Tag: crypto assets

Financial crime risk assessments as a board-level tool

Not long ago, financial crime risk assessments were often approached as a box-ticking exercise. Many firms treated them as annual paperwork designed to satisfy...

Financial crime risk assessments: from formality to strategy

Financial crime risk assessments used to be treated as box-ticking exercises — annual documents produced to keep regulators satisfied, then filed away until the...

EBA: 70% flag high AML risk in FinTech in 2025

The European Banking Authority (EBA) has raised concerns over growing money laundering and terrorist financing (ML/TF) risks across the EU’s financial sector, fuelled by...

Understanding the enhanced reporting requirements of CRS in 2026

Since its launch in 2014, the Common Reporting Standard (CRS) has been a pivotal framework for the automatic exchange of financial account information globally, established by the Organisation for Economic Co-operation and Development (OECD).

FCA discussion paper unveils proposed updates to transaction reporting regime

On 15th November 2024, the FCA published a discussion paper that has significant implications for transaction reporting in the UK. According to MAP FinTech,...

Five major hurdles financial institutions face in client onboarding

A survey conducted by Muinmos has shed light on the significant hurdles financial institutions face during client onboarding.

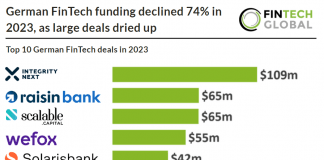

German FinTech funding declined 74% in 2023, as large deals dried...

Key German FinTech investment stats in 2023:

• German FinTech investment totalled at $911m in 2023, a 74% drop YoY

• German FinTech deal activity totalled...

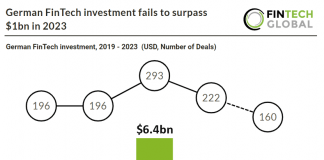

German FinTech investment fails to surpass $1bn in 2023

Key German FinTech investment stats in 2023:

• German FinTech investment totalled at $911m in 2023, a 74% drop YoY

• German FinTech deal activity totalled...

Navigating through MiCA: Unpacking the EU’s new crypto-asset regulations

The Markets in Crypto-Assets Regulation (MiCA) is setting a precedent, crafting a well-structured framework for regulating crypto-assets throughout the European Union (EU) which are not yet encased by current financial services legislations.

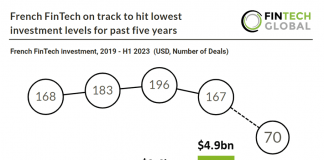

French FinTech on track to hit lowest investment levels for past...

French FinTech investment stats in H1 2023:

• French FinTech companies raised a combined $521m in H1 2023, an 84% drop YoY

• French FinTech companies...