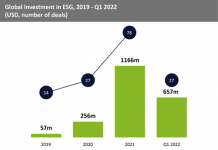

- ESG investment has moved into top gear in 2022, raising a total of $767m as of April 29th more than double 2021’s levels. The ESG sector is expected to reach $2.4bn in total funding in 2022. Bloomberg analysts predict that up to $2.5 trillion ESG-oriented debt will be issued in 2022, nearly doubling 2021’s $1.5 trillion.

- Deepki, a company tracking ESG data for the real estate sector, was the highest valued ESG deal in 2022 as of 29th Deepki co-founders Vincent Bryant and Emmanuel said in a joint statement: “More than $5tn of investment is needed each year to decarbonise the built environment and ensure the real estate sector can meet its commitment of net zero by 2050. To achieve the target Deepki expect the monitoring and analytics segment within this goal to be worth $5bn to 10bn by 2025, with YoY growth of 20% and are positioning themselves as the key player in the market.

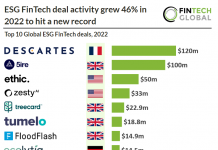

- US and UK companies both had 10 ESG deals in 2022 as of 29th April and combined accounted for 57% of deals so far in 2022. France was third in terms of deal activity with 17% of the deals so far this year at a total of six.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2022 FinTech Global