Decentralised protocol for financial derivatives dYdX has closed a seed investment led by Andreessen Horowitz and Polychain Capital.

Other participants to the investment included Kindred Ventures, Abstract Ventures, and a group of seed and angel investors.

Founded in 2017, the company is a decentralized exchange for derivatives on cryptoassets, using smart contracts for an open protocol. Through the solution, users can take and option or short position, without having to trust funds into a centralised exchange.

The company plans to launch on the main Ethereum network in mid-2018.

This capital will be used to build the company’s engineer, designer, and business operator teams. Funds will also be used for security audits to ensure the platforms safety, and to develop a regulation-compliant approach to derivatives exchange.

Earlier in the year, Andreessen Horowitz led the $65m Series C funding round into the alternative asset investment marketplace, Cadre. The company sought the investment to help drive its expansion across the US and internationally.

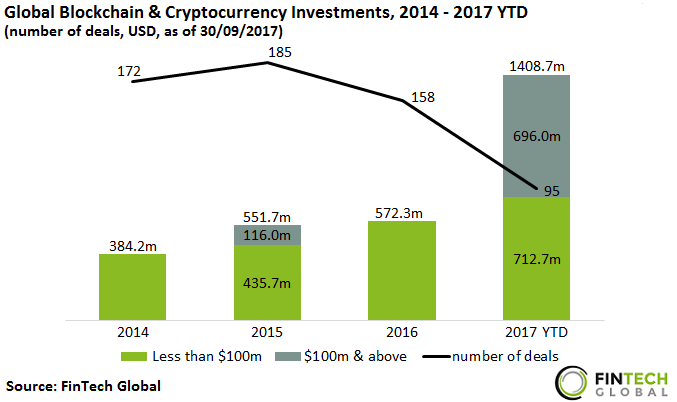

Blockchain and cryptocurrency companies have seen a huge year for investments, with the sector seeing almost triple the capital that was deployed last year. This increased level of funding, has been driven by several deals above $100m.

Copyright © 2017 FinTech Global

Copyright © 2017 FinTech Global