the forefront of redefining security operations through its advanced artificial intelligence (AI) technology. By enabling organisations to optimise the use of their existing cybersecurity products, Reach Security aims to address the common industry challenge of underutilised tools and outdated configurations that leave gaps for attackers to exploit.

The solution offers a new approach by analysing and reprogramming an organization’s security infrastructure to counter specific threats effectively. Unlike traditional solutions, Reach Security operates across the entire security landscape, requiring no new sensors or attack simulations, and delivers insights and actionable intelligence rapidly.

Synctera secures $18.6m in Series A-1 funding to enhance embedded banking globally

Synctera, a trailblazer in embedded banking and finance, has announced an impressive $18.6m extension to its 2021 Series A funding round.

The investment, co-led by Lightspeed and Fin Capital, boasts contributions from previous backers such as NAventures and Diagram, with new investors Banco Popular and Mana Ventures also joining the fray.

At its core, Synctera facilitates companies of all sizes in launching FinTech apps and embedded banking products swiftly and compliantly. Its end-to-end Banking as a Service (BaaS) platform is designed to significantly reduce the time and cost associated with developing these solutions in-house or through multiple vendors. By offering a seamless integration with APIs, compliance support, and bank partnerships, Synctera enables a more efficient and streamlined development process for banking products, including bank accounts, debit cards, lending services, and more.

The fresh capital will be directed towards accelerating Synctera’s growth, particularly focusing on expanding its offerings to support larger and more complex customer use cases in the US and other international markets. This strategic move is aimed at bolstering Synctera’s position as a leader in the FinTech industry, enabling it to cater to an ever-growing range of unique use cases and customer demands.

Adding to its momentum, Synctera has recently appointed Leigh Gross as its Chief Revenue Officer (CRO), a move that further solidifies its commitment to scaling its operations. With Gross’s extensive experience in FinTech and a track record of driving growth, Synctera is poised for a significant surge in 2024. This includes launching new products like SyncteraPay, which allows companies to process and settle payments using Synctera’s platform, and expanding into new geographies and client segments.

The company has seen remarkable growth in the past year, including a 4.5x increase in ARR, doubling its live customer base, and a 20-fold increase in platform spend. These achievements highlight Synctera’s capability to serve larger and more established programs, reflecting its adaptability and the broad applicability of its platform.

Fijoya raises 8.3m in seed funding to pioneer AI-powered platform

Fijoya, a platform specialising in tailored health and wellness services for employers, has revealed that it has secured an $8.3m funding round.

This investment round was spearheaded by the Venture-Creation fund of Team8, and is expected to assist Fijoya on their mission to pioneer an AI-Powered platform for employer-sponsored healthcare.

The funding will be instrumental in enhancing Fijoya’s platform offerings, particularly focusing on addressing challenges within the $32bn point solution vendor market.

Operating within the intersection of FinTech and healthcare, the company’s comprehensive platform offers employers a streamlined approach to offering health benefits, enabling employees to access thousands of health and wellness services and products through a single, pay-per-use contract.

Fluent secures $7.5m in seed funding to transform business insights

Fluent, an AI-powered data analytics firm, is set to transform the landscape of business intelligence with its latest financial milestone.

Specialising in making data analysis accessible to non-technical team members, the company recently announced the successful closure of a $7.5m seed investment round. This significant injection of capital is led by prominent investors Hoxton Ventures and Tiferes Ventures, marking a crucial step forward in Fluent’s mission to empower decision-makers with instant insights.

At its core, Fluent redefines the way businesses interact with their data. Utilising a cutting-edge AI-powered data analyst, the platform allows users to query their data in plain English, delivering fast and accurate insights. This innovation liberates data teams from the burdensome task of responding to ad-hoc data requests, enabling them to focus on strategic analysis that drives transformative business outcomes.

