GAN Integrity, a provider of compliance management software, has raised $9m in a Series A round led by Edison Partners.

The round also featured participation from NorthCap, Chicago Ventures, MissionOG, and Cultivation Capital.

GAN’s aim is to reduce corporate risk and eliminate thousands of hours of paperwork. The company claims its software can transform the way compliance programs operate by bringing critical compliance applications and data together into a single, fully integrated cloud based platform.

With offices in New York, Copenhagen, Denmark, the company’s compliance management software offers applications including training, policy management, third-party due diligence, whistleblower hotline, case management, and reporting.

Compliance has become a key priority on corporate agendas, especially with top management and board members personally exposed by recent scandals. Compliance pressure is not coming just from regulators, but also from business partners and investors protecting their own risks.

Michael Kopelman, general partner at Edison, said: “GAN has exhibited rapid growth on the heels of its comprehensive, yet elegantly simple, product offering. The company’s roster of blue-chip clients, experienced management team, along with positive market tailwinds in the compliance space, makes GAN an ideal fit for our Fund.”

Edison targets businesses, with between $5m and $20m in revenue, in financial, healthcare, enterprise and marketing technology sectors.

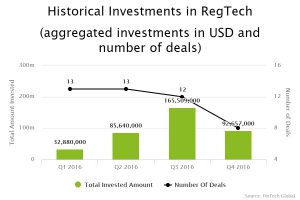

Last year, more than $899m was invested across the global RegTech sector according to data by FinTech Global. Out of that total, more than a third was invested in companies providing compliance solutions, reaching more-than $476.6 in investment.

Copyright © 2017 FinTech Global