The latest news stories, insights, data and expert analysis on all things RegTech from FinTech Global, the world’s leading provider of FinTech information services and B2B media products.

Tag: Risk management

The essential guide to Know Your Business verification processes

KYB, or Know Your Business, is an essential process for businesses engaging with other companies. It serves as the backbone of safe, compliant third-party relationships, enabling firms to assess and manage potential risks before formalizing business agreements.

Revolutionizing risk management: The transformative impact of federated learning

The global financial landscape is increasingly plagued by the complexities of financial crime compliance. As the severity of global money laundering grows, major financial...

Enhancing global security through effective AML and CFT strategies

The IMF has emphasized the critical role of AML and CFT policies in maintaining the stability of the international financial system and economies worldwide.

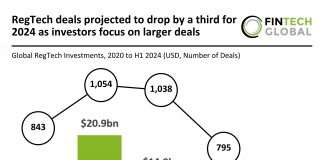

RegTech deals projected to drop by a third for 2024 as...

Key Global RegTech investment stats in H1 2024: Global RegTech deal numbers projected to drop by a third compared to the 795 deals completed...

The strategic advantage of unified loss control and policy admin systems

In the competitive world of insurance, the profitability of underwriting is closely linked to informed decision-making that efficiently mitigates risks and optimizes loss ratios. Traditional barriers, primarily the compartmentalisation of data, often hinder this objective.

Securing FinTech compliance: The high cost of ignoring electronic communication rules

The recent $390m fine imposed by the SEC on 26 interdealer brokers and advisors highlights a growing concern within the financial sector: the imperative of proper electronic communications management.

Navigating the maze of compliance search in unified communications

Compliance search and discovery across unified communications platforms present substantial challenges. Those tasked with governance responsibilities, such as audits, investigations, and e-discovery, find themselves grappling with the complexities and sheer volume of modern communications.

How AI-powered automation is transforming regulatory lifecycle management

The realm of regulatory compliance is intricate and dynamic, presenting a continuous challenge that is crucial to the operational strategies of financial institutions.

Harnessing AI and data integrity in fighting financial crime

In today's rapidly evolving digital world, the fight against financial crime networks demands both vigilance and innovation.

AI compliance leader Datricks lands $15m funding from SAP and Team8

Datricks, a financial integrity and compliance software startup, has successfully secured $15m in its latest Series A funding round.