Following three weeks of relatively modest investment in the FinTech sector, this week saw almost 50 deals reported on by FinTech Global in a red-letter week for capital.

Taking the crown as the biggest investee this week was FinTech firm Ratio, who managed to raise an eye-watering $411m across venture funding and a credit facility.

This week was a dominant week for FinTech and financial infrastructure-focused businesses, with Power – a credit card issuer – and Axle Payments – a financial enablement platform for the freight and logistics industry – raking in $316m and $126m respectively.

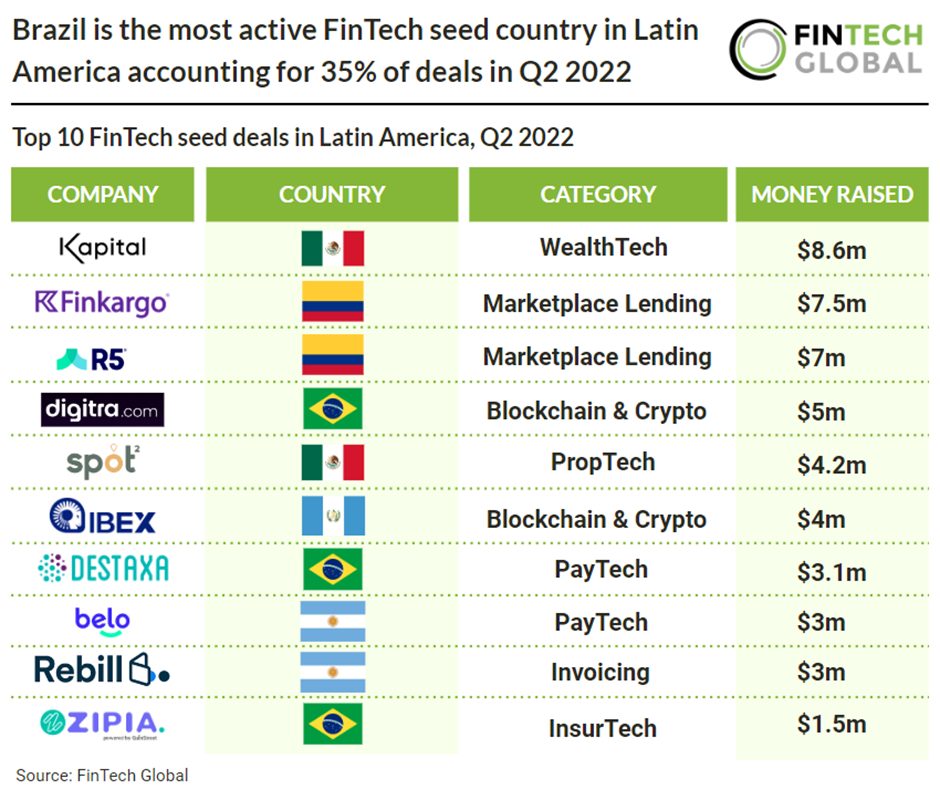

FinTech Global research this week found that Brazil was firing on all cylinders when it comes to FinTech seed deals, with the country being home to more than a third of all of them in Latin America in the second quarter.

Overall, there were 26 FinTech seed deals across Latin America in the second quarter of the year with Brazilian companies taking the biggest share with nine deals, or 35% all deals at that stage.

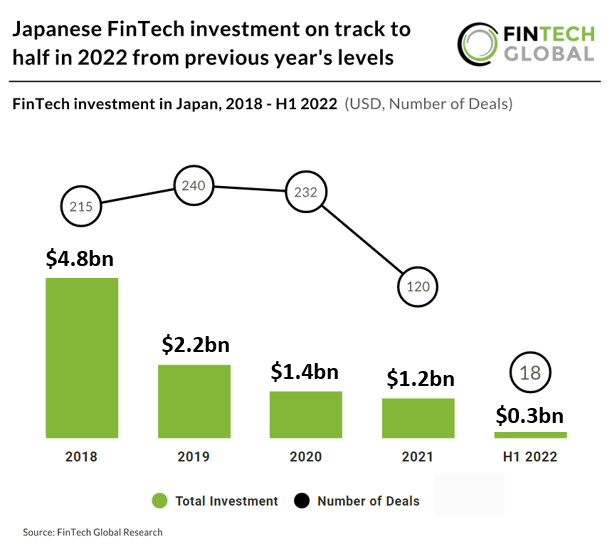

Elsewhere, Japanese FinTech investment is on track to half in 2022. The country recorded a better second quarter compared to Q1 2022 with $240m in investment, which is a four-fold increase from the opening quarter.