The recent investment will fuel Fluent’s ambitions to scale its groundbreaking technology and bolster its team of AI and machine learning specialists across Europe. CEO Robert Van Den Bergh emphasises the transformative potential of Fluent’s natural language interface, noting that “on average, 40% of a data team’s time is spent answering questions from across their business.” By facilitating self-service data inquiries, Fluent aims to make data-driven decision-making accessible to all team members, regardless of their technical expertise.

Fluent’s client roster, including heavyweights like Bain & Company, attests to the platform’s ability to democratise data access. Partners at Bain have lauded Fluent for enabling non-technical users to efficiently and accurately derive insights from complex datasets. Similarly, CTO Cameron Whitehead highlights the limitations of traditional business intelligence tools, underscoring Fluent’s commitment to serving the needs of non-expert users.

The investment arrives at a time when organisations are keen to leverage AI technologies like OpenAI’s ChatGPT for productivity enhancements. Fluent addresses the growing demand for enterprise-ready solutions that combine scalability with reliability, bridging the gap in the market with its user-friendly and trustworthy platform.

PayShepherd secures $7m to advance contractor management solutions with AI

PayShepherd, a FinTech firm specialising in contractor management solutions for the heavy industry, has successfully completed a Seed+ funding round, raising $7m CAD.

The oversubscribed round was led by new investor Inovia Capital, a venture capital firm known for its commitment to supporting sustainable tech companies globally. This round also saw contributions from existing investors including Nashville Capital Network, Thin Air Labs, Accelerate Fund III managed by Yaletown Partners with support from A100, and several strategic angel investors who chose to remain anonymous. As part of the investment, Inovia partner Shawn Abbott will be joining PayShepherd’s board.

Operating at the intersection of SaaS and AI, PayShepherd is designed to eliminate the friction and unfairness in vendor relationship management across North America. The company leverages millions of data points to offer a comprehensive system of record that bridges the gap between contractors and clients, enhancing transparency and efficiency. By incorporating artificial intelligence, PayShepherd aims to significantly improve beyond cost management, addressing the billions lost due to outdated vendor management processes in the heavy industry sector.

The freshly acquired funds are earmarked for expanding PayShepherd’s footprint across North America and further developing its platform with new functionalities.

Theia Insights raises $6.5m to revolutionise global investment with AI

Theia Insights has successfully secured $6.5m in funding, showcasing the UK’s attractiveness to US venture capital firms seeking innovative tech firms.

This investment round was led by Silicon Valley’s Unusual Ventures, with contributions from Fidelity International Strategic Ventures, Clocktower Ventures in Los Angeles, and several strategic angel investors.

The company’s products and solutions stand on a solid foundation of academic and proprietary research, incorporating state-of-the-art developments in artificial intelligence (AI), machine learning, natural language processing (NLP), large language models (LLMs), and advanced financial mathematics.

In today’s rapidly changing and dynamic global economy, Theia Insights addresses the crucial need for foundational AI technologies. These technologies empower investors to navigate the complexities of the economic landscape, company dynamics, and the overwhelming flow of information and data. By providing clarity and insight, Theia’s solutions enable better investment decisions in a world inundated with information.

The newly raised funds will be directed towards attracting top-tier talent from traditional classification and risk management firms, as well as pioneers in recent AI advancements. This strategic expansion of its team supports Theia’s commitment to developing ambitious commercial projects and research initiatives.

Lettuce Financial secures $6m to revolutionise accounting for solopreneurs

Lettuce Financial, a pioneering company in the FinTech sector, has just announced a significant milestone in its journey to democratise accounting and tax services for solopreneurs.

With a fresh infusion of $6m in seed funding led by Zeev Ventures, Lettuce Financial is set to fuel its growth and product development, marking a significant leap forward in its mission.

The investment spearheaded by Zeev Ventures, alongside contributions from numerous industry angel veterans, underscores the confidence in Lettuce Financial’s vision and its commitment to addressing the unique financial challenges faced by solopreneurs. This strategic financial backing is earmarked for accelerating growth, advancing product development, and enhancing AI research, thereby reinforcing Lettuce’s position at the forefront of FinTech innovation.

