Tag: APAC

dLocal and MoneyGram forge strategic partnership to boost payment services in...

dLocal and MoneyGram, two prominent players in the global financial technology sector, have entered into a strategic partnership.

RunSafe Security secures $12m in Series B to bolster global cyber...

RunSafe Security, a CyberTech known for its unique software immunization process, has completed a $12m Series B financing round.

IDEX Pay secures Visa certification

IDEX Biometrics has achieved a significant milestone with its IDEX Pay product by securing certification from Visa.

4 trends financial crime compliance teams should know in APAC

Money laundering continues to pose a significant threat across the Asia Pacific region, with sophisticated tactics challenging financial institutions. As technological advancements emerge, so too do the strategies of those intent on manipulating financial systems. In response, both regulatory bodies and financial institutions are developing innovative approaches to counter these threats.

Morningstar boosts ESG focus with new leader for Sustainalytics in APAC

Morningstar has announced the appointment of Michelle Cameron as the new Commercial Leader for Sustainalytics, their dedicated ESG research and ratings division.

Singapore’s Heymax.ai raises $2.6m, advancing open loop loyalty platforms

Heymax.ai, a pioneering open loop loyalty platform based in Singapore, has recently completed a significant seed funding round, securing US$2.6m.

Advancing KYC technologies to curtail financial crimes in Asia

Money laundering continues to pose a significant challenge in Asia, exacerbated by the diverse economic landscapes, fragmented regulatory frameworks, and intricate financial systems.

Duck Creek Technologies strengthens APAC presence with leadership appointment

Duck Creek Technologies, the intelligent solutions provider shaping the future of property and casualty (P&C) and general insurance, is set to strengthen its APAC (Asia-Pacific) presence through a new leadership appointment.

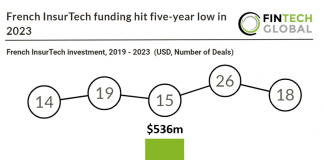

French InsurTech funding hit five-year low in 2023

Key French InsurTech investment stats in 2023:

• French InsurTech companies raised a combined $94m in 2023, a 60% drop from 2022

• French InsurTech deal...

Xcelerate secures over $25m in funding to expand GRC and ESG...

Singapore-headquartered Xcelerate, a prominent governance, risk & compliance (GRC), and environmental, social & governance (ESG) platform, has closed a funding round exceeding $25m.