This is a massive reduction compared to previous years when funding peaked in 2018 at $4.8bn. Deal activity in the country also rose slightly from the first quarter by 25% to ten deals in total for Q2 2022.

Here are this week’s deals.

FinTech Ratio scores $411m in financing

Ratio, a FinTech that combines payments, predictive pricing, financing and a quote-to-cash process into one platform, has raised $411m across venture funding and a credit facility.

The funding was broke up into $11m in venture funding and $400m from the credit facility for customer financing.

Ratio claims its platform enables SaaS companies and other recurring revenue businesses to provide embedded BNPL services that granularly match their customers’ cash flow needs.

Power rockets out of stealth with $316m

Power, a FinTech that has launched a full-stack credit card issuance platform, has bagged $316.1m after a $300m credit facility and $16.1m in seed funding.

The seed round was headed by Anthemis and Fin Capital and also saw investment from Dash Fund, Plug & Play, Financial Venture Studio and CRV. Angel investors also participated.

Power claims it is providing the infrastructure for companies in the consumer, commercial and banking sectors to offer premium FinTech experiences fully embedded within their digital properties.

Power product is fully white-labelled and embedded within the brand’s existing mobile and web applications, offering customers what it describes as a ‘frictionless experience’ as they apply for and manage their cards.

Verkada hits $3.2bn valuation

Verkada, a security and management platform, has raised $205m in its Series D, which values the company at $3.2bn.

Linse Capital led the round, with participation also coming from MSD Partners. Existing investors, Felicis Ventures, Next47, Sequoia Capital, Meritech Capital, and First Round Capital also backed Verkada.

This capital will help Verkada enhance its existing offering and build new product lines. It also plans to hire across all teams and further geographic expansion efforts.

Its core product lines include video security cameras, door-based access control, environmental sensors, alarms, guest, and mailroom management. It supports companies in financial services, government, healthcare, manufacturing and more.

Financial services can leverage the technology for integrated security at banks and ATMs. Its security technology can fit into most standard ATMS and uses people analytics to identify suspicious transactions. It claims the software deters ATM fraud.

Oportun secures $150m loan to boost digital banking

Oportun Financial Corporation has closed a $150m senior secured term loan to drive its mission-driven FinTech and digital banking platform.

The term loan is due in 2026 and is from funds managed or sub-advised by Neuberger Berman Specialty Finance.

FTV Capital backs Patra with $146m

Patra Corporation, a technology-enabled services company for the insurance industry, has raised $146m investment from FTV Capital.

According to Patra, an aging insurance workforce has resulted in a talent crisis as business struggle with increased turnover and higher recruiting and replacement costs. Moreover, a wave of industry consolidation continues to fuel the need for a flexible, front, middle and back-office solutions to streamline processes and put platforms in a position to be able to scale.

Confronted with these challenges, Patra said, brokers, carriers and other market participants are increasingly turning to partners who offer efficient technology-enabled services and help automate key processes in order to drive future growth.

To tackle these challenges, Patra, which was founded in 2005, has developed technology-enabled management solutions for industry participant across the insurance value chain. Therefore, the company said, it is able to alleviate the burden of administrative and operational tasks, completing them at a lower cost, in a quicker time frame and with greater accuracy.

Xepelin secures $140m loan

Chile-based Xepelin, a payment platform for business and financial services for SMEs in Latin America, has reportedly received a $140m loan from Goldman Sachs.

The funds were supplied to support Xepelin’s expansion into Mexico, according to a report from The Paypers. It also reported that this is Xepelin’s largest credit facility, and the funds are denominated in Mexican pesos.

Xepelin is also looking to expand into other nations, but it did not reveal which countries are targeted. The payment platform aims to reach one million clients by 2025, with it currently serving 15,000.

