By leveraging powerful predictive analytics tools, InsurTech Loadsure has set out to deliver on-demand spot freight cargo insurance to the US market, enabling brokers, shippers and carriers to cut costs significantly.

And having just announced the closures of its £1.1m seed round, the startup is one step closer to achieving its goal.

UK startup incubator and investor Insurtech Gateway led the round alongside a number of corporate and angel investors.

“Insurtech Gateway has given us the confidence and support network to achieve our goals as we take Loadsure to the next level,†said Johnny McCord, founder and CEO of Loadsure. “We now have a broader set of experts behind us to help navigate the rocks that founder many startups. Their subtle but supportive approach with Loadsure has been massively appreciated.â€

Insurtech Gateway said that Loadsure is poised to do for the transportation industry what Uber and Lyft did for the ride-hailing sector by harnessing real-time data and a fully automated digital process.

“Informal marketplaces are vulnerable, lacking insurance protection for customers, and that was true of the spot freight market, until now,†said Robert Lumley, co-founder of Insurtech Gateway. “Loadsure really impressed us with their plan to be at the leading edge of this rapidly modernising sector.â€

With its filled war chest, Loadsure will market the transportation industry’s easiest one-click insurance integration to loadboard, freight marketplace, and transportation management system platforms in the US.

“[The] spot freight industry is a huge market with a complex value chain where a significant volume is not insured or is underinsured,†said Stephen Catlin, chairman and CEO at Convex, the insurer. “The digital end-to-end solution created by Loadsure is impressive, as is the scope of their ambition.â€

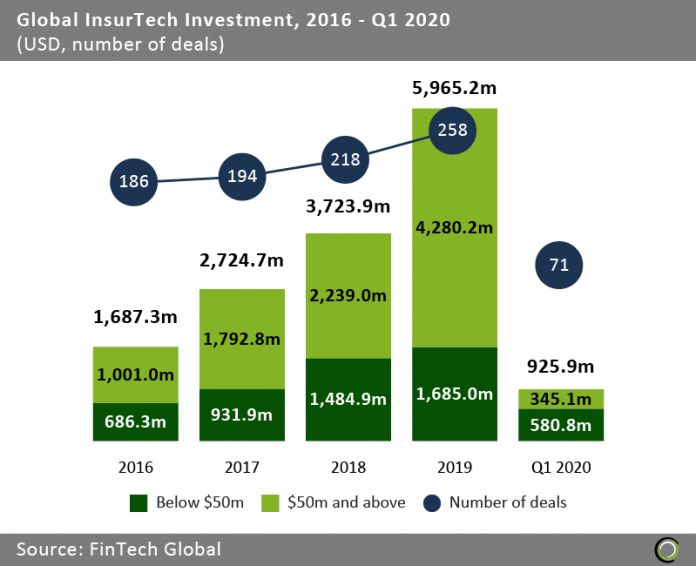

The news comes at a particularly exiting time for the Insurtech industry. The global sector has grown tremendously over the past five years. The industry raised $1.7bn in total in 2016, according to FinTech Global’s data. That figure jumped to $6bn in 2019. In the first three months of 2020, the InsurTech industry raised $925.9m from deals all over the world.

However, it is unclear whether or not the good times will keep on growing as the coronavirus pandemic has disturbed the regular growth of the market.

However, it is unclear whether or not the good times will keep on growing as the coronavirus pandemic has disturbed the regular growth of the market.

Nevertheless, several InsurTech stakeholders FinTech Global has spoken with has noted that this might be a prime opportunity for InsurTech startups. The argument was that many insurers are likely to notice the limitations of their current solutions and infrastructure due to the global COVID-19 outbreak. The small firms in the sector that are able to ride through the market downturn could therefore be perfectly placed to pitch their services to traditional insurers.

Copyright © 2020 FinTech Global