Companies in the United States raised seven of the top 10 CyberTech deals in the first quarter as total funding hit $4.1bn

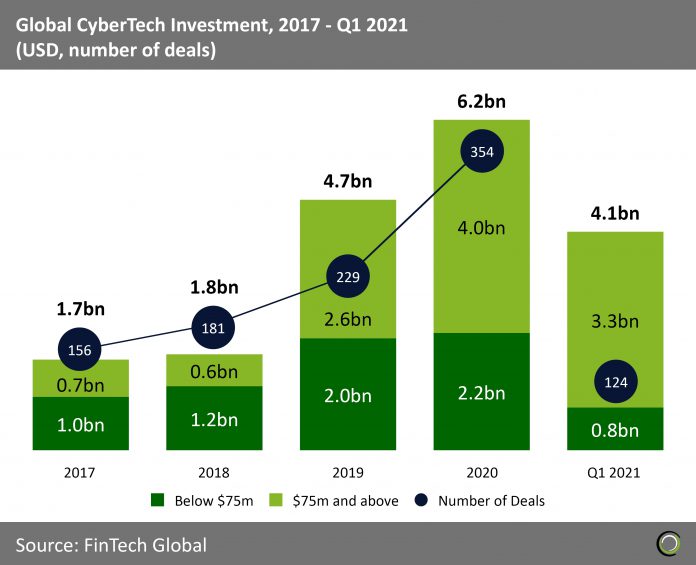

- The global CyberTech industry experienced strong growth between 2017 and 2020 as investors poured money into companies battling the increased threat of cyber attacks and data leaks in financial services. Total funding grew at a CAGR of 53.9% from $1.7bn to just over $6.2bn at the end of last year.

- Increased share of total funding came from deals over $75m which made up 64.5% of the total capital invested in the sector in 2020. The pandemic and the ensuing shift to remote work opened financial institutions to new and increased threats as home setups became easy targets for cyber criminals. As a result, investors upped their stakes in the sector as established companies looked to develop solutions and seize market share by addressing the new cyber challenges.

- The trend continued into 2021 and CyberTech investment had a blistering start to the year with $4.1bn already invested into the sector. The increased funding levels were driven by 17 deals of $100m or more, compared to just three such transactions recorded in Q1 2020. Deal activity also grew 55% YoY to 124 deals, putting the sector on pace for its best year.

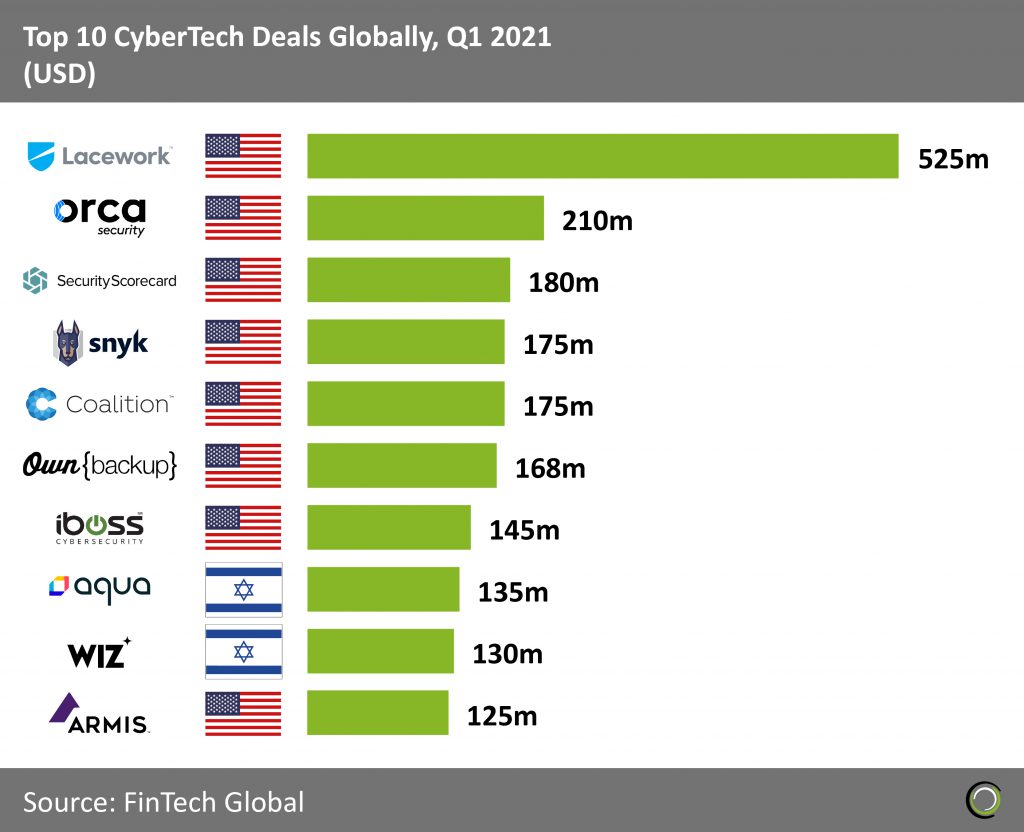

US Companies raised eight of the top ten CyberTech deals in the first quarter of 2021

- The top ten CyberTech deals in the first three months of the year collectively raised over $1.9bn, making up 48% of the overall investment in the sector during the quarter. The ratio is much lower than the one recorded in Q1 2020 when 72.5% of total funding came from the largest ten transactions. This is to be expected given we are seeing much larger proportion of large deals with 17 transactions of $100m or more.

- US companies are leading CyberTech investment, and they also dominate the top ten transactions list in Q1 taking eight spots. The only two companies to break the country’s dominance were Israel-based Aqua Security, an enterprise cloud-security solution, and Wiz, a cloud-native visibility solution for enterprise security.

- The largest deal of the period was raised by Lacework, a threat/anomaly detection and compliance platform across multicloud environments. The company raised $525m in a Series D round led by Altimeter Capital and Sutter Hill Ventures in January. With the fresh equity, the company is looking to increase its go-to-market and partner ecosystem operations, as well as grow its engineering and R&D teams across the US and Europe.

If you want to find out who are the leading CyberTech companies in financial services check out our recently announced CyberTech100 list.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2021 FinTech Global