The company supplies SMEs with real-time financial information and integrates financial services with different data models that reduce the time normally taken by the complicated financial processes.

Axle Payments rebrands, closes Series B on $126m

Axle Payments, a financial enablement platform for the freight and logistics industry, has rebranded to Denim. Alongside this, it closed its Series B on $126m.

Pelion Venture Partners led the investment round. Other backers include Crosslink Capital, Anthemis, Trucks VC, FJ Labs, Tribeca Early Stage Partners and Refashiond Ventures.

The Series B was composed of $26m in equity financing and $100m in debt financing.

These funds will help Denim scale its platform and debt financing to provide working capital to freight brokerages. Denim will also bolster its product expansion efforts.

FinTech Fazz Financial raises $100m

Fazz Financial, a FinTech aimed at Southeast Asia, has raised $100m for its Series C round, which comprises $75m in equity and $25m in debt.

This capital will help Fazz expand its operations and accelerate its mission to catalyse Southeast Asia’s digital transformation.

Fazz has experienced strong growth over the past year, having achieved an annualised transaction volume of $10bn. The company is currently looking to double its transaction volume in the next 12 months, as well as expand its teams in Singapore, Indonesia, Malaysia, Vietnam and Taiwan from 800 to 1,400.

The FinTech company offers a business account that lets businesses of all sizes, from micro to Fortune 500 companies, pay, save and get credit in Southeast Asia.

Alternative asset management platform Ethic bags $50m

Ethic, a sustainability-focused personalisation-powered asset management platform, has closed its Series C round on $50m.

San Francisco-based investment management firm Jordan Park Group led the Series C.

UBS also joined the round through its venture and innovation unit, UBS Next. Other backers include Oak HC/FT, Nyca Partners, Sound Ventures, Urban Innovation Fund and Kapor Capital.

Ethic will use the capital to expand into new markets and launch new products. It will also invest into its platform experience.

Security operations centre CYREBRO nets $40m

CYREBRO, a security operations centre infrastructure, has raised $40m in Series C funding, led by Koch Disruptive Technologies (KDT).

Elaia also joined the round as a first-time backer. Existing investors Mangrove Capital Partners, Prytek, Bank Mizrachi and InCapital Group also joined the round.

CYREBRO has earmarked the capital for its go-to-market strategy. Its goal is to become the global solution for all managed security service providers (MSSPs), IT providers and businesses.

Between 2020 and 2021, CYREBRO experienced a 300% year-over-year growth. Furthermore, between 2019 and 2021, the CyberTech has tripled its revenues.

Majority bags $37.5m

Majority, a mobile bank for migrants, has scored $37.5m in a Series B funding round headed by Valar Ventures.

Valar and Heartcore Capital provided $30m in equity funding while $7.5m in debt financing was invested by an undisclosed US commercial bank.

Majority is the first digital financial service dedicated to serving migrants globally. For $5 a month, Majority members in the US receive a FDIC-insured account, VISA debit card, remittance and international calling, use of more than 50,000 ATMs across North America, native language advisors and access to a network community of up meet-up spaces, events and local discounts.

Diamond trading service Diamond Standard raises $30m

Diamond Standard, which offers the world’s only regulator-approved diamond commodities, has raised $30m in funding.

US-based venture firm Left Lane Capital and investment adviser Horizon Kinetics co-led the round. Gaingels and Republic.co also joined the round.

This equity will enable the company to expand production capacity and speed up distribution.

Diamond recently launched the Diamond Standard Fund. This allows investors to allocate funds to diamonds through convenient shares, rather than holding the gemstones. Blockchain technology enables the asset to be digitally traded.

Colombian FinTech startup Finaktiva raises $25m

Colombian FinTech company Finaktiva has reportedly raised $25m in a mix of debt and equity.

This investment capital will help Finaktiva bolster its financing lines.

Finaktiva is a digital financing ecosystem for SMEs in Colombia. Its platform helps companies quickly access credit lines, early bill payments, payment management and credit insurance.

It leverages technology to generate insights into each stage of business maturation and will offer support for these various stages.

