Tag: AML

Salt Bank selects Napier AI to enhance AML compliance for Romania’s...

Napier AI, a London-based RegTech specialising in financial crime compliance, has partnered with Salt Bank, the first Romanian neobank and the fastest-growing in Southeastern Europe.

Essential guide to Anti-Money Laundering (AML) compliance in 2024

FullCircl, a SaaS platform renowned for eliminating regulatory and verification hurdles, has offered a complete guide to money laundering regulations 2024. The updated guide explores the current global Anti-Money Laundering (AML) regulations, providing essential insights for staying compliant.

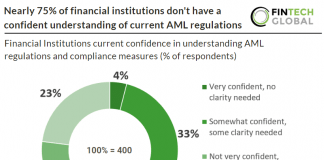

Nearly 75% of financial institutions don’t have a confident understanding of...

Sanction Scanner conducted a comprehensive survey, gathering insights from over 400 respondents across more than 50 countries and various industries. The findings shed light...

How AI transforms KYC into a continuous compliance powerhouse

In the dynamic landscape of anti-money laundering (AML) efforts, financial institutions are facing intensified scrutiny to stay a step ahead of increasingly sophisticated criminal tactics and rigorous regulatory demands.

The importance of feedback loops in AML and CFT

The effectiveness of anti-money laundering (AML) and combatting the financing of terrorism (CFT), is not solely reliant on the initial design, but also comes from the adaptability and responsiveness to evolving risks.

How KYC and AML innovations are shaping the future of FinTech

On 14 March 2023, FullCircl led a significant assembly of the UK's premier financial crime and compliance authorities to impart crucial insights and strategies...

Key AML compliance strategies for wealth and asset managers in 2024

In an era where regulatory oversight of the wealth and asset management sector is intensifying globally, the stakes for compliance have never been higher. This sector, pivotal to national economies, plays a crucial role in helping consumers manage their assets and achieve their financial goals. However, its significance also makes it a potential target for misuse by malicious entities aiming to launder money.

Navigating KYB checks: The gateway to business transparency and trust

In today's digital era, where business transactions and partnerships extend beyond borders, the importance of conducting due diligence cannot be overstated.

How the latest AML/CFT proposals will reshape investment advisory

The world of finance is on the brink of a significant transformation, especially for investment advisors in the United States. On February 15th, 2024, a pivotal announcement was made by the Financial Crimes Enforcement Network (FinCEN) that is set to redefine the landscape of anti-money laundering (AML) and counter-financing of terrorism (CFT) compliance.

Sumsub and Chainalysis join forces to revolutionise compliance and security

Sumsub, a global leader in full-cycle verification, has announced a strategic partnership with Chainalysis, the forefront of blockchain data analysis.