Tag: N26

Don’t miss the 11 biggest FinTech deals of 2021

Billions of dollars are invested into FinTech companies each year and 2021 was no different. The sector has seen eye watering amounts of capital deployed into the sector, but what companies made out with the most?

N26 closes largest financing of a European digital bank

German digital bank N26 has reached a $9bn valuation, following the close of a $900m investment round, which it claims to be the largest financing of a digital bank in Europe.

N26 pays €4.5m fine for delays to reporting suspicious activity

Germany digital bank N26 has been issued a €4.5m fine from the Federal Financial Supervisory Authority (BaFin) for its delay in submitting reports around AML.

N26 under BaFin scanner for inadequate measures against money laundering

German financial regulator BaFin has ordered challenger bank N26 Bank to implement appropriate controls and safeguards to prevent money laundering and terrorist financing.

N26 enters the insurance space with launch of new product

German challenger bank N26 has entered the insurance space, with customers now able to buy cover, manage plans and initiate claims.

Klarna is launching consumer bank accounts in Germany

Swedish FinTech unicorn Klarna has launched consumer bank accounts in Germany.

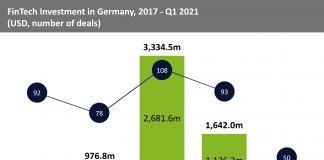

German FinTech investment on track to recover after 2020 slump

FinTech deal activity nearly tripled in the first quarter compared to Q1 2020 as companies completed 50 funding rounds

Revolut broke even in November but didn’t make a big deal...

Revolut's revenues dropped by 40% at the start of the coronavirus crisis, but now the neobank has revealed that it is 50% ahead of its pre-pandemic levels and even broke even in November.

Lunar raises €40m Series C round as it plans to take...

Danish challenger bank Lunar has raised a €40m Series C round and is planning to go into the buy now, pay later market.

Will Monzo’s new Premium card be enough to save the neobank?

With an attractive insurance package and interest rates, Monzo's new Premium metal card looks like a solid offering. But will it be enough to make up for its massive losses?