CyberTech SaaS Alerts rakes in $22m

SaaS Alerts, a cybersecurity firm built for managed service providers, has secured a $22m growth investment from Insight Partners.

SaaS is purpose-built for managed service providers to protect and monetise their customers’ core business applications.

The company claims it was designed to help MSPs monitor and protect their customers’ usage of the most popular SaaS applications. It also was designed to safeguard against security threats to a business’ SasS environment, such as data theft and data at risk.

SaaS Alerts will use the funding to accelerate the growth of its monitoring and response platform.

Software management platform Cledara bags $20m

Cledara, which claims to be the first software management platform aimed at growing companies, has completed a $20m Series A.

With the capital, the funds will help Cledara expand in the US.

Founded in 2018, Cledara aims to help companies take control of their software subscriptions through a simple and intuitive manner. It combines a payment platform with management capabilities. The platform’s dashboard displays all of a company’s software, all in one place.

The company issues credit and bit cards exclusively via the Mastercard network.

Philippines-based BNPL service BillEase nets $20m

Philippines-based BillEase, which offers buy now, pay later (BNPL) services, has reportedly raised $20m in a debt facility from Singapore’s Helicap Securities.

With the funds, BillEase plans to expand the reach of its financial services, according to a report from Marketech APAC. Funds will enable the company to grow and expand its loan portfolio.

The FinTech company offers BNPL services, with users able to make installments between two and 24 months.

Users pick desired terms, submit proof of income, ID and billing, and are approved for a loan on the spot. Its services are available at Samsung, Cole Haan, Aldo and many other stores.

Jordanian FinTech liwwa bags $18.5m pre-Series B

Liwwa, a peer-to-peer lender, has raised $18.5m pre-Series B round of equity and debt funding.

The equity raise – which raised $4.5m – saw participation from DASH Ventures, FMO, Bank al Etihad and Edgo, while DEG invested $790,000.

The debt financing, meanwhile, came from a range of local banks and international entities, such as Bank al Etihad and Capital Bank of Jordan. Also taking part were Triodos Bank and Jordan Kuwait Bank.

Founded in 2013, Amman-based liwwa lends to small businesses in Jordan and Egypt. The company also owns and operates liwwa.com – a marketplace for SME loans where investors can purchase loan receivables.

liwwa claims it will deploy the new funds towards its growth and expansion plans going forward.

Kafene bags $18m to serve the underbanked

Kafene, a digital platform helping merchants offer flexible lease-to-own (LTO) financing options, has raised $18m in Series B funding.

Kafene said its lease-to-own agreements are free of debt and structured in a way that is simple, consumer-friendly and transparent.

These agreements primarily serve the underbanked. Kafene highlighted that this is important given that one-third of Americans have credit scores that limit their purchasing ability, particularly on necessary big-ticket items such as furniture, appliances, electronics, tires and other goods.

Therefore, the financing platform provides retailers with a way to reach more of these consumers than they would otherwise be able to, which can meaningfully add to their customer bases.

Data security firm Theom pulls in $16m seed financing

Theom, a cloud data security firm, has closed a $16.4m seed funding round to widen its cloud data security solution.

Theom claims it is pioneering a new method of securing data in the cloud and SaaS data stores by ensuring that protection always follows the asset, adapting the security as environments change.

The company claims it brings a new approach to data security that identifies high-value assets, analyses and prioritises risks to the assets, and ensures security controls follow the data wherever it is moved, stored, copied or transacted.

Theom enables organisations to gain intelligence about the risks to high-value data and ensure existing security controls are properly armed to prevent data breaches by, amongst other things, providing security intelligence for data at rest and in motion, and prioritising cloud security risks based on potential for exposure of sensitive data.

By understanding both data and access identities, Theom pinpoints the biggest risks to high-value data and prioritszes remediation more effectively. Theom integrates with identity access management (IAM), infrastructure controls, security information and event management (SIEM), security orchestration, automation and response (SOAR), and ticketing systems to increase the return-on-investment of the overall security program.

Accounts payable outfit Candis rakes in €15.9m

Candis, a company looking to simplify accounts payable processes, has raised €15.9m from a recent funding round.

