Tag: regulatory challenges.

US, UK and France continued to take lion’s share of global...

Key Global InsurTech investment stats in 2024: Global InsurTech deal activity dropped by 47% YoY

US, UK and France continued to dominate global InsurTech...

The crucial role of explainable AI in financial regulations

Financial institutions are grappling with increasingly sophisticated financial crimes, ranging from money laundering to sanctions evasion.

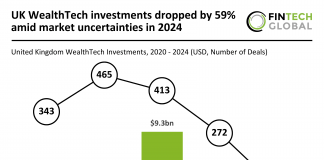

UK WealthTech investments dropped by 59% amid market uncertainties in 2024

Key UK WealthTech investment stats in 2024: UK WealthTech investments dropped by 59% in 2024 YoY

Abound, a leading credit technology company, secured the...

How BIBA’s advocacy shapes the UK’s insurance landscape

In the recently unveiled BIBA 2025 Manifesto, FullCircl, a prominent voice in the insurance broking sector, underscores the critical role of insurance in bolstering...

How artificial intelligence is transforming AML practices in FinTech

Financial crime has evolved significantly in our increasingly digital world. Money laundering, terrorist financing, and fraud are more sophisticated than ever, posing serious challenges for financial institutions mandated to stay compliant.

How to harness LinkedIn’s full potential for financial services

LinkedIn has become an essential tool for professionals, especially within the financial services industry. According to Theta Lake, with its impressive networking capabilities, LinkedIn...

PIMFA Advocates SDR Rules Delay

The trade association for wealth management, investment services, and financial advice, PIMFA, has urged the Financial Conduct Authority (FCA) to postpone the introduction of Sustainability Disclosure Requirements (SDR) for portfolio management by a year.

The real cost of building KYC systems in-house versus outsourcing

Developing KYC solutions from scratch presents significant initial hurdles, particularly during the scoping phase.

Revolutionising finance: The rise of embedded finance in 2024

As we delve deeper into 2024, the embedded finance phenomenon continues to reshape the financial services sector. A Capgemini survey from 2021 revealed that over 70% of banking executives view embedded finance as a catalyst for innovation, customer base expansion, and cost reduction, predicting its market value to soar to $588bn by 2030 from $22bn in 2020. This trend positions embedded finance as a key strategic channel for banks.

Cambio secures $3m in seed funding to revolutionise debt negotiation with...

Cambio, which is introducing AI bots designed to negotiate debt and communicate with bank customers, has raised $3m for its seed round. The seed round...