Tag: solarisBank

German FinTech deal activity declines 25% YoY in Q3, but fares...

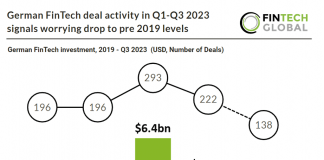

Key German FinTech investment stats in Q1-Q3 2023

• German FinTech companies raised a combined $634m from in the first nine months of 2023, a...

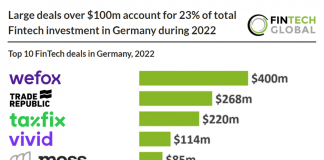

Large deals over $100m account for 23% of total FinTech investment...

German FinTech investment stats in 2022:

• German FinTech investment reached $4.3bn in 2022, a 47% drop from 2021

• FinTech deal activity in Germany dropped...

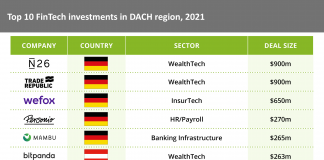

German companies account for seven of the top ten FinTech investments...

N26, an online bank, saw the largest investment in the DACH region during 2021 with a $900m funding round led by Third Point Ventures...

Neobank Vivid Money bags $17.6m in Series A

Vivid Money has raised $17.6m in a Series A round led by Ribbit Capital and aimed at boosting the challenger bank's growth.

These 36 FinTech deals from the last week show that the...

While the downfall of Wirecard may the big story in the FinTech industry, it would be a mistake to not take a closer look at the investment rounds announced in the sector over the past seven days.

Vivid Money sets out to “conquer the European banking market” on...

Vivid Money, the mobile banking platform, has officially launched in Germany with ambitions to grow across the continent.

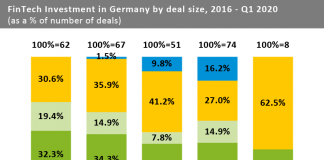

German FinTech investment declined in Q1 due to lack of large...

FinTech funding in Germany declined nearly 90% in the first quarter of 2020 as no deals over $50m were completed, compared to the first...

Banking FinTech solarisBank push into cryptocurrencies with the launch of subsidiary...

German tech company solarisBank has unveiled its new subsidiary solaris Digital Assets, to strengthen its grip on the digital assets market.

solarisBank, CrossLend partner to automate loan securitisation

CrossLend and solarisBank have formed a strategic partnership to offer digital and fully automated loan securitisation.

solarisBank launches Blockchain Factory to become leader in crypto, blockchain market

Germany-based solarisBank has launched Blockchain Factory, in a bid to the lead banking support for the blockchain and cryptocurrency industry.