As the Canadian FinTech scene is going from strength to strength, 12 of its companies have gone on five-day trade mission to Britain as they look to set up shop in the UK.

Companies attending the mission are Clearbanc, Overbond, Koho, Purefacts, Highline, Mindbridge, Mylo, Impak Finance, Katipult, Fispan, Canalyst and Finn AI.

The delegation participants have collectively raised over half a billion dollars in venture capital and are actively looking to expand their operations overseas. During their stay, the businesses will meet industry and government to find support and explore opportunities to invest or set up in the UK.

Graham Stuart, minister for investment at the Department for International Trade, which organised the trade mission, said, “The UK and Canada are natural partners in FinTech, and we are determined to make the UK the easiest and most attractive place for Canadian innovators to open and build their businesses.

“Trade missions like this allow us to show the strength and depth of the UK offer and encourage investment, market entry and partnership between UK and Canadian firms.

“The UK is a global leader in FinTech, welcomes foreign entrants to its market and, through its dedicated trade department, DIT, will continue to reach out to the world’s most exciting entrepreneurs and show them all that the UK has to offer.”

Damir Hot, co-founder and CEO at Canalyst, added, “Since founding, we’ve been singularly focused on building a solid, long-standing business centered around the needs of our clients.

“As we’ve grown to serve many of the world’s most sophisticated money managers, the UK plays an important role in our overall business development strategy. This trade mission provides us with direct, valuable insights on the local business and capital markets landscape that will shape how we build our UK presence.”

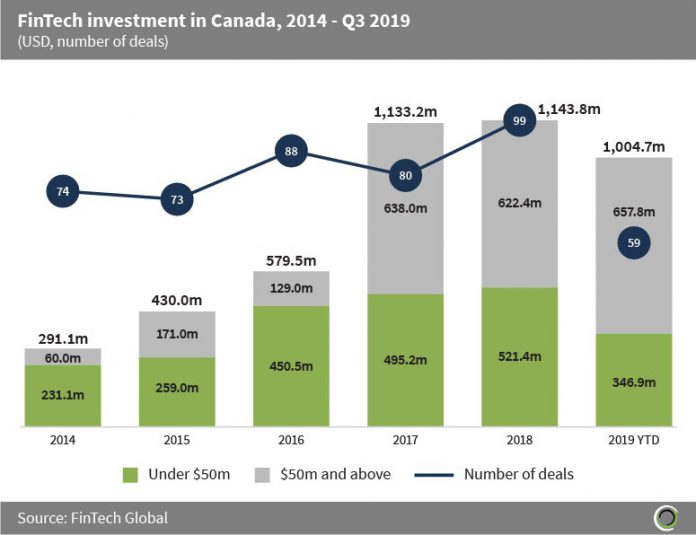

The Canadian FinTech industry has grown a lot since 2014 when the sector attracted $291.1m in investment, according to FinTech Global’s data. That number had grown to $1.14bn in 2018. In 2019 could be another record year, with $1bn having already been invested in the Canadian industry in the first nine months of the year. In total, Canada’s FinTech sector has attracted nearly $4.6bn since 2014.

And more might be coming as the venture capital investor Luge Capital is looking to give Canadian FinTech startups more financial muscles through its new $85m fund.

Copyright © 2019 FinTech Global