Insurity, which designs policy administration, claims, billing, and data analytics software, has been acquired by GI Partners.

Following the acquisition, GI Partners is hoping to accelerate the growth of Insurity by expanding its policy administration and related software solutions.

Prior to the acquisition, Insurity’s investors included TA Associates, General Atlantic, and Genstar Capital.

Headquartered in Connecticut, Insurity supplies over 200 insurance clients with software for policy administration, claims, billing, and data analytics. Its cloud-based technology can be easily integrated with existing systems and can evolve the insurance experience for consumers.

As part of the deal, GI Partners director Sendil Rajendran, principal Sean Turner, and vice president John Wang, will join the Insurity board of directors.

Last year, payment and software developer group Togetherwork from Aquiline Capital Partners for an undisclosed amount. The company provides businesses SaaS solutions to support their administration and payment processes.

There has been a lot of activity in the InsurTech space over the past couple of months. Last week, online home insurance company Hippo Insurance closed its Series D round on $100m to support its continued growth efforts across the US.

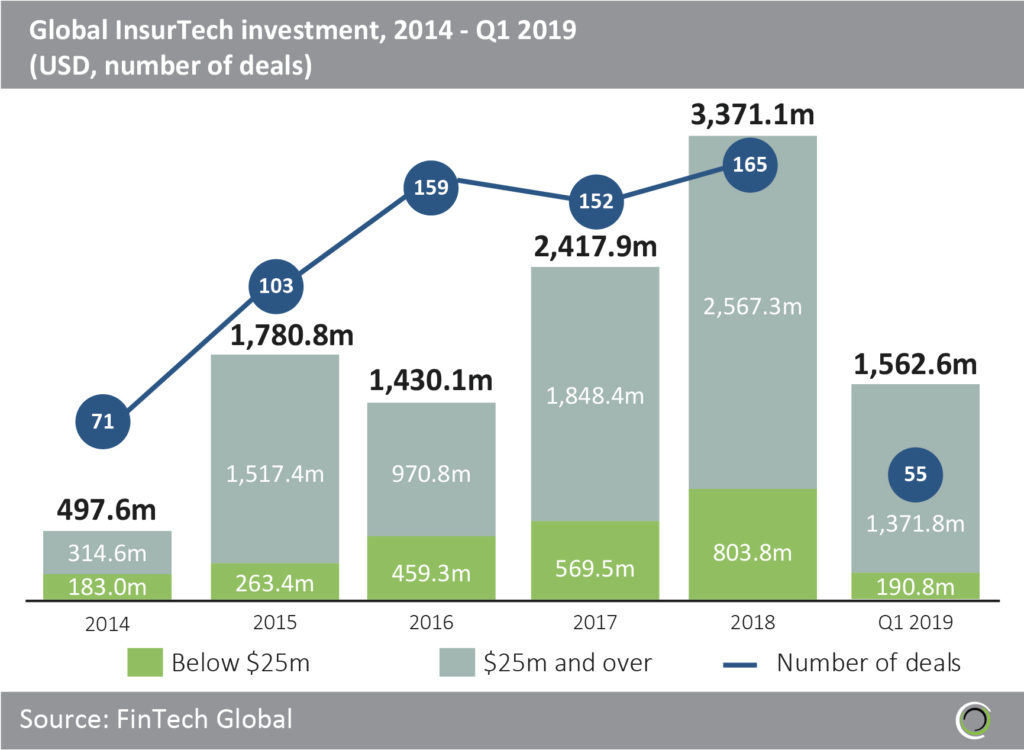

The appetite in InsurTech is shown by the record level of investment capital be deployed into the sector last year. A total of $3.3bn was spread across 165 funding rounds in 2018, nearly $1bn more than the previous year.

Excitement looks to be continuing, with the first quarter of 2019 already seeing $1.5bn invested.

Copyright © 2019 FinTech Global