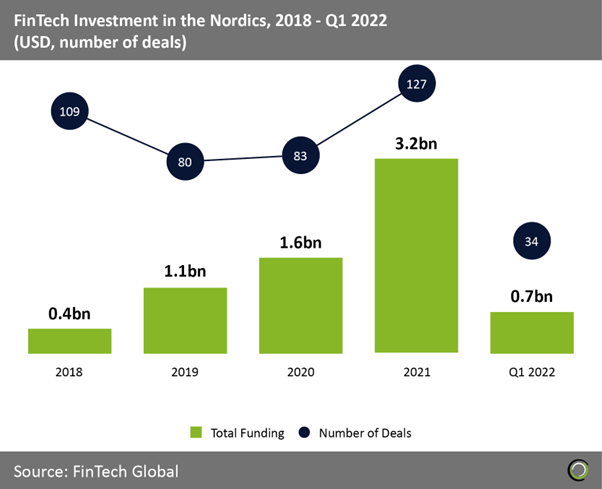

- Nordic FinTech deal activity in Q1 2022 indicates another strong year for the region with total deal activity expected to rise 7%. Overall investment in 2022 doesn’t look like it will surpass 2021’s levels when total capital invested hit a record $3.2bn. Based on current run rate in the opening quarter, FinTech funding is projected to raise to $2.4bn.

- PayTech and WealthTech companies accounted for the most deals in Q1 2022, completing 18% of total deals each. Norway’s Ardoq, a data-driven tool for enterprise architecture and digital transformation, was the largest FinTech deal in Q1 2022 raising $126m in their latest Series D funding round led by EQT. Ardoq said it will use the proceeds to expand the company’s services globally and focus on its commercial platform and new product offerings.

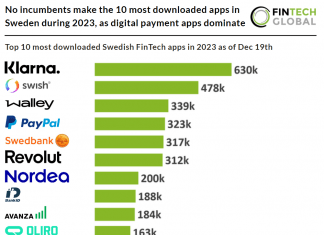

- Large deals in the region from Swedish company Klarna, a buy now pay later company, have bolstered Nordic investment in previous years. Last year the company raised an enormous $1.6bn in funding but this importantly has not occurred so far in 2022. This indicates that Nordic FinTech investment may set a new record in 2022 if another large FinTech company such as Klarna or Tink raises more funding.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2022 FinTech Global