Lettuce Financial is designed by solopreneurs, for solopreneurs, providing a comprehensive system that empowers businesses-of-one to effectively navigate the tax system and implement accounting strategies tailored to their specific needs. Leveraging the power of AI and automation, Lettuce offers proactive tax-saving suggestions, streamlines accounting processes, and eliminates the need for expensive accountants, thereby unlocking corporate-level profitability and efficiency for solopreneurs.

The newly announced funding will be utilised to further these objectives, with a focus on eliminating tax-related and accounting concerns, enabling solopreneurs to concentrate on growing their businesses. Additionally, the launch of the Solopreneur Accelerator program signifies Lettuce’s commitment to providing tangible support to solopreneurs, offering a free personalized business assessment and complimentary tax filing services for the first 1,000 registrants.

Lettuce Financial’s initiatives come at a crucial time when the solopreneur segment is experiencing exponential growth. Despite their significant contribution to the economy, solopreneurs have historically been underserved, often lacking access to critical financial management tools and information. Lettuce aims to bridge this gap, ensuring solopreneurs are well-equipped to make informed decisions about their tax and accounting strategies.

HR and FinTech leader RemotePass raises $5.5m to revolutionise remote employment

RemotePass, a trailblazer in the HR and FinTech sector, has successfully closed a Series A funding round, amassing $5.5m.

The funding was spearheaded by 212 VC and saw contributions from a diverse group of investors across the US, Europe, and the Middle East, including Endeavor Catalyst, Khwarizmi Ventures, Oraseya Capital, Flyer One Ventures, Access Bridge Ventures, A15, and Swiss Founders Fund.

RemotePass stands at the forefront of HR and FinTech solutions, offering a comprehensive platform that simplifies the complexities of managing remote teams. By facilitating the onboarding, payment, and retention of remote employees, RemotePass caters to companies of all sizes, enabling them to leverage global talent pools without the need for a legal entity in each country.

RemotePass’s cumulative funding has now exceeded $10m, thanks to previous rounds of investment from notable entities such as BECO Capital, Wamda Capital, Plug & Play, and Flat6Labs. This underscores the company’s robust financial foundation and its commitment to enhancing the remote work ecosystem.

Altro’s credit-building revolution gains $4m boost, expanding to 47 states

Altro, a transformative credit-building app, has announced a significant expansion and has now spread its services to 47 U.S. states.

This expansion is powered by a strategic $4m funding round, which includes investment from high-profile figures such as Tinashe and Chris Paul. Altro’s services are facilitated by Hatch Bank and are supported by the Discover® Global Network.

Founded in 2019, Altro is on a mission to empower individuals financially, irrespective of their credit history. Initially available in just 10 states, the app’s reach has now been extended to 47 states, marking a significant milestone in its goal to democratize credit-building. The app also boasts of its latest version, Altro: Culture & Finance, which integrates a wider range of features to guide users through various aspects of their financial journey. Altro’s membership model is designed to enhance financial literacy by offering access to discussions on culture and finance, and opportunities for networking and financial education.

The newly raised funds are earmarked for several pivotal projects, including the launch of the Altro Credit Builder Card and the latest app version, aimed at facilitating an inclusive financial ecosystem. The Credit Builder Card, available to Premium members without the need for credit approval, is specifically designed for digital and streaming subscriptions, supporting those new to credit or looking to rebuild their financial standing

Zactor Tech revolutionises personal finance with significant pre-seed funding

Zactor Tech, a burgeoning name in the FinTech sector, has closed its pre-seed funding round on an undisclosed amount.

This round saw the company being valued at an impressive $3m, according to a report from entrackr. The financial injection was co-led by High Net Worth Individuals (HNIs).

