Tag: Quantexa

Quantexa achieves unicorn status following £103.9m Series E raise

Quantexa, data analytics firm, has scored £103.9m in a Series E funding round, lifting its valuation to $1.8bn and becoming a unicorn.

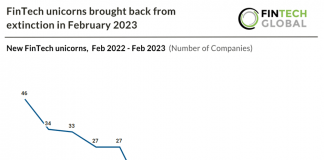

FinTech unicorns brought back from extinction in February 2023

MNT-Halan, an Egyptian digital lender, revitalised the FinTech unicorn population in 2023 after their latest $400m private equity round, led by Chimera Investment. The...

RegTech company Quantexa acquires Ireland’s Aylien

Quantexa, a developer of decision intelligence (DI) solutions, has acquired Ireland-based Aylien, which builds NLP and advanced AI tools for data to collect, analyse and understand unstructured data.

Why holistic views of integrity risks is vital in supply chains

Holistic views of integrity risks within the supply chain allows teams to reduce the potential for illicit activity to slip through the net, according to Quantexa.

What is the insurance single customer view?

According to data and analytics software company Quantexa, insurers are taking on a single customer view strategy, however there are different interpretations of what this means.

How data can ensure growth during a turbulent market

With the world in the midst of a very turbulent market, Quantexa has offered advice as to how companies can achieve growth and manage risk during this time. The secret is using all available information and data to anticipate and respond to new risks and emerging opportunities.

RegTech Quantexa opens office in Malaga Tech Park

Quantexa, a developer of contextual decision intelligence (DI) solutions, has opened its new technology and analytics hub in Malaga Tech Park, Spain.

How technology is helping the UK government combat fraud

Combating fraud continues to be a major challenge in the UK. Last year, over £1.3bn was stolen by fraudsters in the UK in 2021, according to Feedzai. However, technology is still making a change.

New and emerging risks: a bumpy road ahead for insurance

Innovation in the insurance industry is not just important, it is essential. A more dynamic market has meant insurers are venturing into non-traditional sectors as well as looking for more advanced ways of serving existing markets. The industry must ramp up its innovation efforts if it is to tackle increasingly threatening risks, such as climate events and cyber-attacks.

The need to make data ethics a priority in the fight...

For as long as insurance has been around, criminals have been committing insurance fraud. With increasingly sophisticated fraud activity, insurers are turning to artificial intelligence and machine learning. However, they must develop standards to prevent unfair discrimination and remove any bias in these technologies.