Tag: financial institutions

Comviva and Gnosys partner to advance digital banking across Asia-Pacific region

Comviva has partnered with Gnosys Skill Bridge in a bid to advance digital banking and payment services in India and the Asia Pacific.

Payments leader Finzly raises $10m in a TZP Growth Equity-backed round

Finzly, a cutting-edge payments infrastructure provider for financial institutions, proudly reported the successful completion of its Series A funding round.

Target Group leverages Protecht’s expertise for holistic risk view

Protecht, a global leader in risk and resilience software, has announced its partnership with Target Group. Protecht, known for its superior Enterprise Risk Management (ERM)...

Revolutionary fraud defense: DataVisor unveils its AI co-pilot solution

DataVisor, renowned as the globe's top AI-driven fraud and risk platform, has stepped into the spotlight once again. In a bid to dramatically boost the...

Enterprise tech giant NCR forges partnership with Clip Money

NCR Corporation, a renowned enterprise technology provider, has announced its strategic investment in Clip Money Inc., a trailblazing firm in the business cash deposit domain.

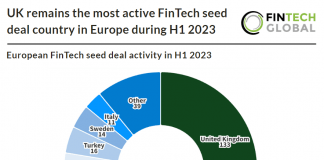

UK remains the most active FinTech seed deal country in Europe...

Key European FinTech seed investment stats in H1 2023:

• European FinTech seed deal activity is on track to reach 714 deals in 2023, a...

Surecomp and Pelican AI team up to redefine digital trade risk...

Surecomp, a leading player in the trade finance industry, and Pelican AI, a global provider of AI-driven financial crime and compliance solutions, have announced a strategic partnership. The collaboration aims to usher in a new era in digital trade-based risk management.

Choosing the Right AML Software for Your Business: Key Factors and...

Banks, money services businesses, and other financial institutions are bound by U.S. laws to establish anti-money laundering (AML) procedures. Implementing identity verification, regulatory reporting, and risk management can be intricate, lengthy, and costly.

Unravelling the importance of CIP rules for financial institutions

Financial institutions often fall prey to money launderers who exploit these platforms to funnel, mask, transfer, and cleanse ill-gotten gains. This doesn’t just endanger the specific institution but imperils the credibility of the entire financial system.

Global financial threads: The risks and rewards of correspondent banking

Correspondent banking plays a pivotal role in shaping the global financial landscape. Serving as the backbone of international trade, especially for budding and developing...