At its core, Zactor Tech is revolutionising the personal finance landscape. Founded in 2023 by Abhishek Walia and Shivam Parihar, the platform aims to modernise how individuals manage their finances. Zactor Tech offers a comprehensive suite of services, including goal setting, investment, retirement, and insurance planning, all tailored to empower users towards financial wellness.

The funds from this latest investment will be channelled towards further product development, user acquisition, and enhancing financial literacy among its users.

In addition to its ambitious goals, Zactor Tech has demonstrated significant traction, with a reported monthly user growth rate of 2x over the last six months.

Keep up with all the latest FinTech news here.

Copyright © 2024 FinTech Global

ZaraFX, leading Forex broker, secures $2m in Series A funding for global expansion

ZaraFX, a cutting-edge CFD Forex broker, has proudly announced the completion of a significant milestone in its journey, securing over $2m in Series A funding.

This substantial financial boost underscores investor confidence in ZaraFX’s innovative approach within the fiercely competitive Forex trading market. Alongside this financial accomplishment, ZaraFX is also excited to unveil its new office in Dubai, a move that promises to enhance its global presence and commitment to meeting client needs across the globe.

The Series A funding round attracted top-tier investors. This influx of capital is poised to drive forward product development, improve customer experiences, and solidify ZaraFX’s position as a leader in the market.

At the heart of ZaraFX’s operations is a dedication to innovation and excellence in the Forex trading industry. The company provides cutting-edge trading solutions and exceptional service, aiming to empower traders worldwide with the tools and resources necessary for success in the global Forex market.

Ubirider’s pioneering MaaS platform secures $1.95m for global expansion

Ubirider, a trailblazer in the mobility FinTech sector, has announced a successful close of its seed funding round, amassing an impressive $1.95m.

According to BNNBreaking, this significant financial injection was co-led by Techtree Investments and Cedrus R&D III, featuring contributions from existing investor Grupo Barraqueiro and a cohort of angel investors from the United States and Colombia. Ubirider’s digital platform stands at the forefront of modernising the interaction between transport providers, riders, and cities, ensuring fluid movement, information exchange, and financial transactions.

This FinTech firm is reinventing urban mobility through its platform, having processed over 11.4 million transactions to date. Ubirider champions the adoption of digital ticketing solutions that support open-loop contactless payments via bank cards or smartphone wallets. This innovation not only streamlines the travel process but is also indicative of the wider trend towards public transport digitisation. According to forecasts by Data Bridge Market Research, the global market for mobile payment technologies is expected to reach $2 trillion by 2030, growing at a compound annual growth rate of 37%. This growth trajectory highlights the pivotal role Ubirider plays in shaping the future of urban transit.

In its quest for innovation, Ubirider has forged strategic partnerships with industry giants such as Mastercard, Deloitte, and Payshop, which have been instrumental in rolling out the firm’s contactless payment solutions across various public transport agencies in Portugal. These collaborations have not only underscored Ubirider’s innovative capacity but have also paved the way for nearly 300,000 registered users and the sale of 2.1 million tickets, demonstrating the platform’s potential to make public transportation more efficient, sustainable, and user-friendly on a global scale.

Central to Ubirider’s mission is improving the commuting experience for both passengers and operators. The company’s intuitive mobile app, Pick, simplifies trip planning, payment, and navigation for riders, while offering operators valuable insights into commuter trends and behaviors. This enables more informed, data-driven operational decisions. With its recent rebranding and push towards internationalisation, Ubirider is poised to significantly impact the global mobility landscape.

Copenhagen’s Meo secures €1.67m ($1.7m) to bolster AML compliance across Europe

Bluecyber secures $1.5m boost to fortify digital life in Latin America

Bluecyber.insure, a trailblazer in the InsurTech sector specializing in cyber insurance within Brazil, has recently secured a significant financial boost.

The firm, known for offering digital protection insurance tailored to small and medium-sized enterprises (SMEs) and families, has successfully raised $1.5m. This investment was contributed by venture capitalists Invisto.com.vc and Bossa Invest, alongside strategic stakeholders from the insurance arena.

