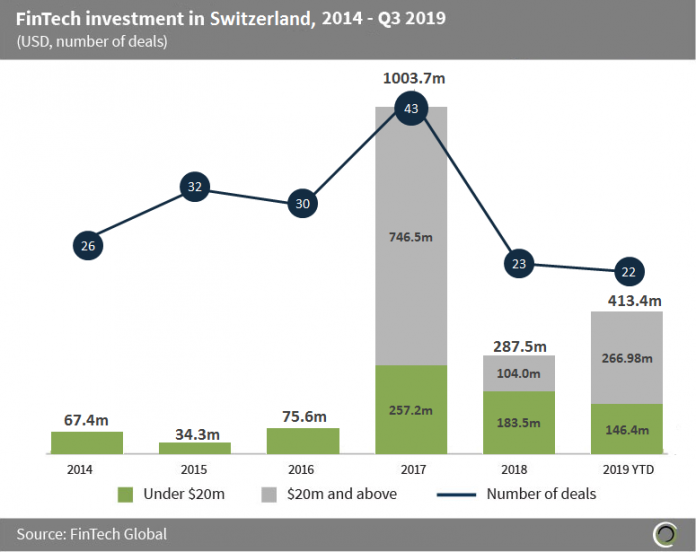

FinTech companies in Switzerland have raised over $413m so far this year, but funding remains below the record levels recorded in 2017

- FinTech companies in Switzerland have raised nearly $2bn across 176 deals between 2014 and Q3 2019.

- Investment grew at a CAGR of 146% between 2014 and 2017, to a record of over $1bn. The record year in 2017 was driven by four deals valued over $100m which accounted for 74.4% of the total investment that year. Investment then dropped significantly in 2018, however it has since rebounded with funding in the region set to grow again in 2019.

- Average deal size has increased over seven-fold from just $2.6m in 2014 to $18.8m in the first three quarters of 2019 as total investment increases at a higher rate than the number of deals closed.

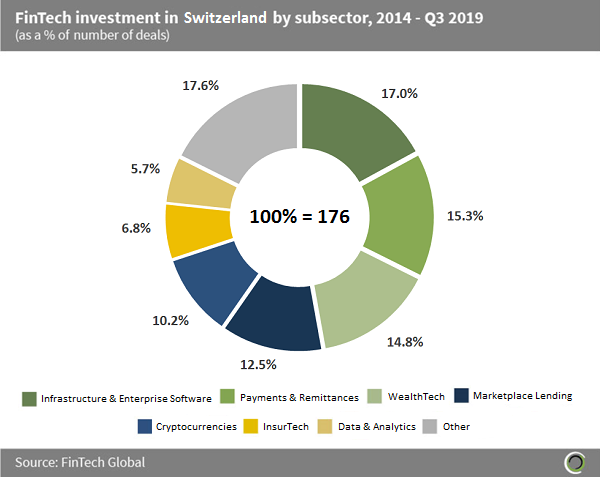

Infrastructure & Enterprise Software, Payments & Remittances and WealthTech companies account for nearly half of all FinTech deals in Switzerland since 2014

- The FinTech landscape in Switzerland has experienced a concentration of deal activity within three subsectors; Infrastructure & Enterprise Software, Payments & Remittances and WealthTech, accounting for 47.1% of FinTech deals in the country since 2014.

- Infrastructure & Enterprise Software companies attracted the largest share of deals, with 17% of all deals being raised by companies in this subsector. Infrastructure & Enterprise Software companies also accounted for the largest share of investment with over 30% of all capital raised being committed to this subsector.

- The other category consists of Blockchain, Real Estate, RegTech, Funding Platforms and Institutional Investments & Trading companies which collectively account for 17.6% of deals raised in the country since 2014. The largest deal in this category came from Trade.io, which looks to disrupt the way the financial ecosystem works and democratise the market using blockchain technology. The company raised $31m in its ICO in Q1 2018.

