Tag: Trade Republic

US firms continue to dominate the global FinTech market securing six...

Key global FinTech investment stats in Q4 2025: Global FinTech investments increased by 53% YoY

US firms secured six of the top 10 deals...

Digital bank Trade Republic valued at €12.5bn in €1.2bn deal

Trade Republic has strengthened its shareholder base as part of a major secondary transaction that values the business at €12.5bn, underscoring sustained investor confidence...

FinTech firm Sibill raises €12m to automate accounting

Italian FinTech company Sibill, which provides a financial management platform for small and medium-sized businesses (SMEs), has secured €12m in Series A funding.

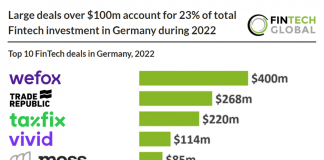

Large deals over $100m account for 23% of total FinTech investment...

German FinTech investment stats in 2022:

• German FinTech investment reached $4.3bn in 2022, a 47% drop from 2021

• FinTech deal activity in Germany dropped...

Neobroker unicorn Trade Republic extends Series C by €250m

German neobroker Trade Republic has closed a €250m Series C extension round, which puts its valuation at €5bn (up from €4.4bn).

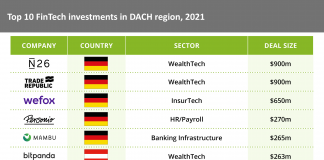

German companies account for seven of the top ten FinTech investments...

N26, an online bank, saw the largest investment in the DACH region during 2021 with a $900m funding round led by Third Point Ventures...

UK companies account for half of the top ten new European...

Europe accounted for 15% of new FinTech unicorns in 2021 with 22 representatives headquartered on the continent. UK companies lead the way with 13...

Don’t miss the 11 biggest FinTech deals of 2021

Billions of dollars are invested into FinTech companies each year and 2021 was no different. The sector has seen eye watering amounts of capital deployed into the sector, but what companies made out with the most?

FinTech companies make up a third of all new unicorns in...

There were 151 FinTech companies among the 457 new unicorns across all industries this year

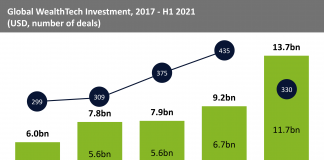

Global WealthTech funding sets a new record in 2021 after $13.6bn...

H1 2021 surpasses entirety of 2020 funding by $4.4bn, boosted by large deals over $50m