Tag: Raisin

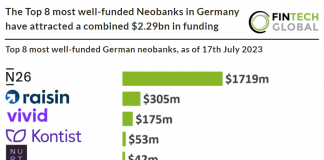

The Top 8 most well-funded Neobanks in Germany have attracted a...

German neobanks have grown in popularity within the country and has the second largest neobanking transaction value which reached $50 billion in 2021. Despite...

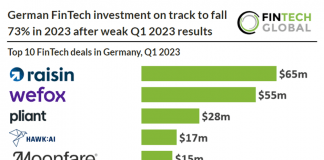

German FinTech investment on track to fall 73% in 2023 after...

German FinTech investment stats in Q1 2023:

• German companies raised a combined $293m in Q1 2023, a 60% drop from the same period last...

Raisin nets €60m in Goldman Sachs-backed Series E

Raisin, a global savings and investment specialist, has raised €60m in a Series E funding round backed by Goldman Sachs.

German FinTechs merge to create business-to-consumer savings juggernaut

German FinTechs Raisin and Deposit Solutions have merged in a move that will see the creation of Raising DS – a new market-leading B2C savings company.

FinTech Raisin launches Savings as a Service software for US banks...

Having already rolled out its deposits services across Europe, Goldman Sachs and PayPal-backed FinTech Raisin is now giving US banks and credit unions the opportunity to tap into the service.

Raisin provides a private bank with its deposits solution

Open banking platform Raisin is supplying its deposits platform to Germany Bankhaus Hauck & Aufh?user as part of a new deal.

Raisin acquires Choice Financial to bring US banks new deposit solutions

Open banking platform Raisin has acquired Choice Financial Solutions so it can offer US banks and credit unions the ability to create flexible deposits.

Raisin to deploy its deposit products through Yolt

Raisin has deployed its deposit products through the money management app Yolt through a new partnership.

Scalable Capital offers new fixed-term deposits opportunities through Raisin deal

Digital wealth management company Scalable Capital will expand its product range with fixed-term deposits through new collaboration with Raisin.

Is the rapid growth of Germany’s FinTech sector a sign of...

Germany’s FinTech sector has been steadily growing over the past six years, but investment levels have sky-rocketed in 2019, is this the foreshadowing of the power shift from the UK to Germany post Brexit?