Tag: Robo-advisors

Navigating risks in wealth management: A balanced approach

Wealth management is not just about augmenting capital—it’s equally about safeguarding it. In an era where market fluctuations can be swift and severe, the essence of wealth management lies in its dual approach: growth and security. This balance is maintained through meticulous risk management strategies, which play a pivotal role in helping clients achieve their financial goals while minimizing potential risks.

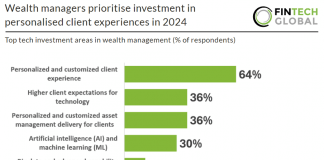

Wealth managers prioritise investment in personalised client experiences in 2024

In a recent WealthTech survey conducted in January 2024 by Orion, 542 Principal, Portfolio Managers, Chief Operating Officers, Operations Staff, Compliance/Risk Managers and Others...

WealthTech’s promising Q1 2024: Valuations soar as strategic buyers lead

WealthTech's promising Q1 2024: Valuations soar as strategic buyers lead

WealthTech’s new horizon: Catering to the Millennial and Gen Z investment...

The financial domain is on the brink of a transformative era, driven by the digital-first mindset of Millennials and Gen Z. These generations are not just reshaping the investment landscape with their tech-savviness and social awareness, but they're also the catalysts for the dynamic evolution of WealthTech. This sector is now keenly focused on tailoring its offerings to meet the unique preferences of these emergent financial powerhouses.

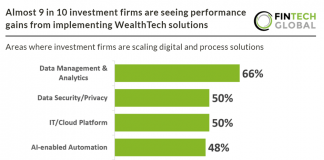

Almost 9 in 10 investment firms are seeing performance gains from...

ThoughtLab conducted a comprehensive survey in September / October 2023 of 250 investment providers. These include broker-dealer/wire-houses, private banks, online trading platforms, wealth management...

Is the era of robo-advisors over?

Go back a few years and robo-advisors were the talk of wealth management. Panel discussions were often dominated by the prospects of robo-advisory, but nowadays they are rarely mentioned. What happened to the robo-advisor hype?

How Nucoro is helping banks digitise to take on FinTechs

Financial institutions are not as nimble as FinTechs, but that doesn’t mean they cannot offer their own digital services. The answer is integrating technology stacks designed by specialised companies, that enables the financial institution to easily implement a range of digital investing propositions.

Why Robo-advisers are still in the Stone Age

Robo-advisers have been a major point of discussion in recent years. However, Embark Group CEO Phil Smith believes we’re not even out of the “stone age” of them yet.

Kasisto nets $15m in Series B extension led by Rho Capital

Kasisto, a digital experience platform for the financial services space, has netted $15m in its Series B extension round.

How can robo-advisors stand out from the pack?

In a crowded robo-advisor marketplace, having different models or pricing is not a differentiator, it’s how you interact with customers that will aid success, according to SenaHill partner Kyle Zasky.