Airwallex, the Australian real-time payment unicorn, has confirmed that it is raising new investments as $18.2m of its funds remain frozen in Hong Kong due to alleged fraud.

“We are in the process but I can’t give you any more details,” Lucy Liu (pictured), president and co-founder of Airwallex, told The Sidney Morning Herald.

While not giving away any details, she is reported to have indicated that the new raise would be about the same size as the $100m Series C round it raised in March 2019. That round gave Airwallex a valuation of over $1bn, pushing it well into unicorn-status territory.

The investors participating in the round included Sequoia Capital China, Tencent, Hillhouse Capital, Gobi Partners, Horizons Ventures and Square Peg Capital.

The company, which enables users to instantly open international bank accounts, is also dealing with the fact that $18.2m of its funds is still frozen by Hong Kong authorities.

The Organised and Serious Crimes Ordinance froze the funds in 2019 after Airwallex remitted it to bank accounts of two of its customers. The FinTech unicorn has denied any wrongdoing and claims it is an innocent third party. It has also argued that Hong Kong police violated private property protection principles.

Liu told The Sidney Morning Herald that the judicial review was still ongoing.

“Given everything going on in Hong Kong at the moment it is very slow,” she said. “It has not impacted us.”

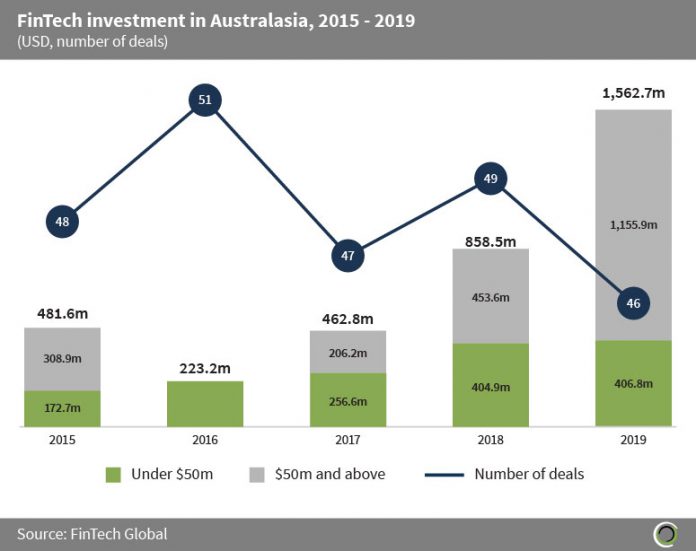

Airwallex meteoric rise comes as Australia’s FinTech industry is rapidly changing. Investment into the FinTech industry tripled between 2015 and 2019, jumping from $481.6m to $1.56bn in that period, according to FinTech Global’s data.

The Australian government has made several efforts to strengthen the sector, including launching a review to find out what obstacles might need to be removed for the industry to flourish.

Earlier in March, Australian regulators agreed to allow FinTech firms to continue the practice of screen scraping data.

However, both neobanks and new FinTech scaleups like Airwallex have many challenges to overcome in order to succeed.

“FinTech and challenger banks have the additional hurdle of gaining consumers’ trust,†James Butland, VP of business banking at Airwallex, the payments unicorn, recently told FinTech Global. “Trust is such a huge factor with a new product, especially one that handles your or your business’ money. Without a 100-year track record, trust is harder to build, but through clear communication, reliability and ensuring you are transparent, and having a product ten times better than the incumbents, trust can be built.â€

Copyright © 2020 FinTech Global