According to EU Startups, Candis is aiming to tackle the issue of simplifying financial processes that require firms to jump between teams and software tools. In addition, miscommunication and a lack of centralised collaboration can result from complicated financial processes.

The result of this convolution is that payments are missed, time-consuming problems arise and mistrust can fester.

To deal with this, Candis has created an intelligent software solution that can support SMEs to automate financial processes such as data entry, data export, invoice approval and invoice receipt.

The Candis platform ensures that missed discounts and payments or late fees are no longer time-consuming and costly to SMEs, by learning to build intelligent approval workflows.

Candis plans to use this new investment to expand its product offering with payments, doubling down on core invoice management functionality, building further integrations and expanding its team.

Token management platform Magna raises $15.2m

Token management platform Magna has closed its seed funding round on $15.2m.

Tiger Global and Tusk Venture Partners served as the lead backers to the round.

Other commitments came from Circle Ventures, Galaxy Digital, Asymmetric, Alchemy Ventures, Solana Ventures, Ava Labs, Polygon, Protocol Labs, Y Combinator Continuity, Blockchain Founders Fund, AV Blockchain Fund, Olive Tree Capital, ProtoFund and Plug and Play Ventures.

The round was also backed by angel investors. These include senior executives from Anchorage, Fireblocks, TRM, Chainalysis, TokenSoft, Phantom, QuantStamp, and QuickNode.

With the funds, Magna will improve the overall experience of its platform. It will also build new product offerings, launch support for new blockchains and protocols and audit its smart contracts.

AC Ventures backs Indonesian crypto platform Reku with $11m

Reku, indonesia-based crypto exchange and marketplace, has raised $11m in Series A funding led by AC Ventures.

Reku said it offers its users the lowest fees in the Indonesian market. The platform was built fully in-house and has been refined over the last five years with “maximum security and compliance in mind,”

Reku has generated $3bn in gross transaction value in 2021.

The startup said it will use the fresh capital to add more than 50 team members to its current headcount of 80. It will also roll out new offerings to address the biggest pain points of Indonesia’s crypto investors for both experienced traders and first-timers alike.

Splitit bags AUD 10.5m

Splitit, an instalments-as-a-service platform that powers buy now, pay later (BNPL), has raised AUD 10.5m in a private placement with institutional investors.

This capital will help Splitit unlock its next growth stage and capitalise on expansion efforts. It hopes to accelerate its product roadmap so platform partners can embed services directly into their technology stack, while supporting a next-generation one-click instalment checkout.

This private placement included several new large institutional investors, as well as existing backers. Funds also came from Splitit’s management team and board of directors.

Launched in 2022, Splitit’s white-label instalments-as-a-service platform eliminates consumer friction and improves conversion numbers. Its merchant-branded experience embeds into the merchant’s checkout flow to allow merchants to focus on delivering a more cohesive shopping experience.

InsurTech firm Turaco sweeps up $10m from Series A

Turaco, a distributor, broker and key customer interface between underwriter and end consumer, has bagged $10m from a Series A round.

Turaco claims its mission is to free people from the fear of financial shocks caused by unexpected health risks. The firm is able to do this through a B2B and B2B2C business model, forming relationships with top-tech-enabled firms with a large pool of customers or staff in emerging markets.

Turaco has designed and delivered a suite of bespoke medical, life, asset, and vehicle insurance packages that have already covered over half a million lives across Nigeria, Kenya, and Uganda.

The company – which is targeted at low-income earners and underserved customers -embeds its service as a white-labelled offering that is bundled with a partner’s core product or service while integrating with their existing payment processes to collect premiums.

Israeli CyberTech Opus Security scores $10m

Opus Security has landed $10m in a seed funding round headed by investment firm YL Ventures.

The Tel Aviv-based company is creating technology to help defenders manage and orchestrate cloud security response and remediation processes.

Opus will use the new funding to build technology for cloud security orchestration and remediation.

Opus Security says its platform integrates with existing security tools and orchestrates the entire remediation process across all stakeholders and organizational environments, based on easily deployed guidelines and playbooks.

Andreessen Horowitz backs cross-border PayTech Payall

Payall, a bank processor for cross-border payments and international money transfers, has closed a $10m seed round led by Andreessen Horowitz (a16z).

