Tag: EU

EU’s battle against money laundering strengthens with AMLA agreement

The European Parliament and Council have reached an agreement on the establishment of an Anti-Money Laundering Authority (AMLA).

EFRAG and GRI forge ahead with MoU for enhanced sustainability reporting

The EFRAG and the GRI, a leading international organisation in sustainability reporting, have recently fortified their partnership.

Navigating KYC and AML in 2023: Trends and challenges in the...

2023 has brought forward unique challenges and trends in the KYC (Know Your Customer) and AML (Anti-Money Laundering) landscape, as revealed in a survey...

CDP and EFRAG link to set new standards in EU sustainability...

CDP and the EFRAG have embarked on a new agreement to enhance the alignment of CDP's disclosure system with the EU's ESRS.

Preparing for the EMIR REFIT Transition

As we approach the deadlines for the new EMIR reporting changes in the EU and the UK, set for April 29, 2024, and September 30, 2024, respectively, it is paramount for stakeholders to grasp the complexities of the upcoming requirements.

TrueLayer breaks ground as first open banking option on Stripe in...

TrueLayer, the foremost player in Europe’s open banking payments scene, today made headlines by becoming the inaugural European open banking payment solution to be featured on Stripe’s Payment Element.

Overcoming challenges in the new EMIR REFIT reporting requirements

As deadlines for implementing EMIR reporting changes near for the EU (set for April 29, 2024) and the UK (scheduled for September 30, 2024), grasping the nuances of these revised requirements becomes paramount.

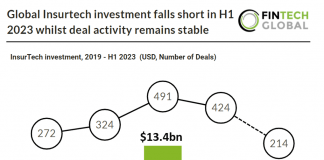

Global Insurtech investment falls short in H1 2023 whilst deal activity...

Key Global InsurTech investment stats in H1 2023:

• InsurTechs have raised a combined $34.8 billion, globally from 2019 – H1 2023

• Global InsurTech deal...

Plum teams up with BlackRock to unveil ‘Plum Interest’ in UK...

Plum, the leading smart money app, has rolled out a groundbreaking product named ‘Plum Interest’ that promises to revolutionise how users in the UK...

Navigating third-party risk management: An EU & UK perspective

With the traditional business landscape being pulled apart due to the ever-hastening digitalisation of our world, traditional brick-and-mortar business has become outdated. We now operate in a world thriving on third party relationships, but that extra complexity comes with extra risk.