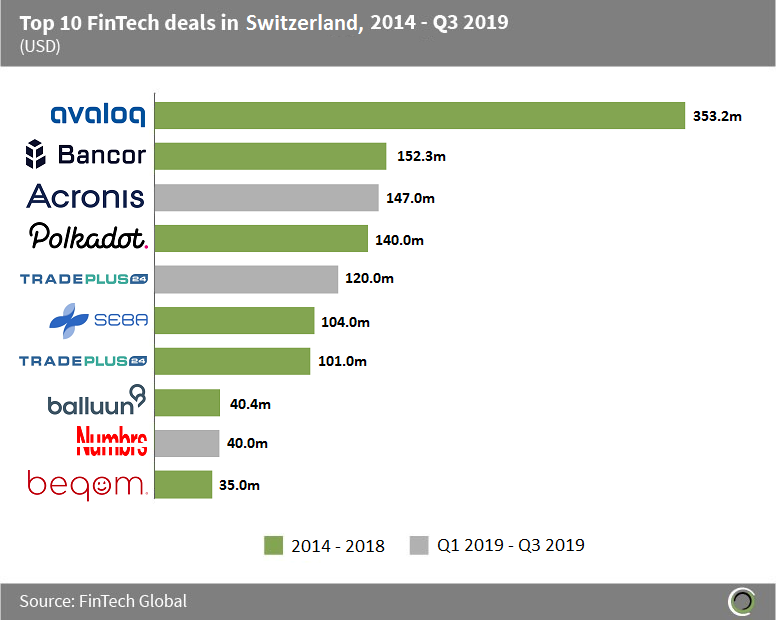

Over $1.2bn has been raised in the top 10 FinTech deals in Switzerland since 2014

- The top 10 FinTech transactions in Switzerland between 2014 and Q3 2019 have collectively raised over $1.2bn. Only three of the top 10 transactions in the country were raised in 2019.

- The largest round of the period went to Avaloq, an international FinTech company which digitizes the automation of the financial services industry. The company raised $353.2m in a private-equity round in Q1 2017 from Warburg Pincus which took a 35% stake in the company. Avaloq used the funds for the acceleration of its value creation strategy and long-term growth.

- The largest round raised this year came from Acronis, a cyber protection company offering innovative products including anti-ransomware and enterprise file sync and share solutions. The company raised $147m in a funding round in Q3 2019 led by Goldman Sachs, which pushed the company to Unicorn status. The funding will be used to help the company expand its engineering team in Arizona, Singapore, and Bulgaria, alongside accelerating business growth in North America.

- Capital allocation within the top 10 has been widely distributed across subsectors with three deals being raised by Infrastructure & Enterprise Software companies, two deals by Payments & Remittances, WealthTech and Data & Analytics companies and one deal completed by a Cryptocurrency company.

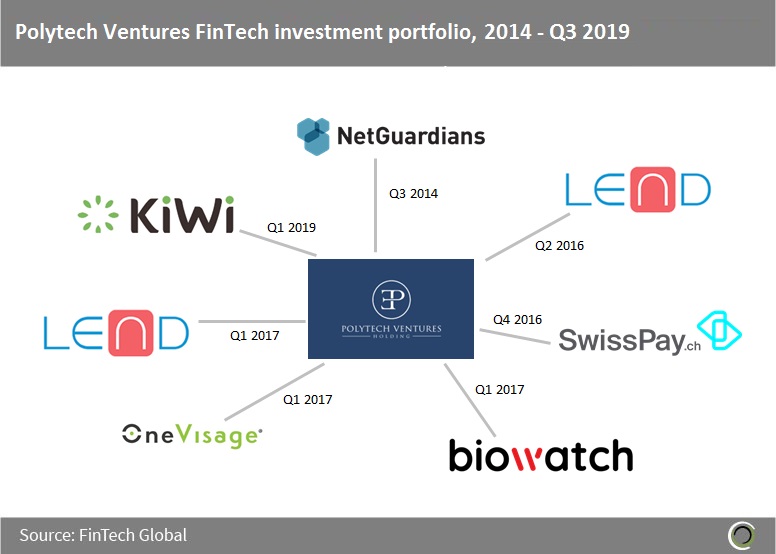

Polytech Ventures has been the most active FinTech investor in Switzerland since 2014

- Polytech Ventures, founded in 2015 and headquartered in Switzerland is a Venture Capital firm investing in early stage software companies with a strong international focus, aiming at creating a bridge between Switzerland and the US.

- Polytech Ventures was particularly active in 2017 where the firm participated in three funding rounds. They participated in the $3.5m Series A round raised by LEND in Q1 2017 along with Alpana Ventures. LEND is a peer-to-peer lending platform that connects investors, who benefit from low interest rates, with borrowers, who earn substantial returns. The capital was used to further enhance customer usability, automation and increase marketing.

- The largest round Polytech Ventures has participated in was a $5.4m Series B round raised by NetGuardians in Q3 2014. NetGuardians offer anti-fraud banking solutions through the use of intelligent behavioural analysis in real time. Polytech Ventures were joined on the round by SBT Venture Capital, Orbium, and FortRoss Ventures.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2019 FinTech Global