Additional participants in the round included Motivate VC along with PS27 Ventures and Bridgeport Partners, with SAFE conversions from RRE Ventures and Transcard.

In addition, payment, security and technology entrepreneurs, innovators and investors, including Chuck Bernicker, Nish Bhalla, Matt Gillin, Stefan Happ, Kabir Syed and Chris Winship, also participated in the funding round.

Founded in 2018 and based in Miami Beach, Florida, Payall describes itself as the world’s first bank processor for cross-border payments.

ModusBox launches PortX after $10m funding round

PortX is a new entity launched by ModusBox. The company is focused on financial services integration software that unlocks access to banking core data, eliminates vendor dependencies and enables banking-as-a-service solutions.

This capital will enable PortX to scale its operations.

ModusBox is a global software company offering equitable and inclusive financial services by driving participation in real-time payments. The decision to spin off PortX was made to enable each side to maximise their potential.

It claims that by being separate entities, they can realise additional financial security, independently pursue strategic objectives and better allocate capital.

Its solutions enable interoperability between internal systems and member services such as online banking, credit checks, mortgage and loan applications and others.

WealthTech firm InvestSuite closes €6m Series A

InvestSuite, a WealthTech firm that provides automated investment solutions, has bagged €6m from a Series A funding round.

InvestSuite welcomed two new strategic investors, the Cronos Group and OSOM Finance, as well as receiving funding from existing investor PMV.

Founded in 2018, the company has developed B2B InvestTech/WealthTech solutions for portfolio construction, digital investing and next-generation portfolio reporting.

InvestSuite said its existing investors maintain their percentage stake, whilst new and existing angels and employees decided to further invest in InvestSuite’s growth.

Composer raises $6m for automated investing platform

Composer Technologies, a US-focused automated investing platform, has closed a $6m investment.

In the past few months, Composer has recorded a 400% growth in trading volume and % AUM growth.

Composer simplifies the process of market research and monitoring. Its platform, which launched in November 2021, allows investors to automatically invest in strategies that react to the market and capture the upside, while protecting their downside.

It stated this systematic investing style is typically locked away from most investors due to time, data costs and skills.

UK-based InsurTech Stubben Edge raises £5.6m

UK-based InsurTech Stubben Edge has raised £5.6m in additional funding following its £10m investment in September 2021.

Its investors include a number of Lloyd’s Names, Nigel Wray, Dowgate Wealth, family offices, institutional investors and other HNW investors.

Since its previous funding round, Stubben Edge has acquired Lloyd’s broker Genesis Special Risks, established the Guernsey entity 1Edge, and bought the SME focused media titles from Bonhill.

The InsurTech also has other announcements planned for the coming months, including additional M&A activity.

Allocations raises $5m for its SPV software

Allocations, which helps build special purpose vehicles (SPVs) and funds instantly, has reportedly hit a $150m valuation after the close of its $5m round.

This capital injection will enable Allocations to bolster its platform.

Allocations was created in 2019 by Kingsley Advani following difficulties he faced setting up his own investment funds. Advani could not find a tool that could create funds quick enough to remain competitive.

The company helps fund managers create SPVs. Its end-to-end platform streamlines the process, allowing quick setup, simple formation of data and legal data. It boasts the ability to raise capital quickly, earn carry, earn management fees, track progress, instant SPV setup and seamless experience.

CoverSelf lands $4.8m to reinvent healthcare claims

CoverSelf, cloud platform for healthcare claims and payment integrity, has raised $4.8m in seed funding.

Founded in 2021, CoverSelf is a an open and transparent healthcare platform, built by a team of experienced healthcare technology and payment integrity visionaries.

CoverSelf has created a collaborative and comprehensive SaaS platform for all stakeholders, purpose-built for healthcare claims and payment integrity, providing a solid foundation for innovation while removing administrative waste and duplication of efforts.

The company’s mission is to enable healthcare claims to be paid accurately, quickly, and conclusively. The platform, CoverSelf said, enables a generational architectural shift that adapts to the dynamic nature of healthcare and empowers users without technical and external dependencies as the industry evolves.

