Tag: Akur8

Elevating insurance pricing models: Akur8 introduces derivative lasso for actuarial precision

In the realm of actuarial science, Akur8 has made a significant stride with the release of their latest research paper titled "Derivative Lasso: Credibility-Based Signal Fitting for GLMs."

Akur8 joins forces with Guidewire: The future of InsurTech pricing

Akur8 and Guidewire, two trailblazers in the FinTech industry, are taking their partnership to new heights. Akur8, renowned for its next-generation insurance pricing solutions, has announced an impressive expansion of its collaboration with Guidewire, a key player in the industry. This expansion is bolstered by Guidewire's recent investment in Akur8.

Akur8 teams with Tokio Marine Seguradora to revolutionise Brazil’s insurance pricing

Tokio Marine Seguradora, a top-ranking insurance provider headquartered in São Paulo, has joined hands with Akur8, a trailblazer in risk modelling solutions.

Akur8 partners with Wüstenrot Gruppe to enhance pricing capabilities in Austria

Akur8 and Wüstenrot Gruppe have announced a new collaboration aimed at enhancing Wüstenrot’s pricing capabilities in Austria.

Akur8 partners with SGI CANADA to innovate insurance pricing process

Akur8, described as the next-generation insurance pricing solution utilising transparent machine learning, has announced a strategic collaboration with SGI CANADA, a prominent property and casualty insurance division operating in five Canadian provinces, with the shared goal of enhancing the insurance pricing process.

InsurTech disruptor Akur8 scores $25m investment

Akur8, a firm specialising in next-generation insurance pricing via Transparent AI, has successfully closed a new funding round to the tune of $25m.

Akur8 partners with Cypress P&C to enhance insurance pricing prowess

Akur8, a trailblazing insurance pricing solution utilising transparent machine learning, and Cypress Property & Casualty Insurance Company (Cypress P&C), a well-established insurance firm offering a variety of innovative insurance products, have joined forces.

Akur8 and Madison Mutual Insurance join forces to redefine pricing in...

Madison Mutual Insurance Company (MMIC), a prominent Midwest insurer, and Akur8, a groundbreaking solution provider for non-life insurance pricing, have announced their partnership. The collaboration...

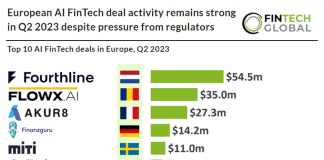

European AI FinTech deal activity remains strong in Q2 2023 despite...

Key European AI investment stats in Q2 2023:

• European AI FinTech deal activity increased 6% to 38 deals in Q2 2023 from the previous...

Akur8 partners with Canal Insurance for state-of-the-art Risk and Rate Modelling

Akur8, the creator of next-generation insurance pricing solutions employing transparent machine learning, has teamed up with Canal Insurance Company, a leading commercial insurance provider.