This funding round highlights the trust investors place in Bluecyber’s vision. The company is on a mission to democratize and enhance insurance coverage for digital life protection across Latin America. This region represents an untapped market, boasting an estimated gross written premium (GWP) of $17.3bn, a fact underscored by Bluecyber CEO Eduardo Rocha’s remarks on the investment.

Central to Bluecyber’s operations is its innovative approach to InsurTech. The company is pioneering in offering cyber insurance, a critical service in today’s digital age. Bluecyber aims to simplify the complex world of insurance for digital life protection, catering to the needs of SMEs and families across Latin America. This goal is further supported by the recent acquisition of Ismac.io, a move that bolsters Bluecyber’s capabilities in managing risk and compliance.

The fresh injection of funds is earmarked for a strategic expansion across the Latin American region. Additionally, it will support the incorporation of Ismac.io’s Managed Detection and Response (MDR) platform into Bluecyber’s service offering. This technology enables continuous monitoring of the insured portfolio, enhancing the company’s ability to respond to security incidents effectively.

Bluecyber’s comprehensive approach to cyber protection insurance goes beyond financial compensation for claims. The company offers a suite of services including a help desk for technological issues, antivirus, vulnerability monitoring, risk management, and incident response. This holistic package aims to minimize the frequency and severity of claims while maximizing value for the insured.

Founded in 2021, Bluecyber has quickly established itself as a Managing General Agent (MGA) of note in the cyber insurance space. The company prides itself on developing customer-centric products, establishing underwriting capacity with reinsurers and insurers, and pioneering innovative distribution channels.

With a digital-first approach to B2B product sales, Bluecyber collaborates with a variety of non-traditional partners, including internet providers and insurance brokers. The company’s ambitious goal is to reach 10,000 subscribers by the end of 2024, underscoring its commitment to simplifying cyber protection. Policies are issued by Seguros Sura, a leading insurance group in Latin America, ensuring compliance with all regulatory standards.

tookeez raises $1.5m from Azur Innovation Fund to revolutionise loyalty programmes

Moroccan FinTech startup tookeez, has successfully secured $1.5m in funding to bolster its technical capabilities and expansion efforts.

This financial injection comes from the Azur Innovation Fund, a notable public-private seed capital initiative based in Casablanca, Morocco, according to a report from TechPoint Africa.

tookeez is at the forefront of harnessing blockchain to address the inefficiencies plaguing traditional loyalty programmes. By enabling the seamless conversion and redemption of loyalty points across a wide network of brands and retailers, tookeez is setting a new standard for customer rewards systems.

The platform serves as a digital wallet for loyalty points, offering unparalleled flexibility for users to transact across its growing network.

The newly acquired funds are earmarked for a strategic expansion into Morocco and the broader MENA region.

Berlin-based InsurTech startup INSRD raises €500k ($547,000) in pre-seed round

Berlin-based InsurTech startup, INSRD, has successfully raised €500k in a pre-seed round from a host of ecosystem angel investors.

Notable names such as Alex Grimm, Florian Huber, and Daniel Dippold of EWOR were involved in the round, alongside other tech executives and venture capitalists, according to EU-Startups.

INSRD is transforming commercial insurance to better serve rapidly expanding companies driven by innovation, which often encounter evolving risk landscapes.

Acknowledging the common challenge of companies outgrowing their insurance coverage, the company believes in producing a flexible insurance solution which evolves alongside the customer’s needs.

At the heart of INSRD’s technology lies its Protect & Connect platform, which utilises sophisticated workflow automation and industry-specific AI.

This platform guarantees the continued relevance of insurance programmes while proactively identifying and monitoring emerging risks.

On top of this, it facilitates seamless collaboration among clients, advisors, and insurers, ensuring accuracy and responsiveness in addressing changes in risk exposure, particularly crucial for emerging sectors such as AI, the Creator Economy, Robotics, and beyond.