One of the long-standing critical challenges that the US healthcare claims and payment integrity has faced, according to CoverSelf, is the lack of an open system that allows collaboration between and among payers, vendors, and providers, without data and workflow silos and “black box” constraints.

Crypto wallet Sender lands $4.5m

Sender, a NEAR-based eco-wallet, has raised $4.5m in a private round led by Pantera Capital.

Sender is a non-custodial wallet tailored for NEAR, including an extension wallet and mobile wallet. It provides a one-stop wallet solution for users to send, receive, and store NEAR-based assets easily and securely.

In addition, several notable projects in the NEAR ecosystem such as Octopus Network, Ref Finance, and Paras also participated in the funding round.

This raise follows Sender’s April 2022 seed round of financing led by Binance Labs and Metaweb Ventures.

With this new round of financing, Sender said it plans to further expand its R&D team, raise the security threshold for Sender Wallet, and expand its wallet ecosystem.

FinTech Claimer picks up $4.2m from seed round

Claimer, a FinTech startup seeking to make it frictionless for firms to claim financial incentives from the government, has raised $4.2m in a seed round.

To date, governments set aside billions in innovation incentives for startups and scaleups globally, but often the barriers to accessing them can be high.

Whether it’s securing tax credits, grants or local tax reliefs of any kind – applying for them can be difficult. The eligibility criteria and application process can often be time-consuming and complex and require specialist knowledge that firms do not have.

By building accessible government financing infrastructure, Claimer claims it can make the experience of claiming innovation incentives much easier.

Regulatory compliance startup Ruleguard raises £3.5m

UK-based Ruleguard, which supplies regulatory compliance to financial institutions, has received a £3.5m investment from Foresight Group.

This capital injection will help Ruleguard develop additional platform capabilities while also scaling its sales and marketing efforts to meet the growing market opportunity.

Founded in 2013 by John O’Dwyer, Ruleguard initially launched as a software development consultancy. O’Dwyer saw an opportunity in 2015 and developed a software platform to support the incoming Client Assets Sourcebook (“CASS”) regulations.

Since then, Ruleguard has gained a growing blue-chip customer base and expanded its capabilities to become one of the most competitive GRC platforms in the financial sector.

The regulatory compliance platform claims to be uniquely positioned as a specialised platform for regulatory compliance and has a broader coverage than point solution providers while being more focussed than generic enterprise grade risk management platforms.

RegTech startup heyData snaps up €3.3m seed

heyData, a German compliance startup, has secured €3.3m from a seed funding round headed by Ten VC.

heyData has developed a SaaS application that reduces compliance issues, such as data protection, for enterprises. Customers of the company include Vytal, Hive Logistics, Everdrop and Numa.

The firm said the digital platform serves as the centrepiece for implementing compliance topics.

Whether this involves integrations into the tech stack or the training of employees to raise awareness this is determined by the company itself based on its requirements.

heyData plans to use the new capital for product expansion and venturing into markets. In addition, the team – which currently has a headcount of 34 – is set to be expanded.

Istanbul FinTech Fimple secures $3m

Fimple, an Istanbul-based FinTech, has raised $3m worth of investments in a pre-seed tour to grow its Banking-as-a-Service (BaaS) solutions.

Founded in March this year, Fimple provides “natural” cloud-based technology solutions specifically tailored for financial institutions, especially digital banks, to realize BaaS and platform business models and their main systems.

By August, the startup could boast a diverse team of 30 experienced engineers specialised in various aspects of banking technology.

Fimple is currently in the process of stepping up its global operations, especially in the European market.

Neem closes $2.5m seed to improve financial wellness in Pakistan

Neem, a financial wellness platform for Pakistan’s underbanked communities, has raised $2.5m in its seed funding round.

This capital enables Neem to bolster its growth and reach.

The FinTech company’s mission is to bring an embedded finance model to Pakistan with a market opportunity of $167bn, it claims.

Neem was co-founded by Nadeem Shaikh, Vladimira Briestenska and Naeem Zamindar. The trio believe that financial inclusion requires a more holistic approach that caters to the full financial needs of people and businesses.

This includes giving individuals and businesses control through payments, addressing their needs through credit, absorbing risk through access to insurance, and access to savings and investments.

