Tag: Claims management

Cytora embeds open-source intelligence to reduce claims leakage

Cytora has entered a new partnership with Pilotbird as it looks to strengthen fraud detection and claims accuracy for commercial and property and casualty insurers.

Client mis-categorisation fallout hits firms harder

Financial services firms are facing a sharp rise in complaints linked to client categorisation errors, as regulators and courts send a clear message that...

Nearmap acquires itel to create all-in-one property intelligence platform for insurers

Nearmap has revealed its plans to acquire itel, a move that will bring together two respected names in the property intelligence and insurance claims ecosystem.

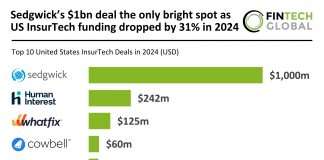

Sedgwick’s $1bn deal the only bright spot as US InsurTech funding...

Key US InsurTech investment stats in 2024: US InsurTech funding dropped by 31% YoY

California continued to dominate the US InsurTech space after it...

California cemented its place as the hub for InsurTech in US...

Key United States InsurTech investment stats for 2024: US InsurTech deal activity dropped by 42% YoY

Californian companies secured over 25% of all US...

US InsurTech funding doubled in Q3 YoY as investors back fewer...

Key United States InsurTech investment stats in Q3 2024: United States InsurTech funding doubled in Q3 YoY

Deal activity halved in Q3 as investors...

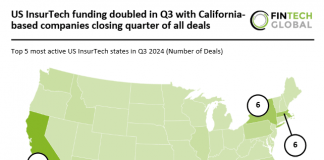

US InsurTech funding doubled in Q3 with California-based companies closing quarter...

Key US InsurTech investment stats in Q3 2024: US InsurTech funding doubled in Q3 YoY

California continues to dominate the US InsurTech space after...

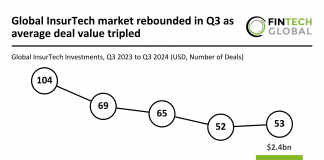

Global InsurTech market rebounded in Q3 as average deal value tripled

Key InsurTech investment stats in Q3 2024: Global InsurTech market rebounded in Q3 as funding increased by 55% YoY

Average deal value tripled in...

Osigu’s $25m Series B to help revolutionise healthcare payments in Latin...

Osigu, a trailblazer in AI-powered healthcare revenue cycle and claims management, has successfully closed the first phase of its $25m Series B funding round.

Sedgwick strengthens global capabilities with strategic investment from Altas Partners

Sedgwick, a global leader in claims management, loss adjusting, and technology-driven solutions, has formed a strategic partnership with Altas Partners, a prominent North American private equity firm.