Tag: Challenger Banks

Asset finance demand steady as renewables rise

Allica Bank, the challenger bank for established businesses, has released new survey findings from more than 570 asset finance brokers, revealing steady demand for...

EV warns of guidance gap in FCA pension plans

EV, a financial services technology provider and leader in stochastic modelling since 1993, has welcomed the Financial Conduct Authority’s (FCA) focus on the changing...

New British bank thisbank targets growth and saver returns

A new entrant has arrived in the UK banking market, thisbank, a newly launched British bank, as it sets out its ambition to scale investor growth while offering competitive savings rates to customers.

FCA enforcement shows AML gaps cost firms millions

The Financial Conduct Authority (FCA) has put anti-money laundering (AML) failures firmly in its sights as part of its five-year strategy plan for 2025–2030....

Visa and Pismo back Dosh’s digital banking push in New Zealand

Dosh, New Zealand’s first locally owned digital wallet and a future contender in the banking sector, has announced a major collaboration with Visa and Pismo to drive the next stage of its growth.

FinTech report reveals new wave of scaled winners as profitability surges

The FinTech industry has reached a major inflection point, with a new class of scaled leaders emerging, according to the latest Global Fintech Report...

Firenze teams up with Monument Bank in £160m deal to democratise...

Firenze, a fast-growing FinTech specialising in Lombard lending for wealth managers, has entered into a strategic partnership with Monument Bank, the UK’s first challenger bank dedicated to the mass-affluent segment.

Regulatory pressure intensifies for digital banks amid rising scrutiny

Amid the rapid evolution of banking, digital-first banks like Starling and Metro Bank are facing increased regulatory scrutiny, particularly around AML controls. According to Corlytics,...

Neobanks and AML compliance: Building robust programs in the digital age

Neobanks have reshaped the banking landscape, boasting a customer base jump from 7.7m in 2018 to nearly 20m by the end of 2019 in the UK alone.

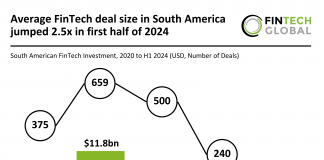

Average FinTech deal size in South America jumped 2.5x in first...

Key South American FinTech investment stats in H1 2024: South American deal activity for H1 2024 dropped by 59% in YoY comparison

Average deal...