This announcement of funding coincides with a downturn in brokers and agents within the commercial insurance market, coupled with a rising demand for emerging and specialised risks. Consequently, dynamic enterprises find themselves underserved, facing coverage gaps and vulnerabilities that endanger their operations.

UK FinTech Nuke From Orbit secures £500k to boost mobile security

Nuke From Orbit, a pioneering UK-based FinTech, has successfully closed a pre-seed funding round, raising a substantial £500,000.

This financial injection comes from a consortium of UK-based investors, including notable figures such as Oliver Bridgen, Co-Founder & COO of Ballinger Group, and Jordan Hallows, founder of Wey Bridging Finance.

Nuke From Orbit stands at the forefront of mobile security, offering a robust solution aimed at protecting financial accounts and personal identifiable information (PII) from the rising threat of mobile theft. In London alone, a smartphone is reported stolen every six minutes, underscoring the critical need for the company’s services. Nuke From Orbit’s innovative approach allows for the instant invalidation of stolen data, effectively cancelling bank cards, securing digital accounts, and blocking the device SIM with a single action.

The company has articulated its intention to use the newly acquired funds to prepare its technology for public beta testing in the UK by late 2024. Additionally, the investment will facilitate the expansion of Nuke From Orbit’s team, enabling the company to bring on board partners from the financial, telecommunications, social media, De-Fi, and other tech sectors. Looking ahead, Nuke From Orbit is setting its sights on global expansion, targeting countries with high smartphone adoption rates, increased crime rates, and a strong presence of modern financial services like Open Banking.

FinTech app Sibstar wins £125k ($160k) on Dragon’s Den to aid dementia sufferers and their families

Sibstar, a novel FinTech application coupled with a debit card designed specifically for dementia patients and their caretakers to manage finances safely, has successfully raised £125,000.

The investment comes from Dragon’s Den investors Sara Davies and Deborah Meaden, according to a report from Crowdfund Insider.

Founded by Jayne Sibley, Sibstar aims to address the unique challenges faced by individuals with dementia and their families in managing financial resources, inspired by Sibley’s personal experiences caring for her parents.

The company has carved a niche for itself by focusing on a demographic that requires specialised financial services. By providing a secure and user-friendly platform, Sibstar ensures that dementia sufferers and their families can manage their funds without the fear of mismanagement or fraud. The service charges a monthly fee of £4.99, with a portion of the proceeds going to support the Alzheimer’s Society, a testament to Sibstar’s commitment to the community it serves.

Comvest Credit Partners backs Billhighway’s expansion with strategic financing

Comvest Credit Partners, a leader in providing flexible direct financing solutions to mid-market entities, has recently declared its role as the Administrative Agent and Sole Lender in a senior secured credit facility for Billhighway.

Specializing in financial management technology solutions for fraternal organizations and associations, alongside private equity firm Lovell Minnick Partners, this financing aims to refinance existing debt and bolster Billhighway’s acquisition strategy, particularly the purchase of ChapterSpot, a CRM provider.

Since its inception in 1999, Billhighway has emerged as a market leader, particularly among multi-chapter member-based organizations. It offers an integrated software platform that enhances efficiency across various domains, including membership and event management, reporting and analytics, as well as payment processing and invoicing.

Brian Cercek, a Managing Director at Comvest, expressed his satisfaction in supporting Billhighway, praising its market leadership and dedicated customer base. He highlighted the significance of the tailored facility in facilitating the company’s growth through strategic acquisitions, like ChapterSpot, which offers complementary technology services to the same market segment.

Billhighway is known for delivering comprehensive software and payment solutions to the non-profit sector, including SaaS-based member management, accounting, and transaction processing services tailored for Fraternities and Sororities, Associations, and Labor Unions.

Keep up with all the latest FinTech news here

Copyright © 2024 FinTech Global