Hillridge bags $2.3m for crop insurance in Australia

Hillridge, a Sydney-based AI crop insurance platform, has raised $2.3m in seed funding as it plans to expand its weather insurance platform to southeast Asia.

As heatwaves, droughts and floods make news around the world, Hillridge said in a post on LinkedIn, that the need has “never been greater” for new tools to help farmers and other climate-exposed industries build resilience to climate shocks and changing weather patterns.

Hillridge offers affordable weather insurance in Australia against risks local insurers may not cover, such as drought, frost, heat and too much rain. The platform collects weather data, machine learning, and personalisation based on farmers’ production to provide insurance and self-executing contracts based on blockchain.

The platform generates a price in seconds and triggers automatic payout instructions if adverse weather occurs. This means policies can be delivered at scale within days.

Bitmama bags $2m pre-seed

US and African-based blockchain payments startup Bitmama has raised an additional $1.65m in its pre-seed round, bringing the total raised to $2m.

Bitmama closed this funding from a group of foreign and domestic investors ten months after its initial pre-seed round of $350,000.

Bitmama describes itself as a highly-secure blockchain payment platform that is pioneering “Crypto Beyond Trading” for Africans globally.

The company said it is approaching the African crypto market differently by promoting the awareness and adoption of crypto through innovative product offerings including its virtual crypto debit cards, which afford over $10,000 in monthly spending limits. Powered by VISA, these cards are funded with stable coins and can work anywhere in the world for online transactions.

The company said the capital will be used to expand its operational presence, strengthen its team across different markets, consolidate its product offerings, and plot market penetration across Africa, while rapidly scaling new use cases for cryptocurrency within the continent.

PeopleHedge scores $1.4m in seed round

PeopleHedge, a FinTech focused on boosting the non-interest income of community banks and credit unions, has bagged $1.4m in a seed round.

PeopleHedge has developed SmartRoute technology, which creates a real-time auction for FX payments. The technology compresses pricing and makes banks competitive with rivals.

The firm’s technology stack was built to create core integrated FX trading marketplaces. Used for cross-border payment transactions, this lessens friction in the process while saving money for the end customer.

PeopleHedge plans to use the funding to grow its US footprint by increasing sales efforts to banks and credit unions in need of more services and revenue opportunities.

Insly secures €1.1m

Insly, a no-code software platform for insurers, insurance brokers and Managing General Agents (MGAs), has raised €1.1m in a bridge round.

Existing investors, Concentric and Uniqa Ventures committed to half. The other half was committed to by an angel syndicate led by Fund Fellow Founders. The round brings Insly’s total raised to €5.8m.

The London and Tallinn based InsurTech, enables insurers, MGAs, brokers, and underwriters to digitise and automate their mid and back-office operations, including distribution, policy administration, underwriting, claims, and reinsurance.

PickMyWork lands $1m seed financing

PickMyWork, a startup that helps digital firms acquire end customers, has raised $1m from a seed funding round.

According to CXO Today, PickMyWork is India’s largest digital distribution network and allows firms to acquire end customers on a pay-per-sale model.

PickMyWork works with 300,000 gig workers as part of its network, providing them with earning opportunities to boost their income.

Binance Labs backs blockchain dev Aptos Labs

Binance Labs, the venture capital division of Binance, has made a strategic investment into Aptos Labs, a layer-1 blockchain.

Aptos will use the funds to expand its team and bolster the development of its infrastructure. Capital will also enable Aptos to extend ecosystem initiatives.

Aptos has developed its blockchain over the past three years with over 350 developers deployed globally. Its blockchain is upgradeable and can evolve to support current and emerging Web3 use cases.

Sigma Partners closes Series A headed by Mosaik Partners

Risk screening and monitoring platform Sigma Ratings has secured a Series A investment round.

The round was headed by Mosaik Partners. Also participating in the round were FinTech Collective, Contour Ventures and AngelList Ventures.

Sigma connects publicly-sourced data and risk intelligence into a platform that helps companies evaluate, risk, onboard, retain and expand relationships.

The company has seen 250% revenue growth and a doubled client base during the pandemic.