Financing solution provider SecFi has scored a $1m investment, as more employees seek shares in the company they work in, according to SecFi founder Wouter Witvoet.

Contributions to the round came from Social Leverage, FJLabs, and CoVenture.

SecFi enables growth and late-stage companies to receive financing to option holders and shareholders, without having to sell the shares. A company applies for a loan, with the amount eligible for based on personal and tax situations.

The loan comes with no risk, as the borrower is not under a legal obligation to pay back the money if the company goes under. Instead, a compounding interest rate and an equity share is given to SecFi for the loan.

Equity from the round will be used to support the growth and evolution of its product offerings. Wouter said, “We believe what the market is missing is good technology products that help employees of startup companies make better decisions on their stock options and shareholders get more value out of their stock.”

He added “It’s becoming increasingly popular around the world to grant people a stake in the companies for which they work. It has been the cornerstone of Silicon Valley’s success for more than three decades but is now also more commonplace in countries such as the UK. This benefit to employees also brings with it a lot of complexity as new forms of equity compensation are often ill-understood by employees.”

SecFi helps these employees to better understand their equity and the relevant taxes. The platform then provides financial products to help the stock holders get more from their equity.

Social Leverage founder Howard Lindzon said, “The value of issuing options to employees of fast growing, venture-backed, late stage growth companies is crystal clear and is a cornerstone of Silicon Valley’s success. Unfortunately, the absence of products which help these employees exercise their options or provide for a simple way to get liquidity on private company stock is a major issue and frustrates both companies and employees.”

Social Leverage has made a range of investments in to the FinTech sector. Last year, the firm took part in the $77m funding round in to farming-focused lending company ProducePay. The company helps to offer cash flow solutions to fresh produce farmers by paying for the goods upfront, instead of once the stock has sold.

Other FinTechs in the firm’s portfolio include online mortgage lending platform CommLoan’s, supply-side P2P lending company Even Financial and stock trading app Robinhood.

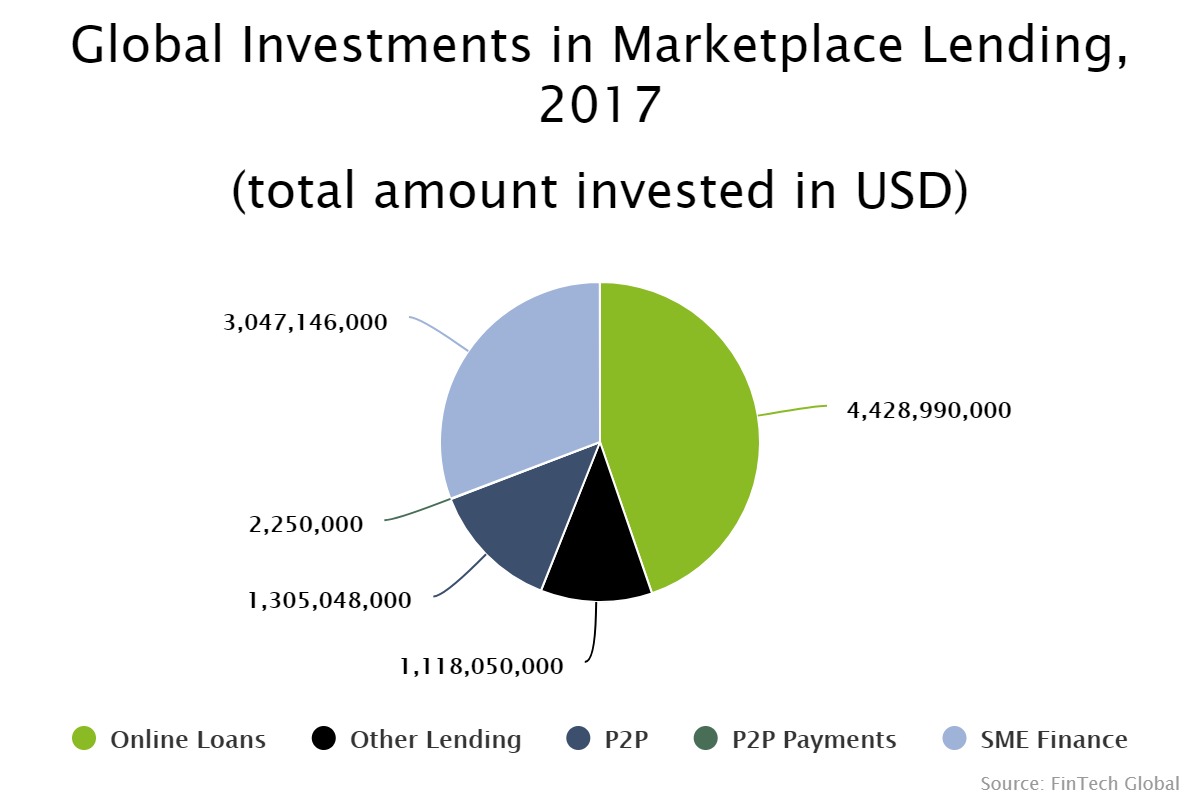

Last year, online loans represented the biggest sub-sector in marketplace lending, picking up around 45 per cent of the capital invested.

Copyright © 2018 FinTech Global

Copyright © 2018 FinTech Global