Tag: operational efficiency

Navigating the future of asset management: Digitalizing investor onboarding

The landscape of Asset Management firms has long been fraught with challenges, particularly in the arena of investor onboarding and lifecycle management. This process, characterized by an intricate Know Your Customer (KYC) procedure and the handling of vast data volumes, has historically grappled with the limitations of outdated technological infrastructures.

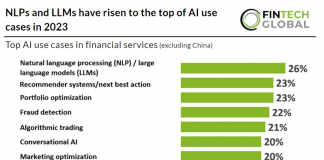

NLPs and LLMs have risen to the top of AI use...

In a recent survey conducted by Nvidia it is clear the adoption of AI in the financial services sector is rapidly gaining momentum. From...

Diesta, the InsurTech startup, raises $1.9m to streamline insurance payments

Diesta, the London-based InsurTech startup, has successfully closed a seed funding round, raising $1.9m.

Streamlining group benefits communication: Key innovations & strategies

In the rapidly evolving world of group benefits, companies are doubling down on strategies that enhance their interactions and boost operational efficiency. Especially during the peak seasons, these firms are navigating a maze of challenges, with effective communication emerging as a paramount concern.

The regulatory evolution: GIPS Standards gain prominence in private markets

The private markets have witnessed a substantial increase in managed assets over the last decade, attracting the attention of U.S. regulators aiming to enhance transparency through expanded regulation. With these regulatory developments, it's time to re-evaluate the Global Investment Performance Standards (GIPS), which have evolved from being the gold standard for investment performance presentation to a tool that assists advisers in meeting new regulations.

Navigating ESG regulations: A roadmap for financial institutions

Today's financial landscape is rapidly evolving, with Environmental, Social, and Governance (ESG) factors gaining a pivotal role. As the sustainability and responsible investing frontiers broaden, financial institutions (FIs) find themselves in a crucial position to respond proactively to the escalating challenges posed by ESG.

Boosting Customer Experience: The Power of Enterprise Forms in Today’s Digital...

As the digital age continues to evolve, the significance of forms in collecting personal, first-party data and streamlining processes to enhance customer interaction cannot be overemphasised. Unfortunately, traditional web forms often fail to meet the complex needs of enterprise organisations. The solution? A shift towards advanced enterprise forms technology.

Navigating the ESG landscape: Are financial institutions ready?

The world of Environmental, Social, and Governance (ESG) compliance is becoming increasingly intricate and crucial for financial institutions (FIs). Amid this rapidly changing landscape, where sustainability and responsible investing have taken centre stage, FIs find themselves under mounting pressure to navigate these challenges effectively.

Unmasking the power of rapid data exchange in delegated authority of...

The insurance sector has witnessed a paradigm shift with the adoption of delegated authority, a concept that propels operational efficiency and streamlining. Amid the complexity of this system, one essential component stands out - the velocity and transparency of data exchange.

Inigo and hyperexponential form partnership to turbocharge insurance pricing

Inigo Insurance, an expeditiously expanding Lloyd’s syndicate specialising in high-risk, high-capacity insurance and reinsurance lines, has announced a partnership with hyperexponential (hx), the creators of the Renew platform. hx is renowned for its platform, which has been widely adopted by several fast-growing specialty (re)insurers and MGAs.