Seed accelerator Y Combinator has just announced its latest batch of startups. And there are some FinTech ventures that piqued our interest.

The accelerator has previously invested in companies like Airbnb, Dropbox and Reddit, giving it a reputation of being ahead of the curve of the trends.

So we looked into the latest batch of 197 companies to find 13 FinTech startups you may want to pay attention to.

The first out the door is Sable. This is a FinTech startup aiming to make it easier for foreigners to set up bank accounts in the US. The international bank’s founding team launched 14 banking products in the past. The company is currently managing credit cards and checking accounts. The company is targeting 4.5 million creditworthy internationals in the US with its offerings aiming to make the process of signing up so smooth it can be done within minutes.

Marble Technologies is a startup providing cashier-free checkout kiosks for restaurants. By using the tablet-based solution, the founders of Marble Technologies believe they can boost customer spending by 16 per cent.

Ever Loved is enabling grieving people to afford burying their loved ones through the startup’s crowdfunding portal.

ScholarMe is a college financing app empowering students to pay for their education by simplifying the process. ScholarMe also aims to put an end to the need of having to search for and fill in forms to find scholarships, FAFSAs, income-share agreements and loans.

Gaiascope is an electricity trading startup. The company aims to tap into the $15bn market by using its algorithms to reduce volatility and offer more predictable prices through its quant fund.

UpEquity has the goal to tap into the $20bn property market by enabling home buyers to put down all-cash offers. The PropTech company offers a mortgage solution it claims to enable customers to bargain better than traditional services would.

Blair is the second education funding startup on this list. It helps people pay for their college education through income-share agreements. Essentially, once students graduate and get a job, they pay Blair back through a percentage of their future salaries.

Another company tapping into the education economy is GradJoy that refers to itself as a roboadviser for student debt. This FinTech startup has created a platform to empower new grads strategize their student loan payments in an improved way. The platform links loans and financial information to create personalized repayment plans for new borrowers.

Soteris is an InsurTech startup. By leveraging its machine learning software, the company creates better insurance pricing models for insurance companies. Soteris claims using artificial intelligence means insurers can better understand the complicated combinations of factors that drive insurance risk at a highly complex level. It already has two insurers under contract, giving them $500,000 in guaranteed annual revenue.

Mela is an Indian e-commerce platform where customers can join forces to buy and pay for things together in groups via WhatsApp and Facebook. India is reportedly reviewing WhatsApp at the moment to ensure it conforms to local rules before it unleashes the app’s payment services upon the country.

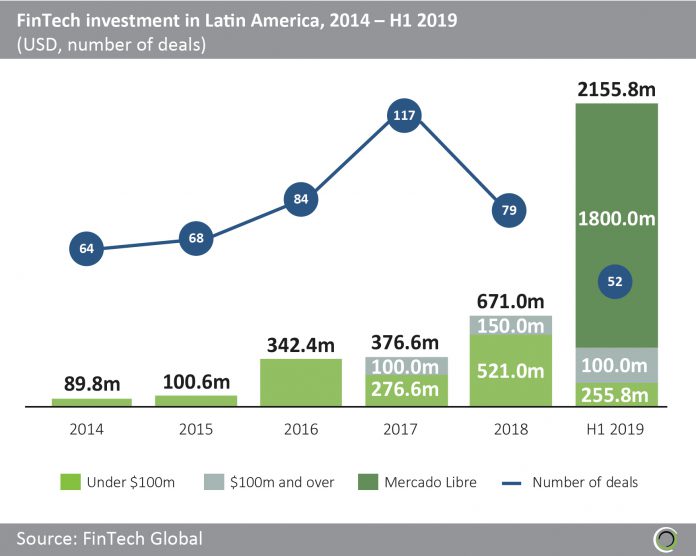

Valiu provides international money transfers in Latin America, beginning in Venezuela. It is not the only company to recognize the opportunity in South America. FinTech Global’s research recently revealed that investment in continent had jumped from $89.8m in 2014 to $2.15bn in the first six months of 2019 alone.

Another startup leveraging the opportunity of Latin America is Tranqui Finanzas. This new enterprise is a provider of consumer debt consolidation on the continent.

GreenTiger refers to itself as the Robinhood for India, empowering Indians to trade US stocks, commission-free. GreenTiger provides transactional shares, allowing Indian traders to start trading with as little as $13.9.

Copyright © 2019 FinTech Global