The banking industry in Australia is changing. And the founder of 86 400 is at the forefront of this push.

July was an intense month for Robert Bell, founder and CEO of 86 400, the Australian challenger bank named after the number of seconds in a year. In the scope of a few weeks, his enterprise got itself a banking license and tapped Morgan Stanley for a $100m funding round.

However, this seemingly sudden rush did not come out of the blue. “86 400 is the end result of an intensive two-year research period, looking at the digital banking opportunity both in Australia and overseas,†Bell tells FinTech Global. “The time felt right to make a serious move within this space and build a smarter way to bank that helps Australians take control of their money.â€

He is not the only one to think that way. Australia has become a proverbial breeding ground for new challenger banks over the past few years. A slew of new banks are either launching Down Under or expanding into Oz. That includes challenger bank Up and Judo Bank, which recently raised a $270.62m round, as well as Xinja.

This is a break from how the banking sector in Australia has previously been run, with four big banks dominating the sector. “Banking is fundamentally good for people, but all banks haven’t served all customers well all of the time,†Bell says. “The truth is most banks have hardly changed in a hundred years. They provide you with a record of what’s happened in your past, but don’t tell you much about what’s coming up.â€

The most obvious reason for this development is the introduction of the new restricted authorised deposit-taking institutions (ADIs) licence. The licence, granted by the Australian Prudential Regulation Authority (APRA) enabled new organizations, like neobanks, to enter the market and conduct a limited range of activities for two years.

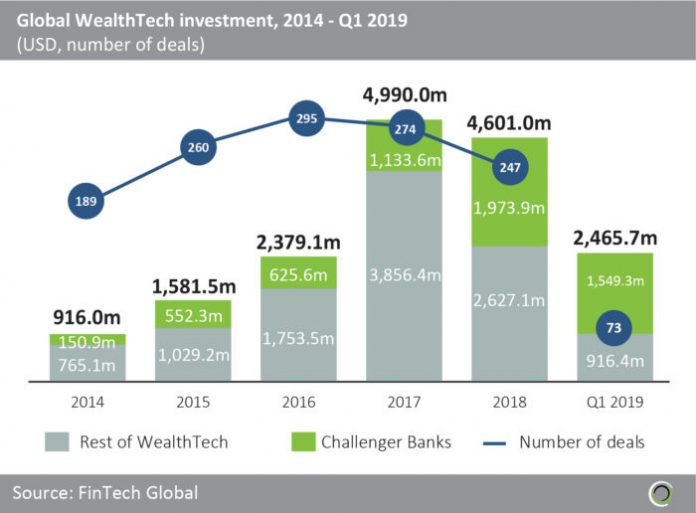

Of course, Australia is not the only place where challenger banks are on the rise. FinTech Global’s own research has revealed that the investment in challenger banks around the world spiked between 2014 and 2018. In that period, the amount of cash injected into the sector grew from $150.9m to $1.97bn. Moreover, $1.54bn was invested in challenger banks in the first quarter of 2019.

Moreover, UK-based challenger banks are predicted to treble their sales within the next 12 months despite Brexit.

It is against this background that Bell and the rest of the team behind 86 400 believe they can bring something new to the mix. “Combining our exceptional banking experience, great product value and a two-minute joining experience, we’ll be able to compete with the big four at a fraction of the cost,†he says. “Our key advantage is our proprietary Customer Experience Engine (CXE), which sits between the ledger and the app. This will help deliver a smarter banking experience for Australians, enabling them to plan forward, as well as look backwards. Up-to-date insights will enable them to take control of their money. For example, nudging customers to make sure they earn bonus interest each month.â€

Yet, launching a disruptive startup is always going to mean tackling plenty of obstacles. “Building a bank presents a lot of challenges, but the biggest challenge we’ve faced was obtaining our banking licence,†Bell explains. “The banking licence process is incredibly thorough – and for very good reason. We had every element of our business stress-tested to confirm that we are as robust, secure and safe as any bricks-and-mortar bank. To have APRA’s approval is a testament to the incredible work of the 86 400 team over the past two years.â€

And he believes this is just the beginning of the Australian challenger bank industry. “Combining increased customer appetite for better banking experiences, a simpler and lower cost structure and the ability to quickly adapt to customers changing behaviours we believe challenger banks can take serious market share in Australia,†Bell concludes. “With a true focus on the customer and being free from legacy systems and processes the time has never been better to change how banking is done.â€

Copyright © 2019 FinTech Global