Key Australian FinTech investment stats in H1 2024:

- Australian deal activity dropped by 62% in H1 2024 YoY

- Average deal value dropped to $16.6m which could indicate investors shifting to smaller investments

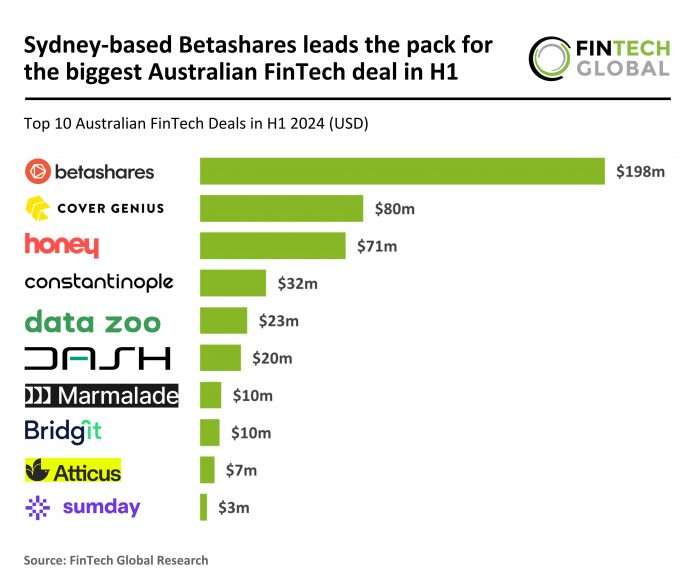

- Sydney based Betashares, secured the largest deal in Australia for H1 2024 with a funding round of $198m

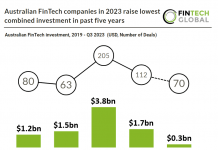

In H1 2024, the Australian FinTech sector experienced a significant decline in both deal activity and funding. Only 34 deals were recorded during the first half of the year, representing a 62% drop compared to the 89 deals completed in H1 2023. Funding saw an even steeper decline, with Australian FinTech companies raising just $564m in H1 2024, a 73% decrease from the $2.1bn raised in the same period last year. If this trend persists, the projected total for deal activity in 2024 would be approximately 68 deals, indicating a 50% reduction from the 136 deals completed in 2023.

The average deal value in H1 2024 was approximately $16.6m, down from $23.8m in H1 2023, reflecting a 30% decline. This shrinking average deal size suggests that not only has deal activity slowed, but investors are also shifting towards smaller investments. This trend could indicate growing caution among investors in the Australian FinTech space, likely due to economic uncertainties and tightening financial conditions impacting the appetite for larger, riskier investments.

Betashares, a leading Australian financial services company known for its investing platform Betashares Direct and range of exchange-traded funds (ETFs), has secured the largest deal for an Australian FinTech in H1 2024 with a $198m investment from Temasek, a global investment firm headquartered in Singapore. This capital injection follows a period of rapid expansion for Betashares, which has managed over $25bn on behalf of more than a million investors, financial advisers, and institutions. The investment from Temasek, which will see the firm become a minority shareholder alongside TA Associates and Betashares’ staff, underscores Betashares’ long-term ambition to become a premier independent financial services provider. The company continues to innovate with initiatives like Betashares Direct, a retail investment platform designed to assist self-directed investors in building long-term wealth. Betashares remains committed to transparency, cost-effectiveness, and simplicity as it expands its market presence and offerings, aiming to create long-term value for customers, partners, and shareholders alike.

Keep up with all the latest FinTech research here

Copyright © 2024 FinTech Global