With the coronavirus causing havoc with businesses’ operations, compliance company Aqubix believes unprecedented times like these make technology more crucial for the on-going business of due diligence and risk-related industries.

Countries around the world are encouraging people to stay inside. This is having a big impact on getting customers, with the only way to attract them being through online means. This may be easy for retail stores which have online websites and do deliveries, but it is not simple for everyone.

In a new blog post, Aqubix stated it is a “huge challenge for those organisations who are still obliged to risk assess their customers and adhere to AML and regulatory processes.” The RegTech stated that unless companies were prepared for the current global situation, which is unlikely as it was not forecasted for, major institutions needing to onboard new customers by conducting full due diligence on clientele will be facing a big challenge.

The companies which will struggle most will be banks, insurance companies, financial services, aviation, pharmaceuticals, payment services as well as others.

Aqubix said, “Not on-boarding new clients until this pandemic is over is not an option for most, and on-boarding new clients without proper due diligence is too much of a risk. This is where technology and KYC Portal comes in handy.”

Institutions need to be ready with onboarding processes on both digital and online means, not just for retail customers but also corporate relationships. “Our compliance department continued to work seamlessly and effectively from home.”

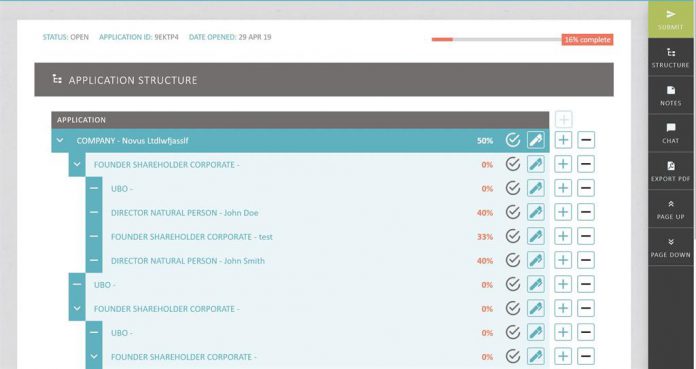

KYC Portal is Aqubix’s end-to-end know your customer (KYC) solution. One of the features the solution offers to ensure business continues as normal while working from home is its embedded face-to-face video engine. This allows an institution to complete face-to-face meetings with their clientele, while backed up with biometric verification to ensure instant auditing of all calls that can be played back at any time, the company said.

The solution ensures that risk on new customers stays low as the strength of the verification technology matches meeting in person, the RegTech said claimed.

Furthermore, KYC Portal’s outreach modules help clients maintain service with existing clients and onboard new customers. “The process of reviews on their existing clientele is running smoothly by sending their client access to upload documents, fill in the necessary questionnaires and also the required forms.”

The company continued, “The Customer Outreach Tool for on-boarding of corporate relationships is another great add-on. KYCP clients are able to offer the same services that used to be offered over meetings through this tool allowing their clientele to apply for new services through this digital experience.”

Finally, KYC Portal’s embedded CHAT module in the Customer Outreach Tool allows for a personal experience. The chat module enables a customer to request assistance at any point. The chat will instantly be audited against the application in KYC Portal to ensure all communication with clients is documented and can be replayed.

To read the full blog click here.

Copyright © 2020 FinTech Global