Admiral Seguros has allegedly become the first insurer in Spain to use artificial intelligence to assess vehicle damage, thanks to a new partnership with InsurTech startup Tractable.

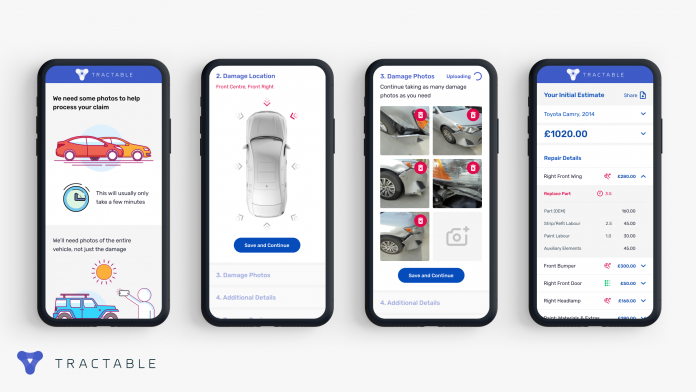

The insurer will leverage Tractable’s solution to evaluate vehicle damage via photos sent through a web application. Tractable’s AI will then complete the manual tasks an advisor would normally be burdened with and produce a damage assessment within seconds, which typically does not need further review.

Following a completed assessment, Admiral Seguros will be able to make immediate payment offers for policyholders. This service can enable the firm to resolve claims within minutes and on the first phone call.

Tractable co-founder and president Adrien Cohen said, “By using our AI to offer immediate payments, Admiral Seguros will resolve many claims almost instantly, to the delight of its customers. This is central to our mission of using Artificial Intelligence to accelerate recovery, converting the process from weeks to minutes.”

The AI solution, which leverages deep learning and machine learning, is trained with millions of photographs of vehicle damage. The platform can be used globally and to assess damage of any vehicle.

Admiral Seguros head of customer management José María Pérez de Vargas said, “Admiral Seguros continues to advance in digitalisation as a means to provide a better service to our policyholders, providing them with an easy, secure and transparent means of evaluating damages without the need for travel, achieving compensation in a few hours. It’s a simple, innovative and efficient claims management process that our clients will surely appreciate.”

The insurance firm said the implementation of the technology will be a big step for its digitalisation and improve customer experience across its brands.

Japan’s property and casualty insurance firm Tokio Marine formed a similar partnership with Tractable earlier this year. The deal sees Tractable deploy its AI solution to help the insurer improve its auto claims.

Copyright © 2020 FinTech Global